The agricultural commodities market has been significantly reshaped by the recent comprehensive reports from the United States Department of Agriculture. These critical assessments provide a fresh perspective on the supply and demand dynamics across major crops, influencing global trade and pricing strategies. Farmers, traders, and policymakers are now analyzing these figures to navigate the evolving landscape of crop production and market trends. The data underscores the inherent volatility and responsiveness of agricultural markets to new information, driving adjustments in investment and operational plans for the coming seasons.

Detailed Insights into the Agricultural Commodity Shifts

On a pivotal day, August 12, 2025, the USDA released its influential WASDE (World Agricultural Supply and Demand Estimates) and crop production reports, which immediately sent shockwaves through the global agricultural markets.

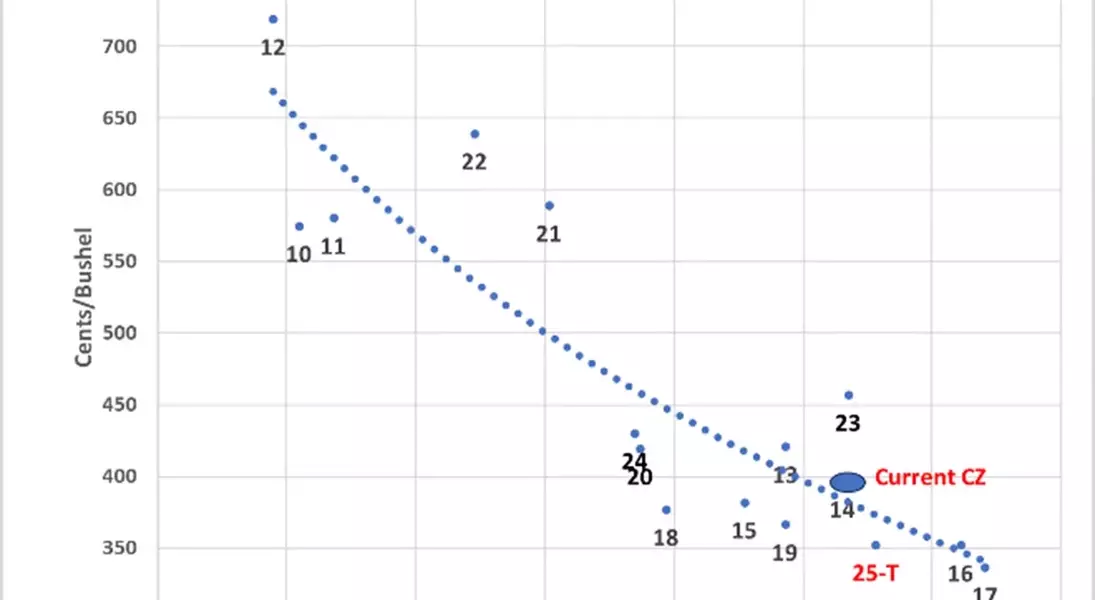

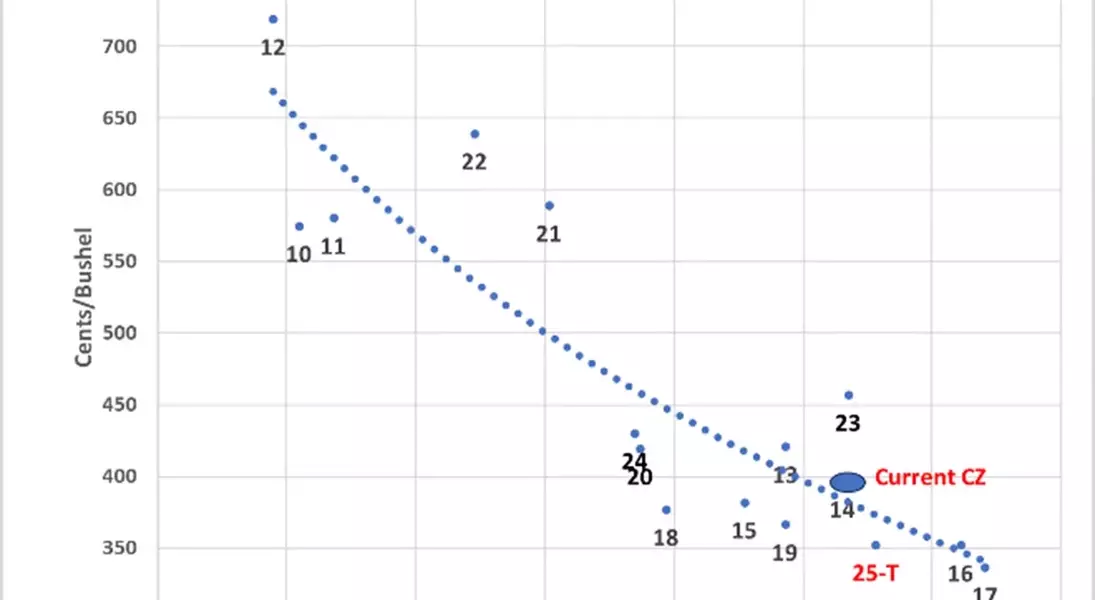

For corn, the outlook turned distinctly bearish. The USDA's updated average yield projection soared to 188.8 bushels per acre, significantly surpassing trade expectations by 4.5 bushels and marking an almost 8-bushel increase from the July forecast. This remarkable surge in yield, coupled with an unexpected expansion of planted acreage by 2.4 million acres (totaling 97 million harvested acres), led to an additional 1.037 billion bushels in projected production. Consequently, the estimated ending corn stocks for the 2025-26 marketing year swelled by 457 million bushels, reaching 2.117 billion. While the 2024-25 carry-out saw a modest reduction to 1.305 billion bushels due to a 70 million bushel increase in exports, the overall effect on prices was a notable decline, with the 2025-26 forecast dropping to $3.90 per bushel. The new crop's stocks-to-use ratio escalated from 10.8% to 13.3%, indicating a substantial supply.

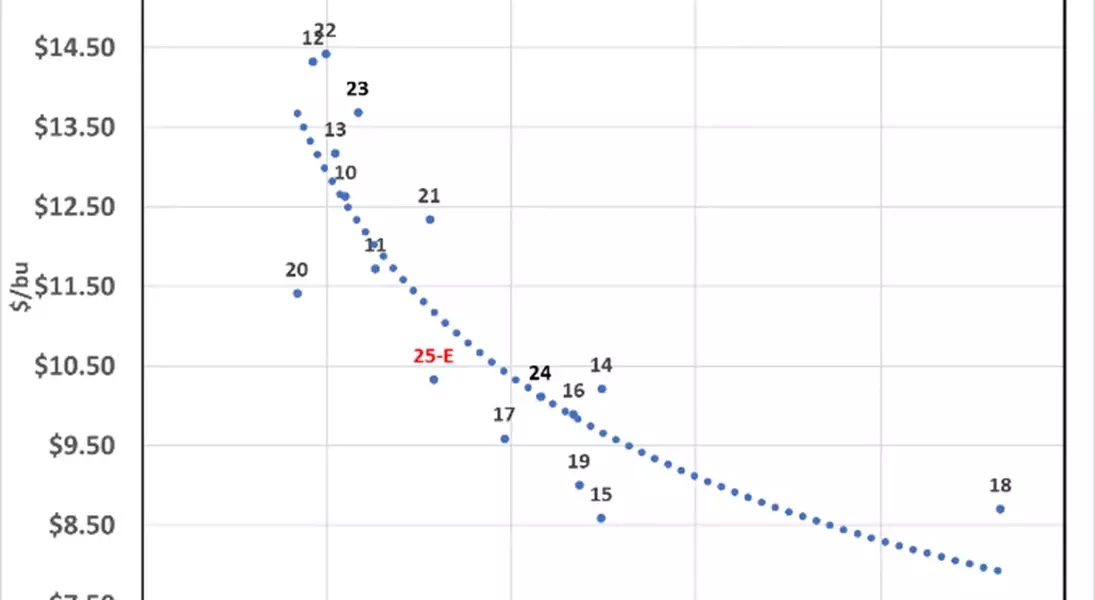

Soybeans experienced an initial bearish reaction, followed by a remarkable rebound. Despite a yield increase of 1.1 bushels to 53.6 bushels per acre, the primary market driver was an unforeseen 3.5 million acre reduction in planted area, bringing the total to 80.9 million acres. This reduction mitigated the impact of higher yields, leading to a net decrease of 63 million bushels in new crop supply. Old crop carry-out was reduced to 330 million bushels, driven by increased estimates for both crushing and exports. Futures prices reflected this volatility, dropping 15 cents at the open before rallying 30 cents, underscoring the market's sensitivity to supply figures. Lingering questions about final yields for the current year and the potential for a U.S.-China trade agreement continue to influence sentiment, particularly as South America anticipates another record soybean harvest, potentially impacting Chinese import patterns.

Wheat markets remained relatively stable, displaying a neutral trend, though corn's sharp downturn exerted some downward pressure on winter wheat varieties. U.S. spring wheat production was estimated at 0.484 billion bushels, slightly below trade expectations. Conversely, winter wheat production stood at 1.355 billion bushels, a modest increase from the previous month and slightly above forecasts. Hard Red Winter (HRW) wheat saw the largest increase. Exports of all wheat classes increased by 25 million bushels, reflecting strong international demand, especially for HRW. Despite a reduction in U.S. ending stocks, the market's focus now shifts to production prospects in Australia and Argentina, which could further influence global wheat prices.

Reflections on Market Volatility and Future Outlook

These recent USDA reports serve as a powerful reminder of the intricate dance between agricultural production, policy, and global trade. The immediate market responses – the bearish turn for corn, the volatile swing for soybeans, and the relative stability for wheat – highlight how swiftly market dynamics can shift based on new information. For those involved in the agricultural sector, the takeaway is clear: adaptability and continuous monitoring of evolving data are paramount. The interdependence of global markets, particularly in relation to major producers like South America and key consumers like China, will continue to shape commodity prices. As we move forward, the ability to anticipate and respond to such detailed statistical releases will be crucial for managing risk and capitalizing on emerging opportunities in the ever-dynamic agricultural landscape.