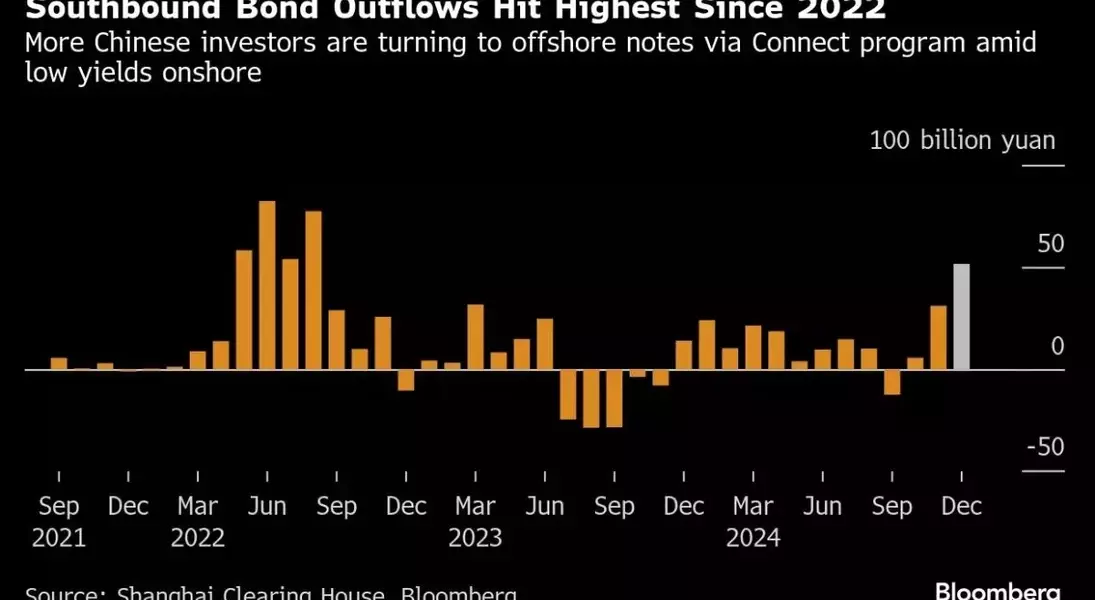

Domestic bond yields in China have experienced a significant decline, prompting mainland investors to explore international markets for higher returns. In December, capital outflows via the Southbound Bond Connect program surged to nearly 52 billion yuan ($7.1 billion), marking the highest level since August 2022. This trend reflects a growing interest in diversifying investment portfolios beyond the Chinese market. The allure of foreign assets has been further amplified by the widening yield gap between China and the US, with some analysts predicting that Chinese yields could fall to unprecedented lows.

Exploring Higher Returns through International Markets

Mainland investors are increasingly turning their attention to overseas bond markets as domestic yields continue to drop. The recent bull run in Chinese bonds has driven yields to record-low levels, making alternative investments more attractive. In particular, dollar-denominated bonds and Dim Sum bonds have gained popularity among those seeking better returns. Analyst Qi Sheng from Orient Securities highlights the importance of diversification in investment strategies to mitigate risks and enhance profitability.

The Southbound Bond Connect program, which allows mainland investors to access the Hong Kong bond market, witnessed substantial capital outflows in December. The total amount reached almost 52 billion yuan ($7.1 billion), indicating a strong appetite for foreign bonds. This surge is partly attributed to the poor performance of domestic consumption and expectations of further monetary easing to stimulate the sluggish economy. As a result, many investors are now looking beyond China's borders for opportunities that offer higher yields and potential growth.

Anticipating Further Monetary Easing and Lower Yields

With the expectation of continued monetary policy relaxation by the People’s Bank of China, investors anticipate further declines in domestic bond yields. Since early December, the benchmark 10-year bond yield has dropped over 30 basis points to around 1.65%. This decline has widened the yield discount compared to the US, making foreign assets even more appealing. Some experts predict that yields could dip below 1%, adding urgency to the search for alternative investment options.

The ongoing economic challenges within China have fueled the shift towards international markets. Poor domestic consumption and the anticipation of additional monetary easing measures have contributed to the attractiveness of higher-yielding foreign bonds. Investors are closely monitoring the central bank's actions and economic indicators, preparing to capitalize on emerging opportunities abroad. The widening yield gap between China and other countries, particularly the US, underscores the growing appeal of overseas investments. As domestic yields continue to fall, the trend of capital outflows is likely to persist, driving more investors to explore diverse and potentially lucrative markets outside of China.