Intel has taken proactive measures to secure a sufficient supply of memory for its Lunar Lake mobile processors, effectively navigating the current memory market volatility. According to Chief Financial Officer David Zinsner, the company adopted an "aggressive" procurement strategy to acquire the necessary memory components early, thereby safeguarding its production plans for the mobile chip.

Zinsner stated that Intel possesses the required memory stock based on current projections. He acknowledged that an unexpected increase in demand could necessitate further memory acquisition, potentially impacting gross margins. However, the early procurement strategy has largely insulated Intel from the worst effects of the prevailing memory shortage.

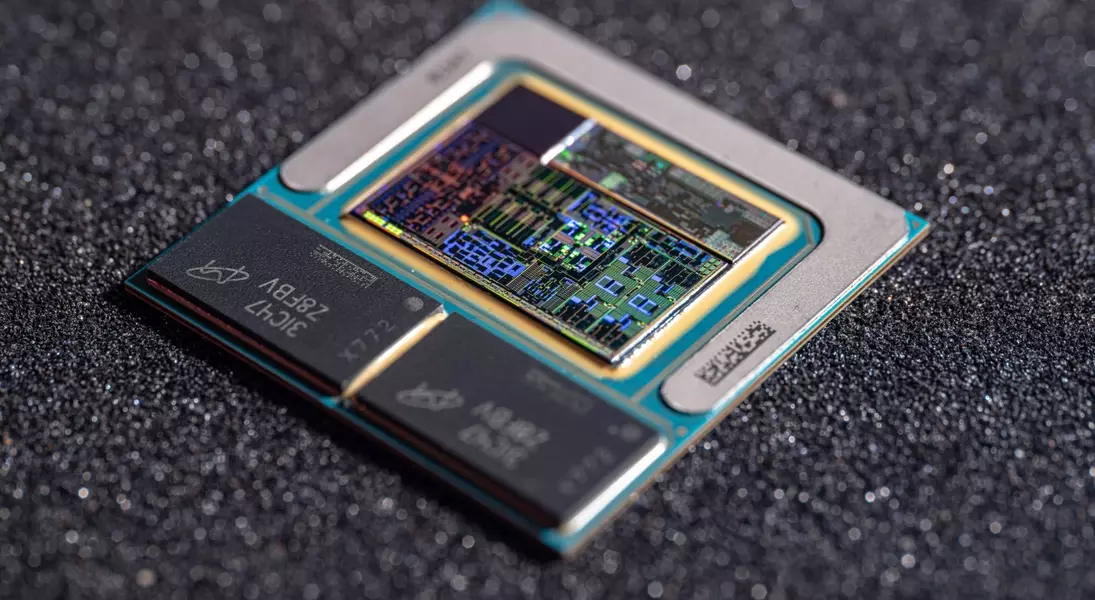

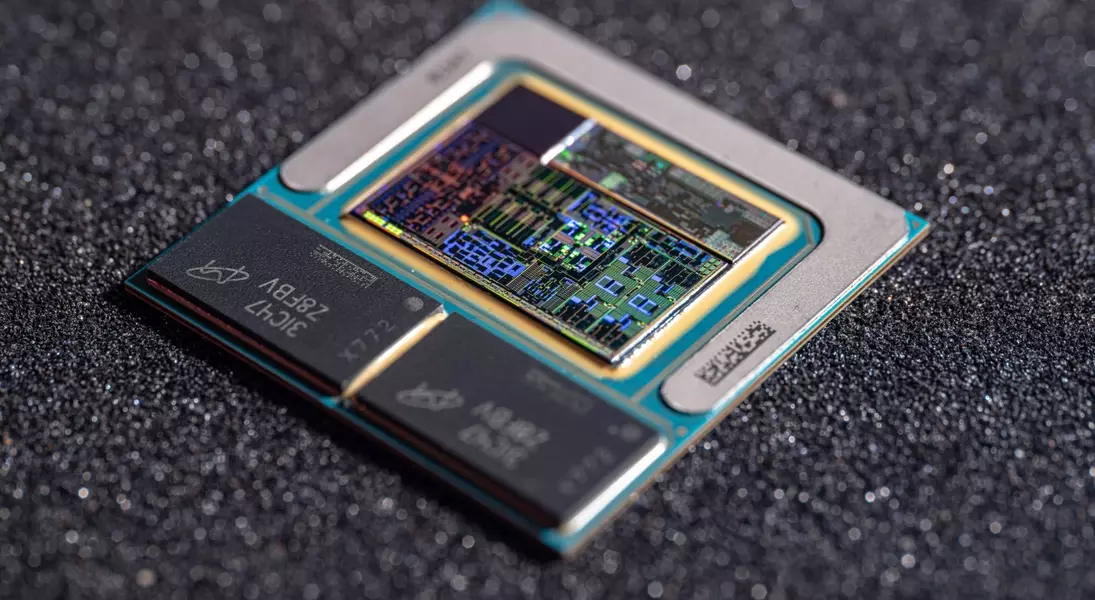

The decision to secure memory proactively was particularly crucial for Lunar Lake, as these processors utilize an on-package memory design, incorporating two LPDDR5X chips directly alongside the processor. While this design offers advantages in terms of efficiency and compact size, it also makes the chips highly susceptible to disruptions in memory supply. The ongoing memory crisis has led to tight supply conditions and a significant increase in prices, posing a considerable challenge for manufacturers.

One of the initial hurdles with Lunar Lake's integrated memory approach was the cost. The inclusion of additional chips, along with more complex packaging processes and the expense of acquiring memory, contributed to higher production costs compared to conventional chip designs. Consequently, Lunar Lake's profit margins have been lower than Intel's desired levels. Purchasing more memory at elevated market prices would further erode these margins.

Zinsner reiterated that the lower margins are a direct consequence of the integrated memory packaging. Despite these challenges, he indicated that Intel is largely operating within its anticipated financial parameters from a few quarters prior. Notably, former Intel CEO Pat Gelsinger had previously signaled a departure from on-package memory for future designs even before his departure.

Gelsinger had explicitly stated that on-package memory would be a "one-off" for Lunar Lake, and that subsequent generations, including Panther Lake and Nova Lake, would revert to a more traditional architecture with memory placed off-package. This future roadmap involves integrating the CPU, GPU, NPU, and I/O capabilities within the package, but with volume memory located externally.

Intel's foresight in securing memory for Lunar Lake proved beneficial, especially given the severity of the current memory shortage. While some might have anticipated price fluctuations, few could have predicted the extent of the present crisis. Memory scarcity is expected to persist throughout the year, compelling many manufacturers to intensely pursue additional supplies, often at substantially increased costs.

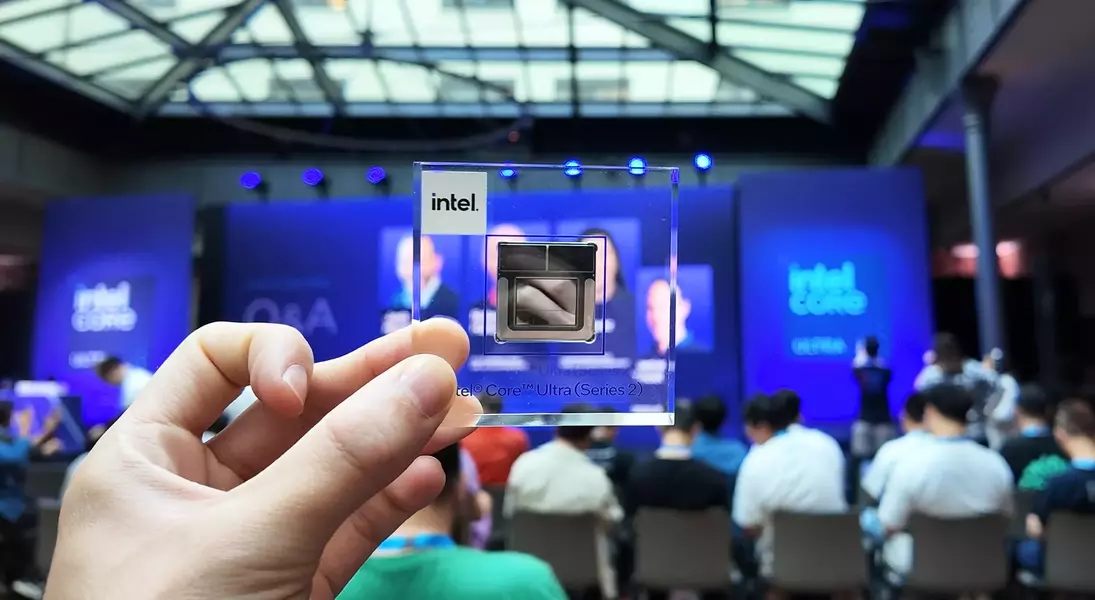

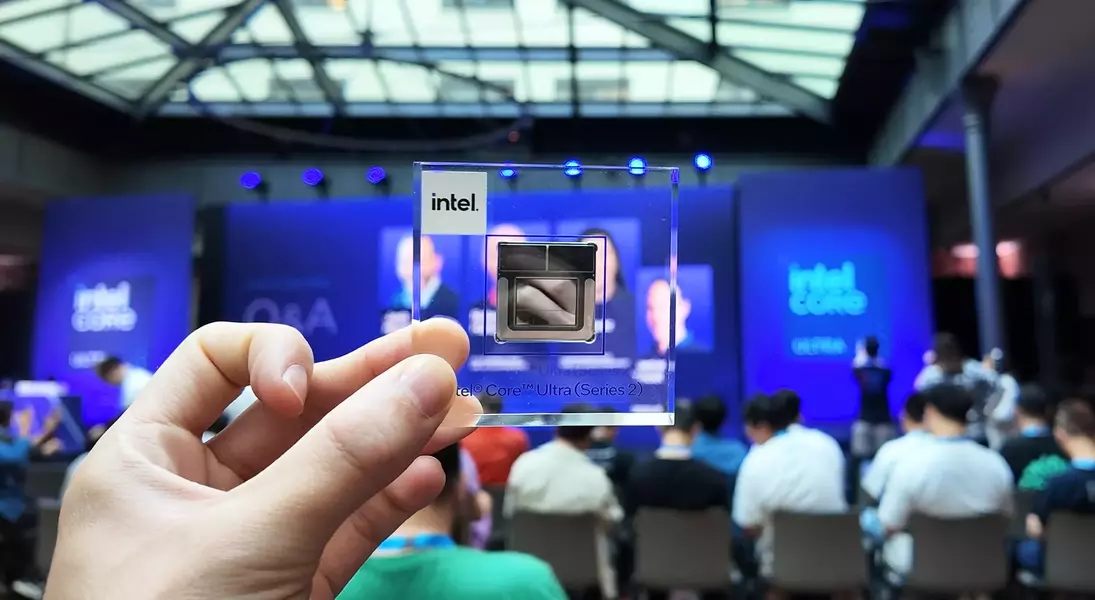

The upcoming Core Ultra Series 3, known as Panther Lake, will succeed the Core Ultra Series 2 and will not feature on-package memory. This shift will alleviate Intel's direct responsibility for sourcing memory, though the company will still feel the broader impact of the ongoing market challenges. Ultimately, the cost of memory, whether borne by Intel or its partners, typically translates into higher prices for consumers. This dynamic could potentially lead to reduced sales of laptops and other systems, subsequently affecting chip demand from Intel and impacting its financial performance. As a result, research firm IDC forecasts an "extremely volatile" period for PC sales in the coming year.