Gold Shines Bright: A Haven in Tumultuous Times

Warren Buffett's Investment Philosophy and His Stance on Gold

Warren Buffett, a titan in the investment world and the head of Berkshire Hathaway since 1965, has consistently championed assets that generate income, viewing them as the bedrock of wealth creation. His remarkable success, which saw a $1,000 investment in Berkshire Hathaway grow to an astonishing $44.7 million by 2024, far eclipsing the S&P 500's returns, stems from his focus on companies with predictable growth, robust earnings, and strong management. These companies often reward shareholders through dividends and stock repurchases, mechanisms Buffett highly favors for compounding returns. Consequently, Buffett has historically been critical of gold, famously calling it an \"unproductive\" asset due to its inability to generate revenue or earnings.

Gold's Unprecedented Performance in 2025

Defying Buffett's long-held view, gold has experienced an extraordinary year in 2025, delivering an impressive 62% return. This performance has allowed it to significantly outperform major market benchmarks such as the S&P 500 and the Nasdaq-100, and even surpassed the gains of technology behemoth Nvidia, which saw returns ranging between 13% and 32%. This unexpected surge underscores gold's enduring appeal as a safe-haven asset, particularly during periods of economic uncertainty and political turbulence.

The Driving Forces Behind Gold's Current Appeal to Investors

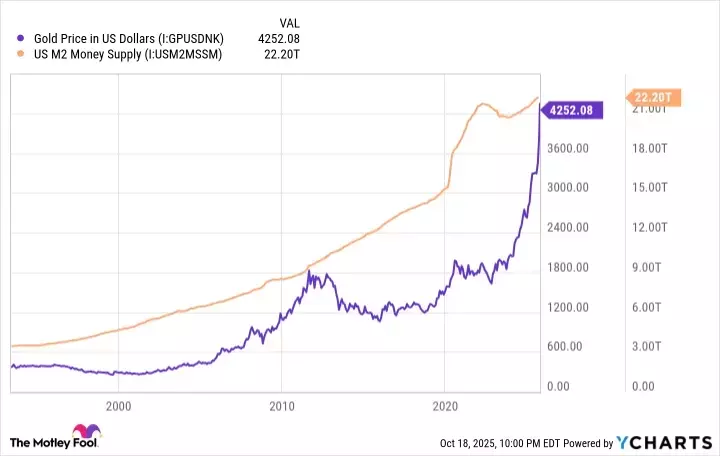

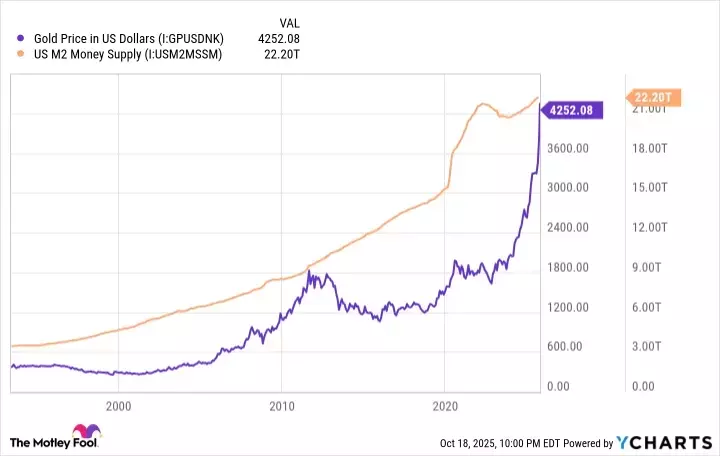

Gold's intrinsic value as a non-income-generating asset and its limited industrial applications (primarily in semiconductors for electrical conductivity and in jewelry) have always been points of contention for investors like Buffett. However, its demand predominantly stems from speculation regarding its future value. The historical context reveals gold's role as a trusted store of value for millennia, largely due to its scarcity. Historically, many nations, including the United States, pegged their currencies to gold through the gold standard, which served as a natural restraint on monetary expansion and inflation. The abandonment of the gold standard by the U.S. in 1971 paved the way for an explosion in money supply, leading to a significant erosion of the U.S. dollar's purchasing power.

Impact of Fiscal Policies and National Debt on Gold's Value

Currently, investors are keenly observing the potential for accelerated money supply growth, driven by the U.S. government's substantial budget deficits. Projections from the Committee for a Responsible Federal Budget indicate a staggering $22.7 trillion shortfall over the next decade, which could inflate the national debt from $37.9 trillion to approximately $60 trillion. This fiscal trajectory leads many investors to believe that further devaluation of the U.S. dollar through aggressive monetary expansion is inevitable. In this environment, gold, with its consistent history of preserving value, becomes an increasingly attractive asset for safeguarding wealth.

Simplified Access to Gold for Modern Investors Through ETFs

Investing in gold has become more accessible than ever, thanks to the advent of Exchange-Traded Funds (ETFs) that directly mirror gold's market movements. These funds offer the convenience of being traded on investment platforms, eliminating the logistical challenges and costs associated with storing and insuring physical gold. While ETFs typically incur an annual expense ratio, these fees are often offset by the savings on physical storage and insurance, making them a cost-effective option for most investors. Notable gold ETFs include the SPDR Gold Trust (GLD), Abrdn Physical Gold Shares ETF (SGOL), and VanEck Merk Gold ETF (OUNZ), each offering varying expense ratios and liquidity levels to suit different investment strategies. The SPDR Gold Trust, for instance, is the largest with $142 billion in assets, all backed by physical gold, offering high liquidity despite a slightly higher expense ratio. For investors prioritizing minimal costs, the Abrdn Physical Gold Shares ETF provides similar gold exposure at a lower annual fee.

Revisiting the Debate: Gold's Role in a Diversified Portfolio

Despite gold's impressive short-term gains in 2025, a look at its long-term performance reveals a more nuanced picture. Over the past three decades, gold has achieved a compound annual return of 7.96%, which, while respectable, lags behind the S&P 500's 10.67% annual growth over the same period. This difference, though seemingly minor, has a profound impact on accumulated wealth; a $50,000 investment would have yielded significantly more in the S&P 500 than in gold. This data reinforces Buffett's long-term strategy of favoring productive assets. However, this does not mean gold should be entirely dismissed. Financial experts suggest that allocating a small portion, perhaps around 10%, of a portfolio to gold can offer substantial benefits during times of political instability and expansive government spending, acting as a hedge against market volatility and currency devaluation. Such an approach acknowledges gold's unique role as a protective asset without compromising the growth potential of a diversified investment strategy.