Significant alterations to the tax brackets are on the horizon for the 2026 tax filing period, a development that will influence virtually every individual who earns income. Understanding one's tax obligations is crucial, especially given the intricate nature of tax laws. A fundamental aspect of these obligations involves comprehending tax brackets and their direct influence on the amount of tax owed. It is equally important to acknowledge that these brackets are not static; they undergo periodic revisions. The Internal Revenue Service (IRS) has recently unveiled such adjustments for 2026, which are likely to impact a broad spectrum of taxpayers.

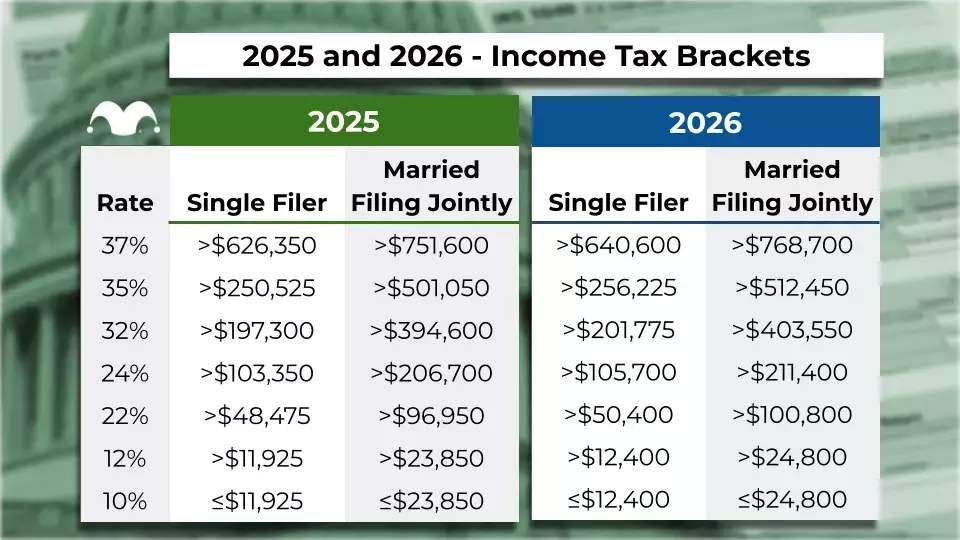

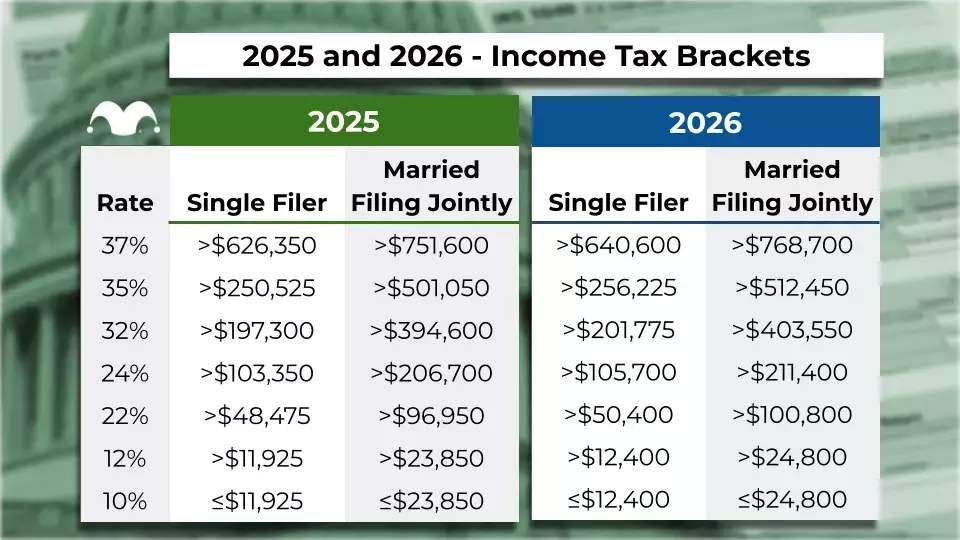

These upcoming changes mean that individuals will be able to earn a higher income before transitioning into a more elevated tax bracket, whether filing as a single person or jointly as a married couple. For example, under the new structure, a single filer could earn up to $12,400 in 2026 before their income is subject to the 12% tax rate, an increase from the $11,925 threshold in 2025. This pattern of adjustment extends across all brackets, including the highest 37% rate, which will only apply once a single filer's income surpasses $640,600, a notable rise from the previous $626,350. It is crucial to remember that these modifications will not affect the tax liability for income earned in 2025, which will be filed in April 2026; rather, they will commence with the 2026 tax returns filed in April 2027.

The U.S. tax system operates on a progressive scale, meaning tax rates increase with income, but each rate applies only to the portion of income falling within its specific range. Consequently, these bracket adjustments are beneficial for most taxpayers, as a larger portion of their income will be taxed at lower rates. The higher an individual's income, the greater the potential benefit from these changes, as the thresholds for each successive bracket are expanded. This favorable shift allows workers to retain more of their earnings, providing more capital for personal investments, such as retirement planning. However, it is important not to anticipate an immediate larger tax refund, as the benefits of these new brackets will only manifest in future tax filings.

The adjustments to tax brackets represent a positive step towards ensuring that the tax system remains responsive to economic shifts, offering taxpayers the opportunity to manage their finances more effectively. By empowering individuals to keep a greater share of their hard-earned money, these changes can stimulate personal savings, encourage investment, and ultimately contribute to a more robust financial future for many. It is a reminder that informed financial planning and an understanding of tax policy are essential tools for navigating the complexities of personal wealth management, fostering a sense of financial empowerment and stability.