Amazon is set to release its third-quarter financial outcomes on October 30th, and market observers are keenly anticipating how the company's significant investments in artificial intelligence (AI) will translate into its performance. With a diversified AI strategy spanning its vast e-commerce operations, industry-leading cloud computing services (Amazon Web Services, or AWS), and growing digital advertising segments, Amazon is strategically leveraging AI to enhance operational efficiencies and unlock new revenue streams. The company's consistent track record of surpassing analyst expectations positions it as a compelling stock option, particularly for investors focused on long-term value creation.

As the end of October approaches, major American corporations are preparing to unveil their financial results for the quarter concluding on September 30th. Investors and analysts are particularly focused on companies at the forefront of the artificial intelligence revolution, as these entities are seen as having the potential to drive accelerated growth in both revenue and earnings, outpacing the broader market. Amazon, a titan in the technology sector, stands out in this landscape.

Amazon's comprehensive approach to AI involves deploying over a thousand applications across its diverse business units, including e-commerce, cloud services, streaming, and digital advertising. This widespread integration is designed to not only boost the company's overall efficiency but also to create novel avenues for revenue generation. A key component of this strategy is Amazon Web Services (AWS), which plays a pivotal role in the company's AI initiatives.

AWS, recognized as the world's leading cloud infrastructure provider with a substantial 30% market share, is central to Amazon's ambition to dominate all three layers of AI: the underlying infrastructure (data centers and advanced chips), large language models (LLMs), and specialized software. The critical importance of AWS was highlighted recently when a technical glitch caused a temporary outage for several hours, affecting numerous services. While this incident occurred in the fourth quarter and won't impact the upcoming third-quarter results, it underscored the extensive reach of Amazon's online services and will undoubtedly be a topic of discussion during the earnings call.

Beyond relying on external chip suppliers like Nvidia for its data centers, Amazon has innovated by developing its own AI accelerator chips, namely the Inferentia and Trainium lines. These proprietary chips, such as the Trainium2, offer superior price performance compared to GPU-based alternatives. Furthermore, through the AWS Bedrock platform, businesses gain access to pre-built large language models from leading AI firms like Anthropic and Meta Platforms, facilitating their own AI development efforts. Amazon's own foundational LLM, Nova, offers enhanced customization options and has quickly become a highly favored model on Bedrock. By excelling in both data center capabilities and LLM development, AWS aims to solidify its position as the preferred cloud solution for businesses worldwide.

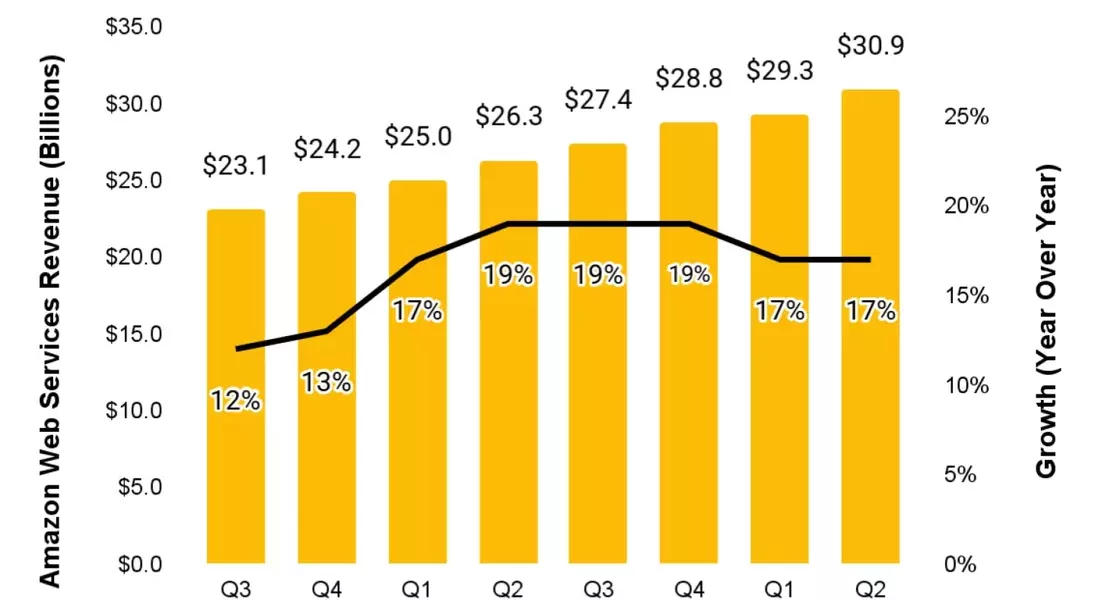

In the second quarter, AWS reported a revenue of $30.9 billion, marking a 17% increase year-over-year. However, Amazon CEO Andy Jassy noted that demand for AWS's data center capacity continues to outstrip supply, which has somewhat constrained even faster revenue growth. Jassy expressed optimism that this supply-demand imbalance would gradually improve in subsequent quarters, suggesting that investors might observe an acceleration in AWS's revenue growth once the third-quarter results are released.

Despite accounting for only 18% of Amazon's total revenue in the second quarter, AWS contributed a remarkable 57% to the company's operating income, making it the primary driver of profitability. Amazon's original e-commerce business, while remaining its largest revenue source, operates with thin profit margins due to its focus on offering the lowest prices to customers. Strategic improvements in its logistics network, such as segmenting the U.S. network into eight regions and customizing product storage by geographic location, have reduced shipping distances and package handling, thereby boosting profit margins. This, coupled with the robust performance of AWS, is fueling a significant surge in Amazon's profitability.

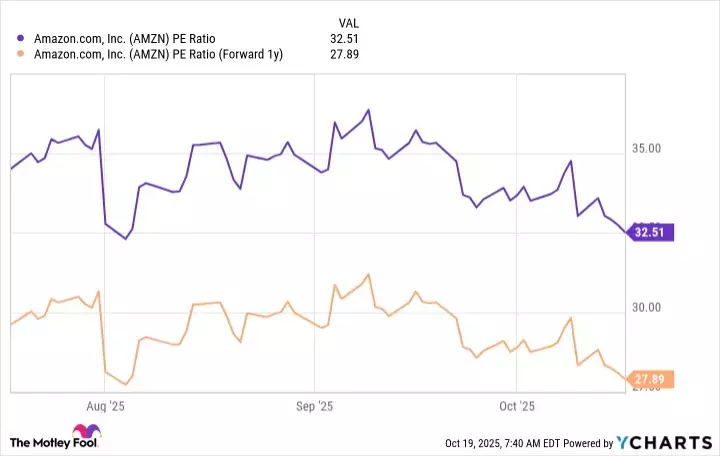

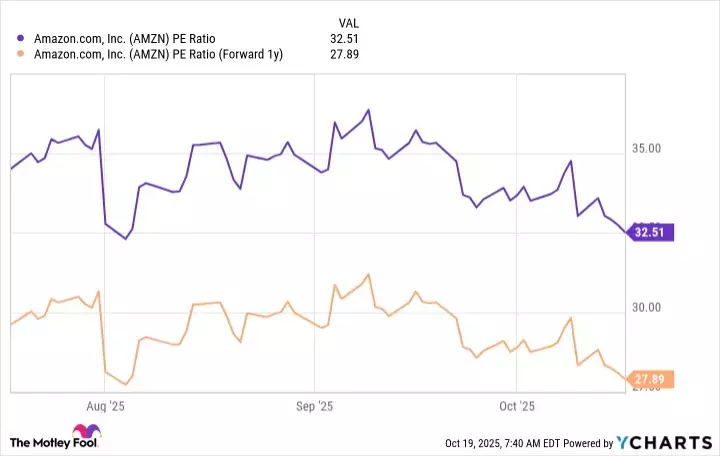

In the second quarter, Amazon's earnings per share (EPS) surged by 33% to $1.68, significantly surpassing Wall Street's forecast of $1.33. This impressive performance followed a 62% earnings growth in the first quarter, which also exceeded analyst predictions. Amazon has established a pattern of consistently beating Wall Street's estimates, achieving an average beat of 23% in each quarter of 2024. With analysts projecting an EPS of $1.56 for the third quarter, an even stronger outcome appears probable. Considering Amazon's current price-to-earnings (P/E) ratio of 32.5 based on its trailing 12-month EPS of $6.55, which is slightly below the Nasdaq-100 index's P/E of 33.1, and a forward P/E ratio of just 27.9 for 2026, the stock presents an attractive valuation. Investors willing to commit for a period of three to five years or more could experience substantial returns as Amazon's AI initiatives mature and yield greater value.