A recent analysis of custom farming rates in Indiana indicates a period of stabilization for fertilizer and chemical application costs. Following significant increases in previous years, largely driven by soaring fuel and repair expenses, the agricultural sector is now experiencing more consistent pricing. This newfound stability offers a clearer outlook for farmers planning their upcoming seasonal operations, allowing for better budget management and operational forecasting. The findings suggest that the market has adapted to the earlier cost adjustments, providing a more predictable financial landscape for essential agricultural services.

Indiana's Agricultural Application Costs Remain Steady in 2025 Survey

In a detailed survey conducted by Purdue University's Center for Commercial Agriculture, custom rates for fertilizer and chemical applications in Indiana for the year 2025 have shown remarkable stability. This comes as a welcome relief to the agricultural community, particularly after the noticeable price escalations recorded in 2023. These earlier increases were primarily a direct consequence of rising input costs, including fuel and equipment maintenance, which had significantly impacted farming operations across the state.

Dr. Michael Langemeier, a distinguished expert and the director of the Purdue Center for Commercial Agriculture, noted that the current stabilization was an anticipated development. "Most input costs experienced sharp increases in 2021 and 2022, subsequently leveling off," he explained. "Therefore, it was not unexpected to observe minimal changes in fertilizer and chemical application rates for the 2025 season."

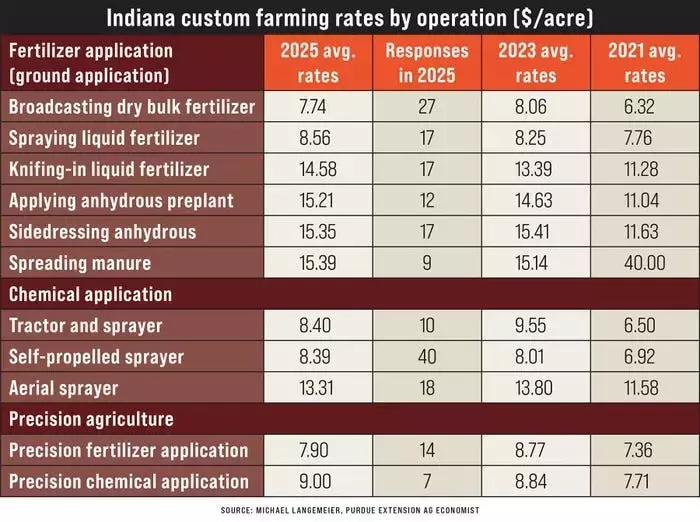

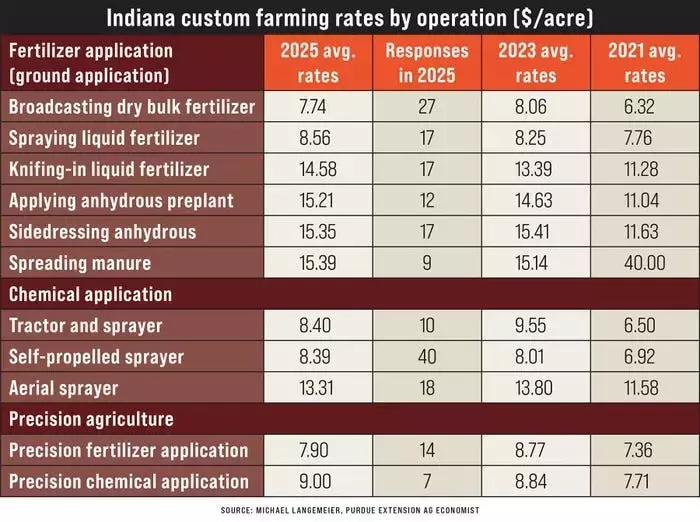

Among the various custom operations surveyed, the most notable change was a modest increase in the rate for knifing-in liquid fertilizer, which now averages $14.58 per acre, a slight rise from $13.39 per acre in 2023. Similarly, the cost for anhydrous preplant application also saw a minor uptick, moving from $14.63 to $15.21 per acre. Interestingly, the survey revealed a convergence in pricing for chemical applications using different equipment types; both tractor-pulled and self-propelled sprayers now command similar rates, approximately $8.40 and $8.39 per acre, respectively. This parity contrasts with 2023, where tractor-pulled applications were notably more expensive at $9.55 per acre compared to $8.01 for self-propelled units.

Langemeier highlighted the significance of the increased participation in the 2025 survey, which has provided a more robust and realistic representation of current market charges. This expanded data set contributes to a more reliable benchmark for farmers, whether they are engaging custom services or determining their own pricing for custom work. The overall consensus from the survey is that farmers should not anticipate dramatic fluctuations in application costs as they prepare for the autumn season, fostering a sense of financial reassurance in the agricultural sector.

As a seasoned observer of agricultural economics, I view these findings as a crucial indicator of a maturing market. The stabilization of custom rates suggests that the initial shock of increased input costs has been absorbed, allowing for a more predictable operational environment. This predictability is invaluable for farmers, enabling them to make more informed decisions regarding their investments in crop nutrition and protection. It also underscores the importance of ongoing, comprehensive surveys like Purdue's, which provide transparent data essential for equitable pricing and strategic planning within the farming community. For those contemplating providing or utilizing custom services this fall, these rates offer a solid foundation for fair negotiations and efficient resource allocation, promoting a healthier agricultural economy.