Intel is adopting a measured approach to the expansion of its cutting-edge 14A process node facilities. This decision comes even as the recently launched Core Ultra 300-series processors, leveraging the 18A node, are showing promising early results. The company's strategy is centered on aligning production capacity with confirmed market demand, a prudent move in the dynamic semiconductor landscape.

According to Intel's Chief Financial Officer, David Zinser, the company is actively deploying equipment for existing and upcoming nodes like Intel 7, 10, Intel 3, and 18A. However, a different stance is being taken for 14A. Zinser clarified that significant investment in 14A capacity will be deferred until there is clear evidence of customer commitments. This cautious outlook is primarily due to the 14A node's strong tie-in with foundry customers, and Intel aims to prevent an oversupply situation by ensuring demand is solidified before scaling up production.

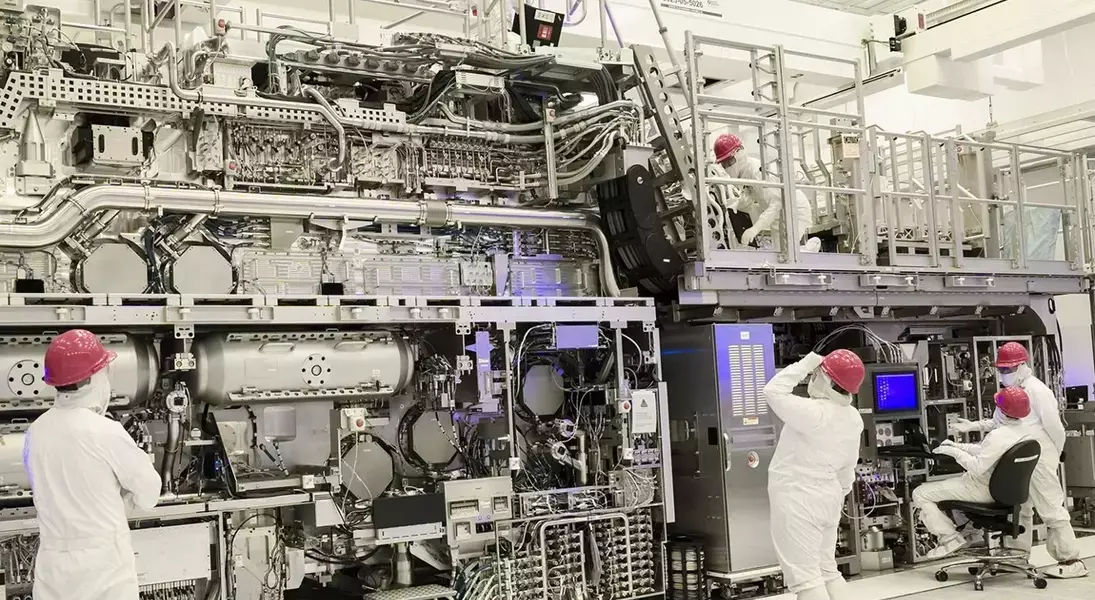

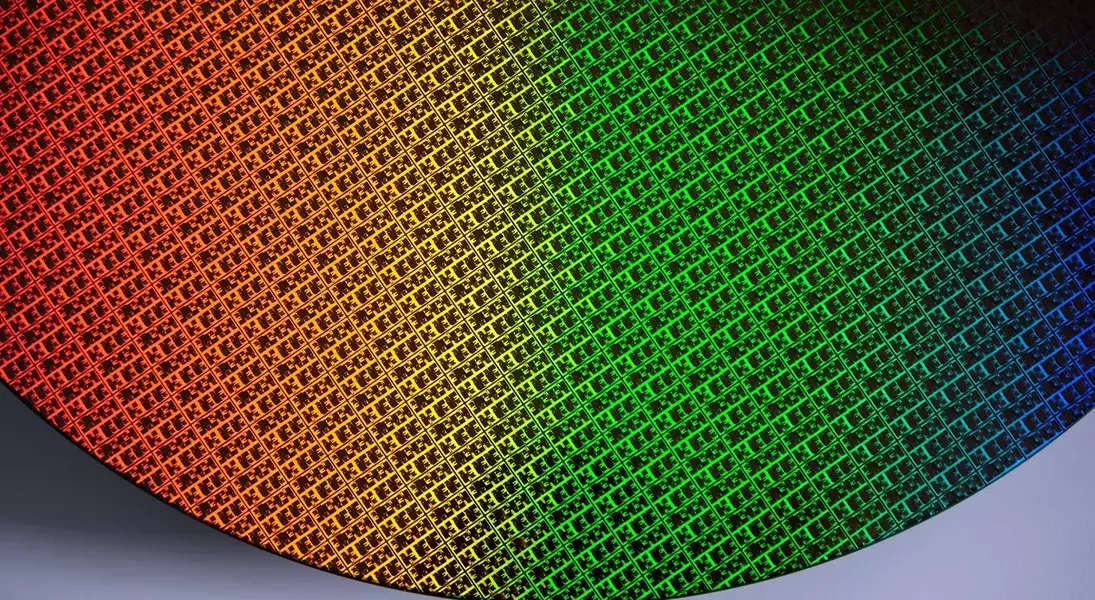

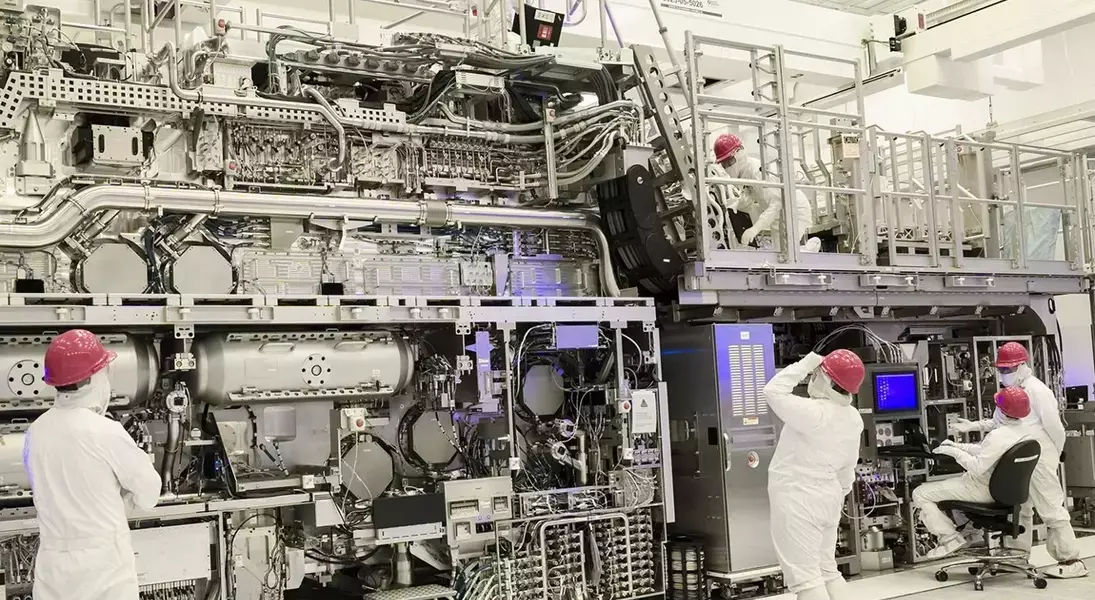

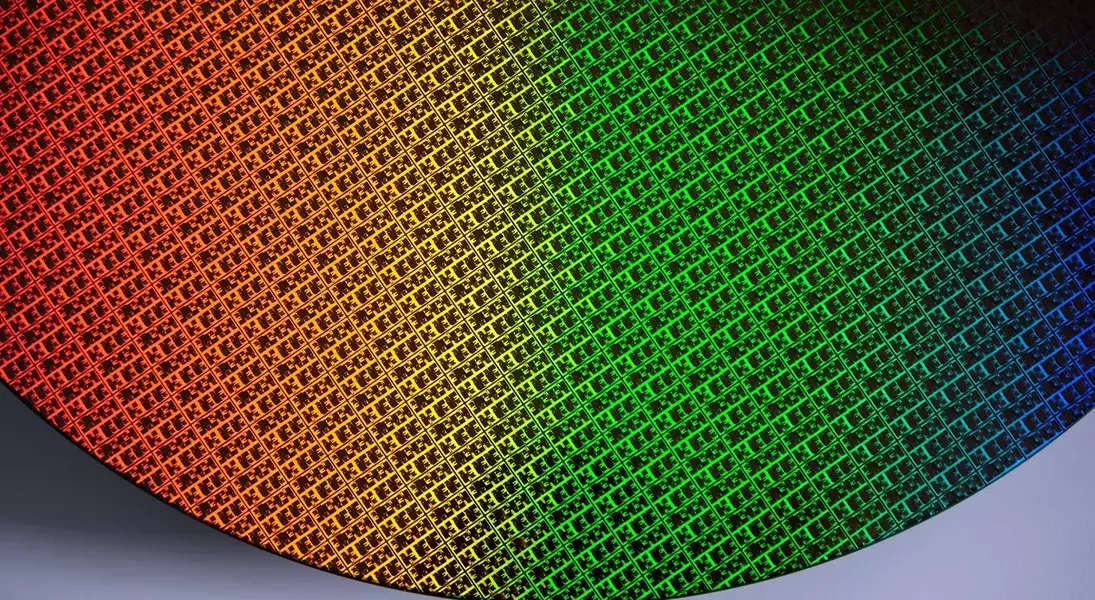

The term "getting tools" in the semiconductor industry refers to the acquisition of essential machinery and materials required for large-scale wafer manufacturing. In a period of high chip demand, manufacturers typically secure these resources in advance. Intel's deliberate pace for 14A production contrasts with an aggressive procurement strategy, reflecting a nuanced understanding of market conditions. This is partly because the 14A node is not yet ready for mass production. More importantly, Intel recognizes the risk of producing a large volume of chips without guaranteed buyers, which could lead to significant financial implications.

The current global memory supply crunch, heavily influenced by the demands of artificial intelligence, has introduced considerable uncertainty into the consumer PC market. The escalating costs and reduced availability of DRAM and flash memory, crucial components for any personal computer, cast a shadow over future demand for processors. This situation suggests that PC manufacturers and system integrators might place fewer orders than in previous periods, a factor Intel is carefully considering.

Despite the cautious ramp-up, Intel's commitment to the 14A node remains firm. Zinser mentioned the existence of various iterations of 14A, including those incorporating advanced High NA lithography technology. While this indicates ongoing development and future potential, consumers should temper expectations for a rapid influx of products based on this technology, such as the upcoming Nova Lake series, upon their eventual release.

In essence, Intel's measured expansion of its 14A process node capacity underscores a strategic shift towards demand-driven manufacturing. By prioritizing confirmed customer needs, the company aims to navigate the complexities of the semiconductor market, mitigate risks associated with overproduction, and ensure a more sustainable growth trajectory. This approach reflects a realistic assessment of the current economic climate and the evolving dynamics of the technology sector, particularly in light of AI's impact on component supply chains.