The agricultural land market in Mississippi is experiencing a notable shift, with a growing presence of non-agricultural investors, particularly real estate developers, acquiring what was traditionally farm acreage. Although farming individuals and general partnerships continue to represent the largest segment of land purchasers, data from 2019 to mid-2023 reveal an increasing share of transactions involving financial, real estate, and other business sectors. This evolving landscape in land ownership raises important considerations for the agricultural community, as the heightened demand from diverse buyers is contributing to rising property values, which presents both opportunities and potential challenges for farmers and policymakers alike. Understanding these dynamics is crucial for future land use planning and economic strategies in the region.

For agricultural producers, land stands as a critical asset, fundamental to both their operational viability and their economic stability. Over recent years, the escalating demand for agricultural properties has consistently driven up farmland values across the Southern United States. According to detailed analyses from the USDA Economic Research Service, the period between 2018 and 2024 saw an average annual growth rate in farmland values approaching 5%. Yet, contemporary discussions suggest that this demand is not exclusively originating from those directly involved in farming. Reports frequently highlight instances of affluent individuals or significant development corporations acquiring extensive tracts of agricultural land, sparking widespread dialogue and some apprehension within farming communities. Despite these anecdotal accounts and the inherent concerns they trigger, precise data on the frequency of non-producer participation in the farmland market has historically been limited.

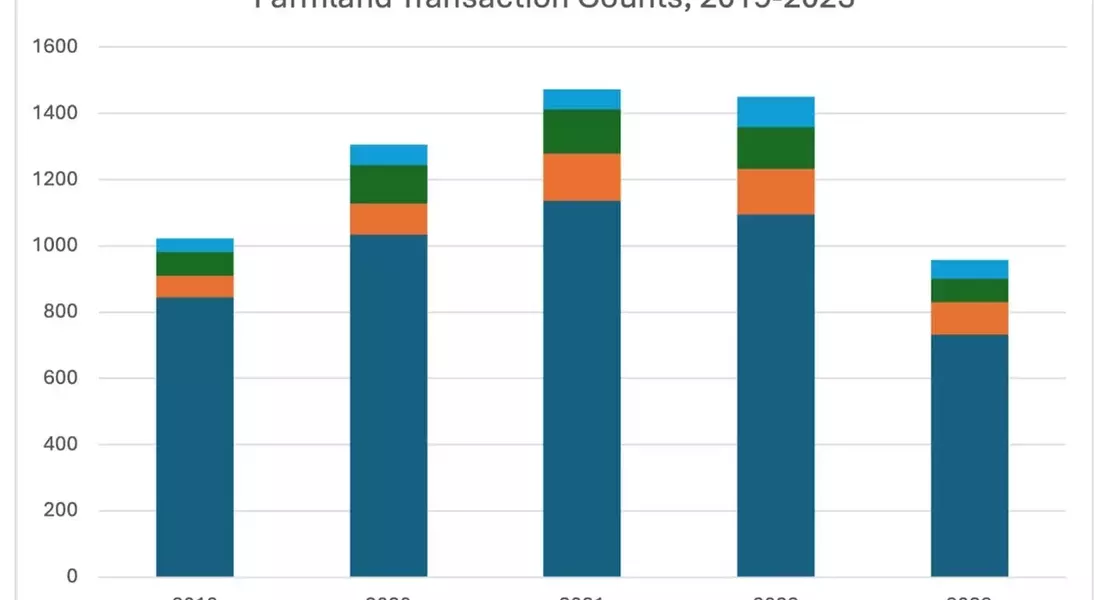

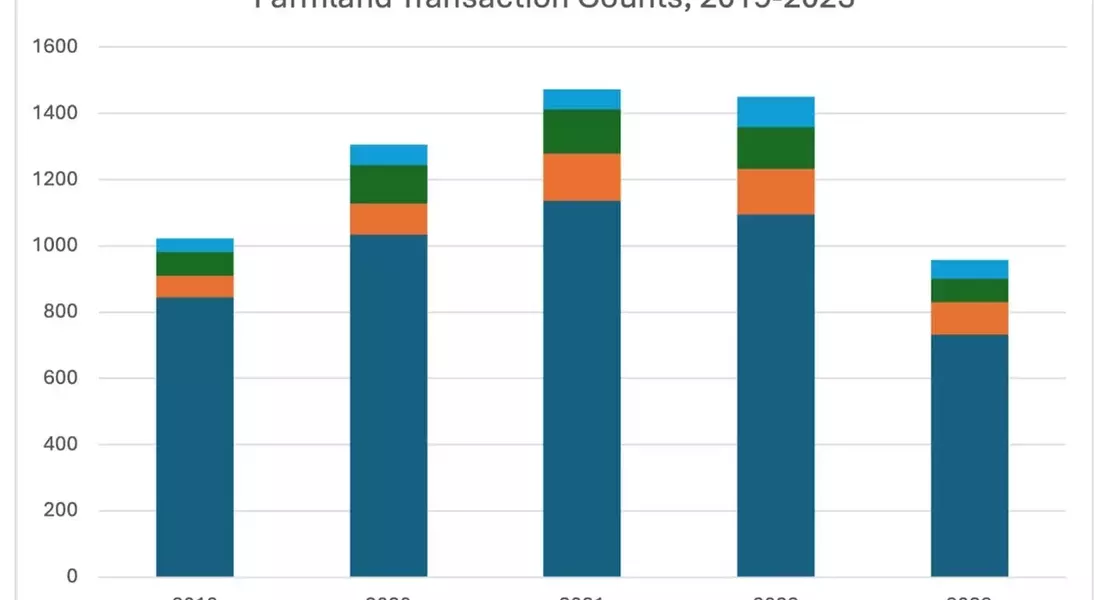

This evolving scenario compels a closer examination of the agricultural land market's participant demographics. To gain clarity, a comprehensive analysis of transaction-level data from lending institutions within Mississippi was conducted, spanning from 2019 through the initial half of 2023. This research allowed for the classification of buyers into distinct categories: individuals and general partnerships, predominantly involved in agricultural production; financial and real estate enterprises; non-individual or non-general partnership agricultural businesses; and entities from other varied industries. The insights garnered from this data offer a clearer picture of who is acquiring farmland and the extent of non-traditional buyer involvement.

The findings indicate that individuals and general partnerships, typically engaged in agricultural production, remain the predominant acquirers of farmland in Mississippi. Between 75% and 83% of all land transactions during the study period were conducted by buyers from this segment. However, the presence of financial and real estate businesses has steadily expanded, albeit still representing a smaller proportion of overall transactions. Their share increased from 6.36% in 2019 to 10.42% in the first half of 2023, surpassing non-individual or non-GP agricultural businesses, whose share fluctuated between 7% and 9%. Additionally, businesses from other sectors, including construction and warehousing, accounted for approximately 4% to 6% of total transactions.

Ultimately, while traditional farmers and farming entities continue to be the primary drivers of farmland transactions, the increasing engagement of non-agricultural investors, particularly developers, is undeniable. This external demand, while potentially bolstering property values, also introduces the prospect of elevated land prices, posing both advantages and challenges for current and prospective agricultural producers. Furthermore, this alteration in ownership patterns aligns with a broader, long-term trend of diminishing farmland acreage across the U.S. A thorough understanding of these complex relationships necessitates continued, in-depth research. As the dynamics of the farmland market continue to evolve, closely monitoring buyer trends becomes increasingly vital to inform policy formulation, guide land use planning, and devise effective long-term strategies for sustainable agricultural development.