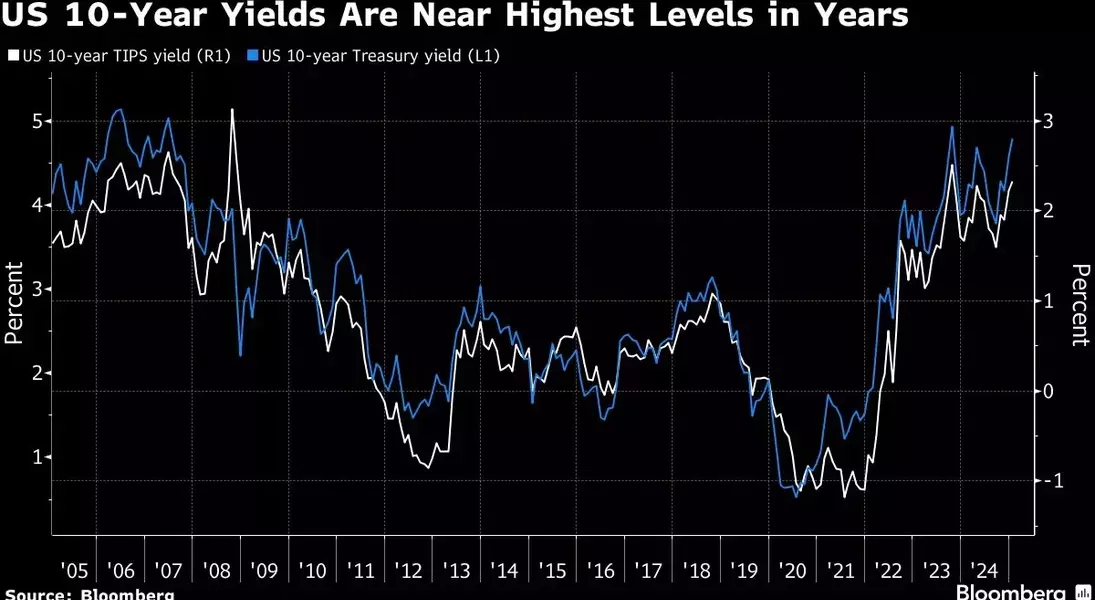

The upcoming auction of US Treasury Inflation-Protected Securities (TIPS) is anticipated to offer the highest yield in over a decade, reflecting significant shifts in economic conditions and market sentiment. As investors prepare for the $20 billion 10-year TIPS auction scheduled for 1 p.m. New York time, experts predict a yield of approximately 2.25%, surpassing levels not seen since the financial crisis of 2008. This milestone underscores the evolving dynamics in the global financial markets.

Several factors contribute to this notable increase in TIPS yields. Michael Pond, head of global inflation-linked market strategy at Barclays Capital Inc., attributes this trend to robust economic fundamentals and concerns about long-term fiscal stability. The Federal Reserve's ongoing reduction in its Treasury holdings has also played a role in driving up yields. Moreover, current market conditions differ markedly from those during the 2008 financial crisis, where demand for inflation protection plummeted alongside growth expectations. Today, the TIPS market benefits from greater liquidity and a larger base of long-term investors, providing more stability and resilience.

The performance of TIPS in recent years highlights the market's adaptability and resilience. While the financial crisis caused liquidity issues that artificially inflated TIPS yields, the market has since matured. During the onset of the Covid-19 pandemic in 2020, TIPS underperformed nominal Treasuries but to a lesser extent than in 2008. The Federal Reserve's swift intervention through asset purchases helped stabilize the market, demonstrating the importance of proactive measures in maintaining financial health. As we look forward, the rising TIPS yields signal a positive outlook for economic growth and investor confidence, reinforcing the strength of the US economy.