In a market predominantly driven by growth stocks, some robust dividend-paying companies are currently overlooked, offering compelling investment prospects. Honeywell International and Energy Transfer, despite recent market dips, exemplify such opportunities, providing stability and potential for long-term returns through their strategic initiatives and consistent income generation.

These companies are particularly appealing to investors seeking quality assets at attractive valuations, a stark contrast to the premium prices seen in broader market segments. Their resilience and proactive management strategies position them as strong candidates for those aiming to enhance their passive income streams and diversify their portfolios.

Honeywell's Strategic Transformation and Value Proposition

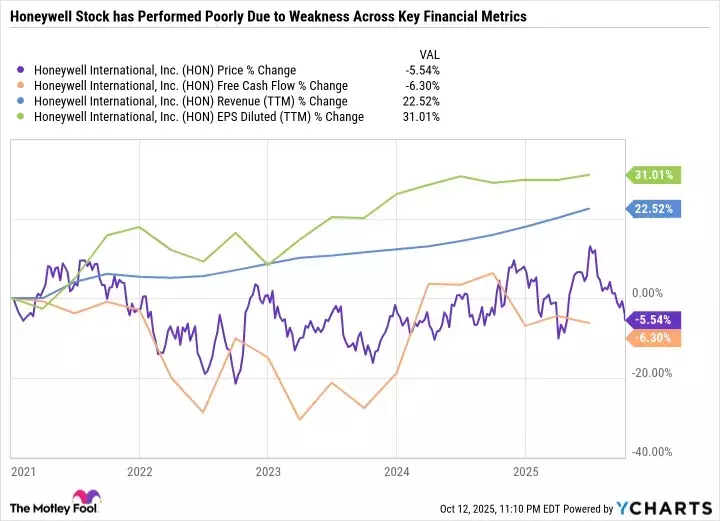

Honeywell International is currently navigating a significant corporate overhaul designed to unlock greater shareholder value. This industrial giant announced the spinoff of its advanced materials division, now operating independently as Solstice Advanced Materials. Furthermore, following pressure from activist investors like Elliott Investment Management, Honeywell is considering splitting its aerospace and automation sectors. These strategic realignments aim to create more focused, agile entities that can better capitalize on market opportunities. The imminent distribution of Solstice shares to existing Honeywell stockholders marks a pivotal moment, offering investors a unique chance to acquire Honeywell's core automation and aerospace businesses at a potentially undervalued price, especially for those who foresee the success of these newly independent ventures.

Despite its recent stock performance, which shows a decline of over 11% year-to-date, Honeywell's current valuation metrics suggest an attractive entry point. Its price-to-earnings ratio is notably lower than its ten-year median, indicating a discount that could pay off if the post-spinoff entities achieve even a fraction of their outlined growth potential. This makes Honeywell a compelling choice for patient investors looking for strong industrial sector representation in a market often characterized by inflated valuations. The ongoing restructuring is a calculated move to enhance long-term growth and profitability by streamlining operations and allowing each segment to pursue its distinct strategic objectives more effectively.

Energy Transfer: Resilience and Growth in a Dynamic Market

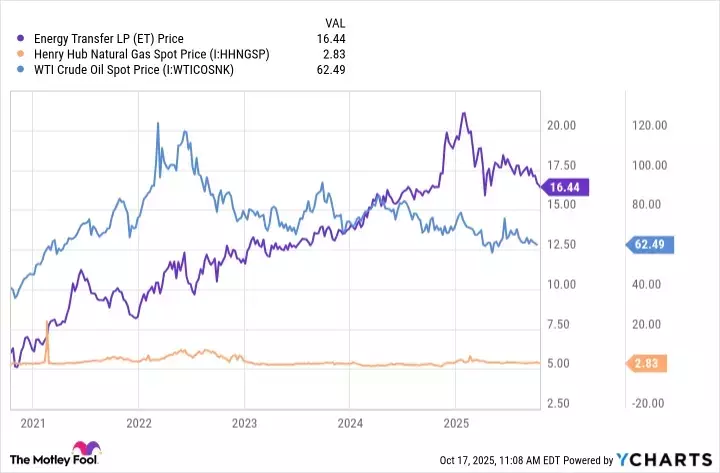

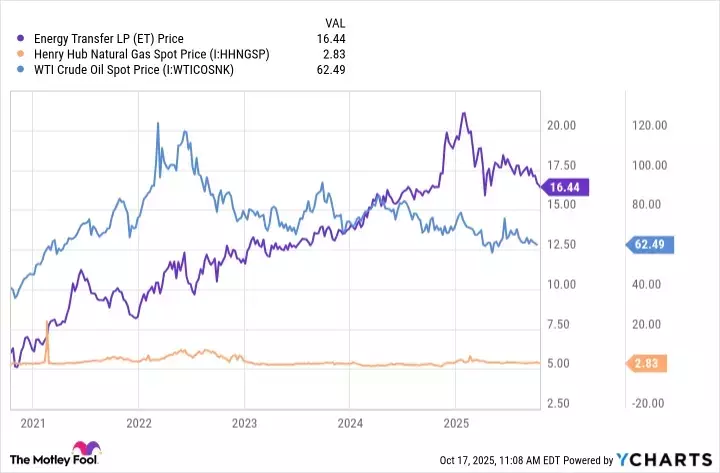

Energy Transfer has experienced a 16% dip in its stock price this year, largely influenced by fluctuating oil and natural gas prices and a modest projected growth in adjusted EBITDA. However, this downturn presents an opportune moment for investors to consider this midstream energy powerhouse. Energy Transfer's business model, which primarily involves fee-based services under long-term contracts for its vast pipeline network, ensures predictable revenue and stable cash flows, insulating it significantly from direct commodity price volatility. This structural advantage allows the company to maintain robust operations and continue its expansion initiatives, even when energy markets face headwinds. Its extensive infrastructure transports nearly 30% of U.S. natural gas, along with crude oil, NGLs, LNG, and refined products, underscoring its critical role in the energy sector.

Despite the current market sentiment, Energy Transfer is making substantial investments in growth projects, including major pipeline expansions and the development of large-scale NGL export facilities. These strategic capital expenditures, totaling nearly $5 billion for the current year, are designed to bolster future cash flows and earnings, regardless of short-term commodity price movements. Furthermore, the company has expressed confidence in increasing its annual dividend payout by 3% to 5%, supporting a compelling dividend yield of 7.9%. For investors seeking a blend of income and growth, Energy Transfer offers an attractive proposition, as its ongoing expansion and resilient business model are poised to drive its stock price higher once these projects come online and begin to contribute to its financial performance.