Secure Your Financial Future with Enduring Dividend Leaders

Examining the Current Market Landscape for Essential Goods

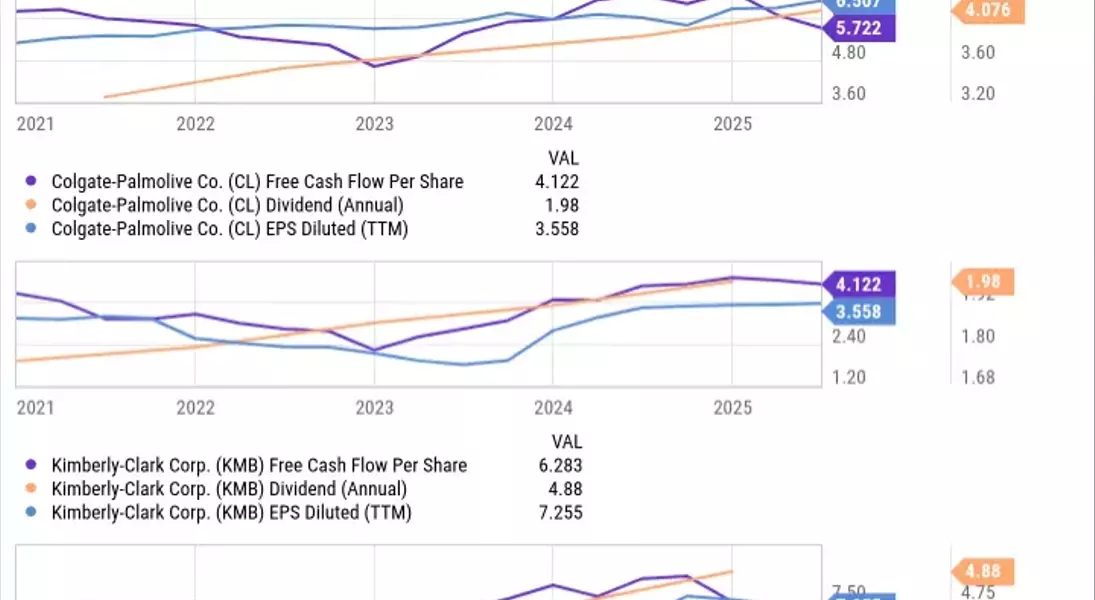

While the broader market, particularly technology, communications, finance, and industrial sectors, has experienced substantial growth this year, the consumer staples segment has shown more subdued performance, hovering around a flat trajectory. This trend would be even more pronounced were it not for the significant contribution of giants like Walmart, a dominant force within the sector, whose stock has outpaced the general S&P 500 index. This divergence in performance sets the stage for a closer look at the underlying dynamics affecting companies that produce everyday necessities.

Understanding the Pressures on Household Product Powerhouses

Companies such as Procter & Gamble, Colgate-Palmolive, and Kimberly-Clark specialize in essential household and personal care items. Procter & Gamble's vast portfolio spans fabric care, baby products, skin care, and oral hygiene, among others. Colgate-Palmolive, while sharing some common ground with P&G, emphasizes oral health and also includes popular personal and home care brands. Kimberly-Clark focuses on paper-based and absorbent products, including tissues, diapers, and feminine hygiene items. The consistent consumer demand for these products generally positions these companies as stable performers, even during economic slowdowns. However, the current economic climate presents unique difficulties, with consumer confidence wavering and spending habits shifting. Leadership from these companies points to consumers being more cautious, exhausting existing household inventories, and actively seeking better value through different packaging sizes or promotional offers, indicating a prolonged period of consumer restraint rather than a quick return to pre-inflationary spending patterns.

Navigating Economic Headwinds: Strategic Adjustments by Industry Leaders

The management teams at these consumer staples giants are actively adapting to a challenging operational landscape. Executives from Procter & Gamble, Colgate-Palmolive, and Kimberly-Clark have all acknowledged the significant pressures on consumers' purchasing power. These pressures stem from ongoing inflation, increasing costs of living, and a general sense of economic uncertainty, which contrasts sharply with the booming investment in sectors like artificial intelligence. In response, these companies are moving beyond simple price increases to implement strategies that deliver more value to customers. This includes offering larger, more economical product packages and multi-packs, which lower the unit cost, as well as smaller, more affordable items to cater to consumers looking to manage their budgets more effectively. While these approaches might temporarily impact profit margins, they are crucial for maintaining sales volume and customer loyalty in a competitive and cost-sensitive market.

The Enduring Appeal of Dividend Kings in a Volatile Market

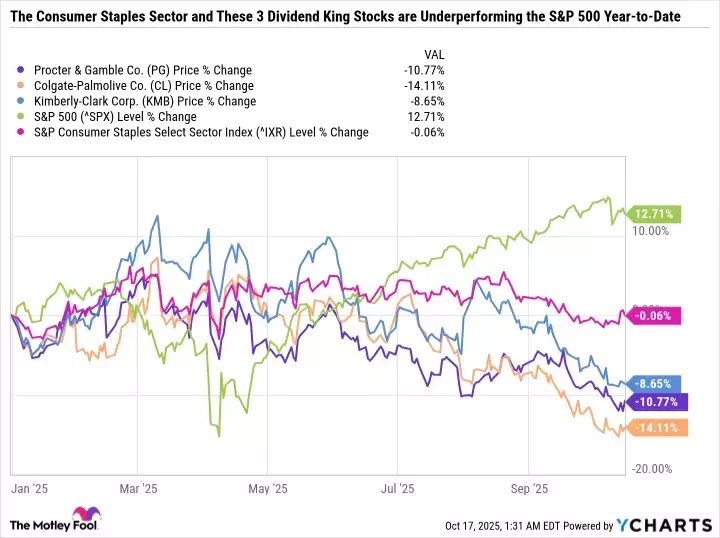

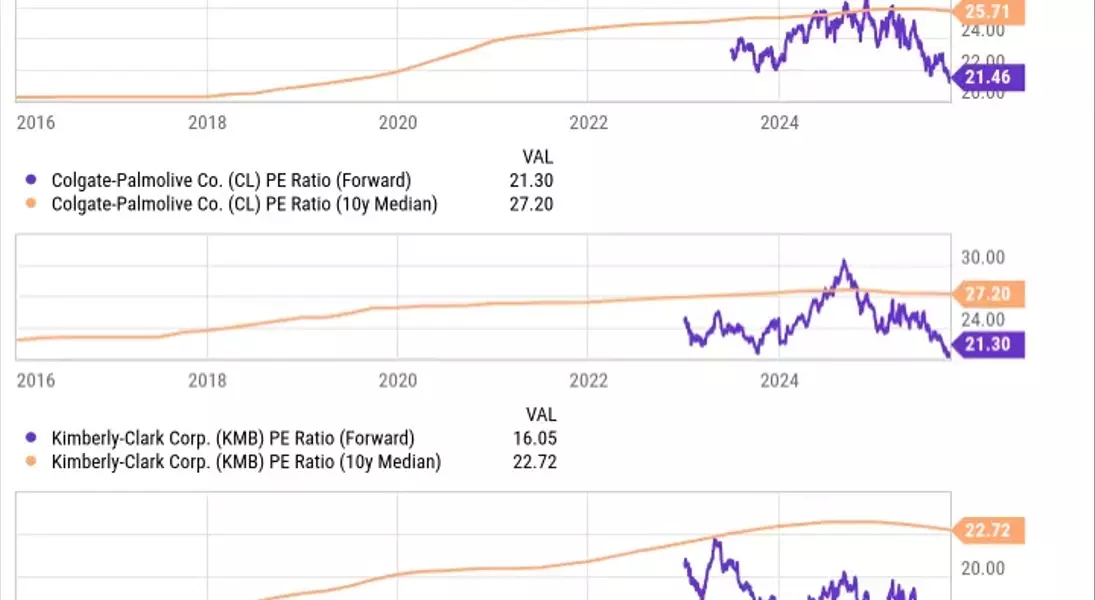

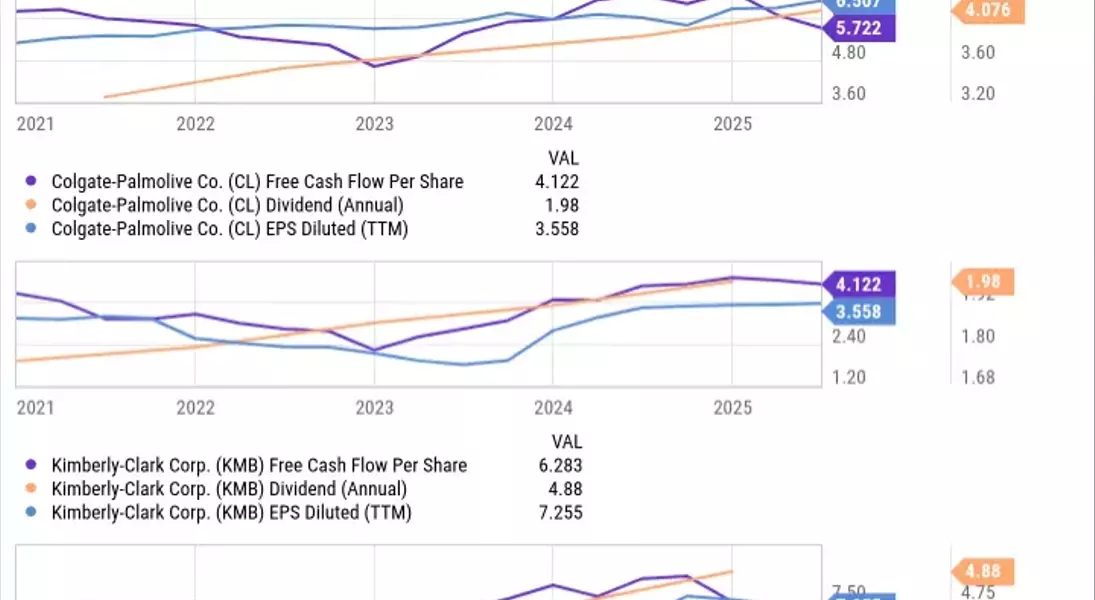

Despite facing slowing revenue growth and stagnant operating margins, P&G, Colgate-Palmolive, and Kimberly-Clark remain highly attractive to long-term investors due to their classification as \"Dividend Kings.\" This prestigious title signifies their remarkable track record of increasing dividends for over five decades. For example, Kimberly-Clark recently marked its 53rd consecutive annual dividend hike, Colgate-Palmolive its 63rd, and P&G its 69th. This consistent commitment to shareholder returns, coupled with recent stock sell-offs, has pushed their dividend yields to appealing levels: Kimberly-Clark at 4.2%, P&G at 2.8%, and Colgate-Palmolive at 2.7%. Furthermore, these companies are currently trading at significant discounts compared to their historical valuation averages, indicating that their strong fundamentals and reliable cash flows can comfortably support future dividend increases, even in an environment of prolonged modest growth. For discerning investors prioritizing stability and passive income, these firms represent a compelling opportunity.

Why This Trio Offers a Royal Path to Passive Income

In a market often captivated by high-growth narratives, particularly in emerging sectors like AI, seasoned investors are reminded of the fundamental strengths offered by established consumer staples companies. Procter & Gamble, Colgate-Palmolive, and Kimberly-Clark, with their robust business models, attractive valuations, and consistent dividend payouts, stand out as pillars of stability. While immediate, explosive earnings growth may not be on the horizon, their ability to steadily expand over time and generously reward shareholders through reliable dividends makes them invaluable additions to a long-term investment portfolio. These Dividend Kings offer a powerful means to enhance passive income streams, making them a wise choice for investors seeking dependability amidst market fluctuations.