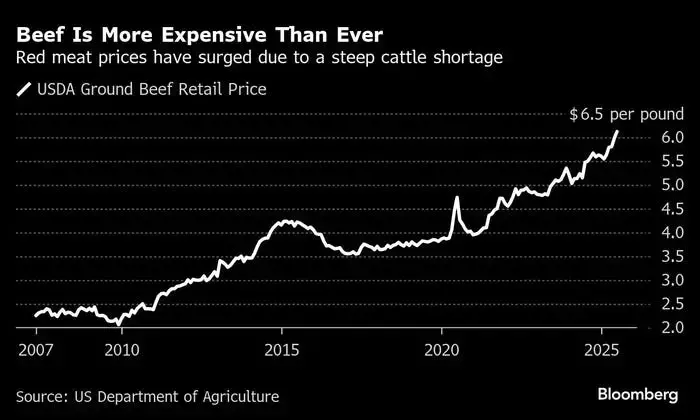

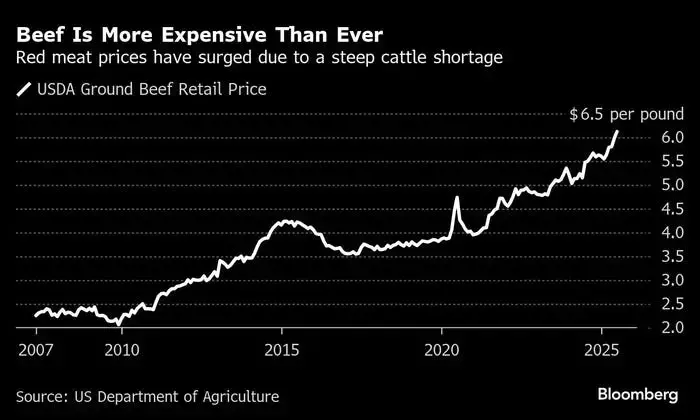

The American beef industry is navigating a challenging period marked by a historic reduction in cattle numbers, a trend that is exerting significant upward pressure on beef prices for consumers nationwide. Recent data from the U.S. Department of Agriculture (USDA) indicates a dramatic decrease in the national cattle herd, reaching its lowest mid-year total in over five decades. This contraction in supply has profound implications, not only for the agricultural sector but also for the broader economy and consumer spending habits. The current situation is a culmination of various pressures on ranchers, including economic strains and environmental adversities, which have made herd expansion difficult and, in many cases, unprofitable.

The diminished cattle population signals a prolonged period of high beef costs, as the delicate balance between supply and demand continues to favor elevated prices. While there's an inherent desire within the industry to replenish herd numbers, the path to recovery is neither simple nor swift. Experts project that even if concerted rebuilding efforts commence now, it will be several years before the market sees a substantial increase in beef availability. This scenario not only impacts the profitability of meat processing companies but also compels consumers to re-evaluate their purchasing choices, potentially leading to a shift towards more affordable protein alternatives.

Shrinking Herd Dynamics and Market Impact

The U.S. cattle inventory has plummeted to an unprecedented low, with the USDA reporting just 94.2 million head by mid-year. This figure represents the smallest herd size recorded since 1973, highlighting a significant and sustained contraction within the livestock sector. This decline is not merely a statistical anomaly but a reflection of complex agricultural realities, including persistent drought conditions that limit pasture availability, rising costs for feed, and higher interest rates that discourage borrowing for expansion. The cumulative effect of these challenges has driven many ranchers to reduce their herds, rather than expand them, thereby tightening the supply of beef in the market. Consequently, cattle prices have soared, leading to record-high beef prices for consumers at grocery stores and presenting considerable financial challenges for major meat processors like JBS NV and Tyson Foods Inc., who are experiencing billions in profit losses.

The implications of this shrinking herd are far-reaching, extending from the rancher to the dinner table. The severe shortage in the world's largest beef-producing nation has undeniably driven up cattle acquisition costs for processors, directly translating into elevated retail beef prices. This economic pressure point is forcing consumers to contend with significantly higher costs for a staple food item, prompting discussions about household budgets and dietary adjustments. For meat producers, the current market dynamics mean operating with thinner margins and facing a difficult environment for profitability. The absence of a clear upward trend in the number of heifers retained for breeding underscores the industry's hesitation to embark on aggressive rebuilding, suggesting a cautious approach that will inevitably extend the period of tight supply and elevated prices. This delicate balance of supply, demand, and input costs shapes the immediate future of the beef market, influencing both producer strategies and consumer behavior.

Outlook for Beef Supply and Consumer Choices

The current state of the U.S. cattle herd offers little immediate promise of relief for consumers burdened by elevated beef prices. Despite some hopeful signs of stabilization in cattle numbers, significant herd expansion has yet to materialize. Agricultural economists, such as Derrell Peel from Oklahoma State University, emphasize that while the decline might be slowing, the industry is not yet in a growth phase. This assessment is supported by the relatively stable number of heifers in feedlots compared to steers, indicating that ranchers are not actively retaining female calves for future breeding purposes—a crucial step for herd rebuilding. Furthermore, a notable reduction in beef cows specifically raised for breeding signals that a comprehensive rebuilding cycle is still some way off, perpetuating a financially challenging period for meat producers and potentially pushing consumers towards more cost-effective protein sources like pork and chicken.

Looking ahead, the prospect of substantial recovery in beef supplies appears distant. Even under optimistic scenarios where ranchers begin rebuilding their herds immediately, industry analysts project that it will take until at least 2028 or 2029 for beef availability to increase meaningfully. This extended timeline implies that the prevailing high prices for both live cattle and retail beef are likely to persist for several years. This sustained period of elevated costs could fundamentally alter consumer dietary patterns, fostering a greater demand for poultry and other protein alternatives that offer better value. For the beef industry, the challenge lies not only in incentivizing herd growth but also in adapting to evolving consumer preferences and market dynamics shaped by prolonged supply constraints and price sensitivity. The path to a balanced and affordable beef market is a long one, requiring strategic decisions from producers and a sustained period of favorable conditions for expansion.