The UK housing market is currently navigating a period of significant recalibration, as asking prices for residential properties experience an unprecedented seasonal decline. This downward trend, primarily driven by an increased inventory of homes and shifting buyer behaviors, signals a notable adjustment from the robust growth observed in previous months. Industry experts emphasize that strategic pricing is now paramount for sellers looking to successfully close deals in this evolving landscape.

Despite the current price contractions in many areas, there's a cautiously optimistic outlook for the latter half of the year. Falling mortgage rates and anticipated further cuts to interest rates are expected to gradually improve affordability for prospective homeowners. This potential accessibility, combined with sustained buyer interest, could provide a foundation for market resilience, even as seasonal fluctuations continue to influence activity.

Current Market Trends and Price Adjustments

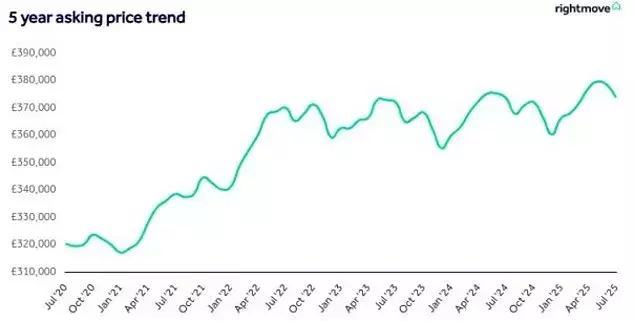

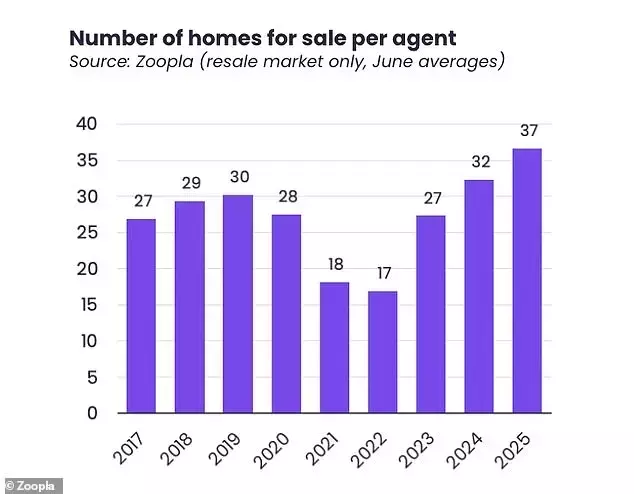

The UK property market is experiencing its most pronounced seasonal downturn in over two decades, with asking prices for newly listed homes showing a significant decline. Data from leading property portals indicates that average prices have dropped by approximately £6,000 since May, pushing the national average for new listings to just over £373,700. This sharp reduction has led to a halving of annual price growth forecasts, reflecting a profound shift in market conditions. The primary catalyst for this adjustment is a notable increase in housing supply, which has resulted in a glut of available properties. With more choices at their disposal, buyers are becoming increasingly discerning, leading to a greater emphasis on competitive pricing from sellers. This oversupply, exacerbated by the traditional summer holiday slowdown, means that vendors who set overly ambitious asking prices risk their properties becoming stagnant amidst a crowded market.

This current market dynamic underscores the critical importance of realistic pricing for anyone looking to sell a home. Property experts highlight that the high volume of properties on the market empowers buyers to be more selective, making an attractive initial price essential for generating interest and securing a sale. The shift is particularly evident in some areas, where the seasonal dip has been more pronounced, necessitating a strategic approach to valuation. This period of price correction is also influenced by broader economic factors, including changes in stamp duty and potential adjustments to non-domicile tax rules, which can disproportionately affect higher-value markets. As a result, the market is favoring those who price their properties acutely to stand out, reflecting a departure from previous periods of rapid price appreciation and signaling a return to more balanced, buyer-influenced conditions.

Future Outlook and Affordability Improvements

Looking ahead, the UK property market, despite its recent dip, is poised for a more stable and potentially more accessible future. The current environment, characterized by easing mortgage rates and the anticipation of further interest rate reductions, suggests a gradual improvement in affordability for a wider range of buyers. Average two-year fixed mortgage rates have already seen a decline compared to the previous year, translating into significant monthly savings for new homeowners. This trend, coupled with earnings growth outstripping property price increases over the last year, indicates an enhanced purchasing power for many. Market analysts remain optimistic about sustained buyer activity throughout the latter half of the year, projecting that these affordability gains will encourage continued engagement, even during traditionally quieter periods such as the summer holidays and the festive season.

The overall trajectory points towards a resilient market, as key indicators such as rising buyer inquiries demonstrate strong underlying demand. The expectation of additional interest rate cuts before the close of 2025 further strengthens this positive outlook, promising even greater affordability and potentially stimulating increased transaction volumes. This period represents a crucial opportunity for prospective buyers, as the market transitions from one of rapid inflation to one offering more balanced and sustainable conditions. For sellers, adapting to current valuations and understanding the shift in buyer sentiment will be key to successful transactions. Ultimately, as borrowing costs become more manageable and the market adjusts to a healthier equilibrium, the housing sector is expected to regain momentum, fostering a more favorable environment for both buying and selling.