Unraveling Cotton Acreage: Predicting Future Harvests

The Foundation of Acreage Reporting: USDA's Approach to Data Collection

Since 2011, the United States Department of Agriculture's Farm Service Agency (FSA) has diligently compiled and released monthly reports on crop acreage, commencing each August. This comprehensive data, derived from farmer submissions detailing planted, prevented planting, and failed acres, forms a crucial initial snapshot. A definitive summary of acreage is subsequently published in January. From October, and occasionally as early as September, the National Agricultural Statistics Service (NASS) leverages this FSA data for comparative analysis against its own survey-based planted acreage estimates, which are featured in the monthly 'Crop Production' report.

Distinguishing Data Sources: FSA vs. NASS Acreage Estimates

While the FSA's acreage data encompasses a broad census of planted areas enrolled in various farm programs, it is important to note that these figures do not serve as the official planted acreage estimates for the USDA. This distinction arises because not all agricultural operations participate in FSA-administered programs. The official and authoritative estimates for planted acreage are the sole responsibility of NASS, which functions as the USDA's primary statistical arm.

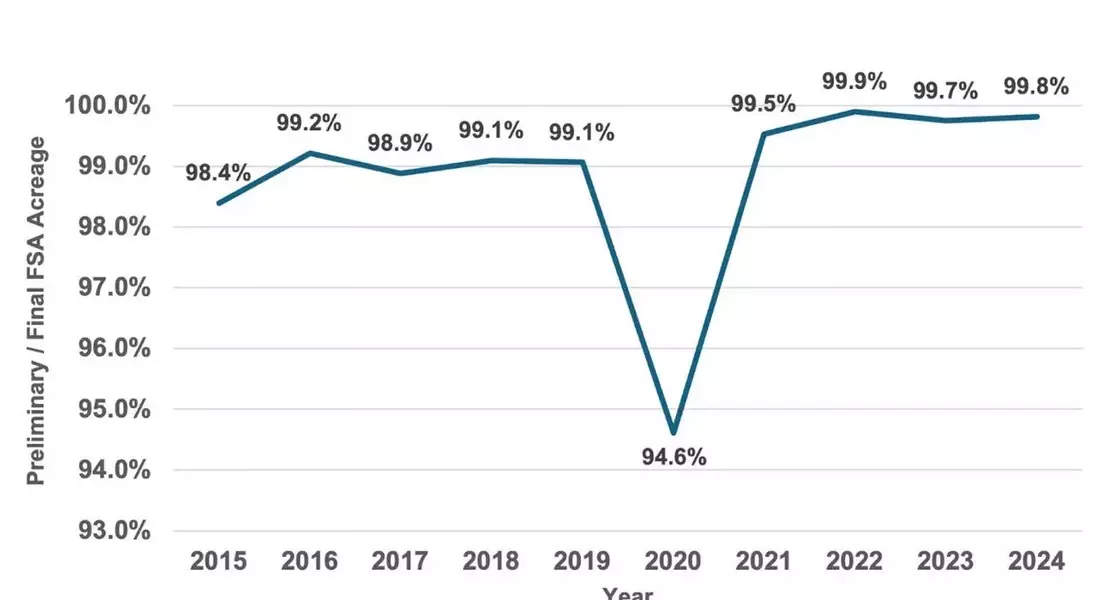

Forecasting Cotton Acreage: Analyzing August's Preliminary Report

Our investigation commenced with an in-depth examination of the correlation between the preliminary August FSA planted acreage figures and the final January summaries for cotton, encompassing both upland and Pima varieties. As depicted in accompanying charts, reporting in August 2020 experienced a notable deviation due to extensions implemented during the COVID-19 pandemic. However, data from both pre-2020 and post-2020 periods consistently indicate that the vast majority of planted cotton acreage is typically reported to the FSA by August. For instance, between 2015 and 2019, the average ratio of preliminary to final FSA planted acreage for cotton stood at 98.9%. More recently, from 2021 to 2024, this average ratio increased to 99.7% in August, suggesting that the most recent period offers the most accurate basis for projecting 2025 forecasts.

The Interplay Between FSA and NASS Final Acreage Data

We further extended our analysis to explore the relationship between the final FSA planted acreage and the final NASS planted acreage. Historical data from 2015 to 2024 reveals a remarkable consistency in this relationship. Specifically, the final FSA estimate for cotton planted acreage consistently averages 98.2% of the final NASS planted acreage, with a minimal range of variation, typically around 0.9%. This strong correlation underscores the reliability of these datasets in conjunction.

The Significance of FSA Program Enrollment in Acreage Consistency

The observed consistency in the relationships between these various acreage estimates can largely be attributed to the relatively stable enrollment rates in FSA farm programs year after year. For the current year, 2025, the cotton planting season has been particularly challenging due to extensive spring rainfall across several states. Many industry experts expressed skepticism regarding the NASS June Acreage survey, which unexpectedly reported significantly higher cotton acreage estimates for the Midsouth region. Consequently, the findings from the USDA's inaugural monthly acreage report for 2025 are highly anticipated within the cotton sector. This report, scheduled for release on August 12th, is expected to offer crucial insights into the overall cotton acreage for 2025, and its data will be closely monitored by the market for potential adjustments to official USDA planted acreage estimates.