A significant slowdown in home renovation and extension projects is sweeping across England, marking the lowest point in a decade for planning consents. This downturn is primarily fueled by a dramatic rise in construction expenses and a shift in homeowner priorities, making extensive property overhauls less appealing. The once-lucrative practice of 'property flipping' has also dwindled, further impacting the renovation sector as heightened transactional costs erode potential gains. These converging factors indicate a housing market recalibration, where affordability and convenience now outweigh the allure of custom improvements, prompting both individual homeowners and professional developers to reconsider their investment strategies in an evolving economic landscape.

This current trend reflects a broader economic caution, as consumers and investors grapple with financial uncertainties and inflated material prices. The substantial increase in building material costs, combined with a tightening labor market and rising wages for skilled trades, has pushed the cost of home improvements beyond what many find justifiable. Consequently, a market that once thrived on renovation and expansion is now experiencing a profound contraction, altering traditional patterns of property ownership and investment. The shift towards purchasing finished homes underscores a widespread desire to avoid the financial and logistical complexities associated with extensive construction work in the present climate.

Soaring Costs Deter Home Improvements

The number of planning approvals for home improvements and extensions in England has reached its lowest level in a decade, according to Savills, a leading real estate firm. This decline is attributed largely to the soaring costs of construction materials and labor, which have made renovation projects considerably more expensive. Since early 2020, the price of essential building materials has increased by an average of 37%, with some specific items seeing jumps of over 60%. This steep rise, combined with increased wages for skilled tradespeople, has made the financial viability of extensive renovations questionable for many homeowners, leading to a significant reduction in new applications.

Historically, there has been a close link between property transactions and home improvements, as new homeowners often embark on renovations shortly after purchasing. However, this correlation has weakened considerably, with the ratio of planning approvals to transactions falling to one for every 6.8 transactions in 2024, compared to the typical one in five. This divergence highlights a shift in buyer behavior, with a growing preference for 'turn-key' properties that require no immediate work. The prevailing economic uncertainty further discourages homeowners from undertaking costly and logistically challenging renovation projects, opting instead for a lower-risk approach. This trend is impacting regions across Britain, including London and the South, which traditionally saw high levels of renovation activity, as well as significant declines in the North of England, reflecting a widespread reevaluation of home improvement investments.

The Decline of Property Flipping

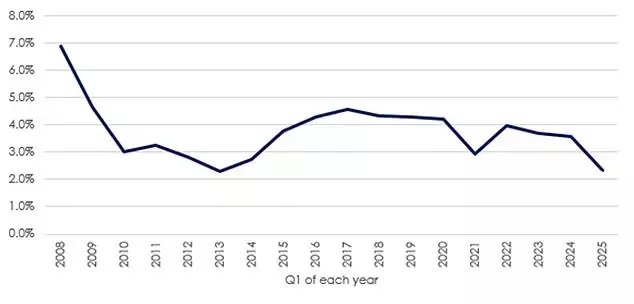

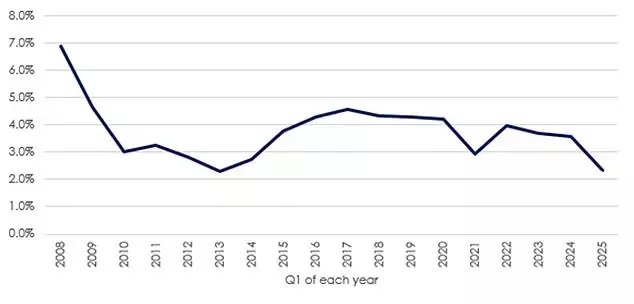

The practice of 'property flipping'—buying homes to quickly renovate and resell for profit—has plummeted to its lowest point since 2013. In the first quarter of 2025, only 2.3% of homes sold in England and Wales were flipped within a year, a sharp decrease from 3.6% in the same period last year. This downturn is primarily driven by the escalating costs of renovation, including both materials and labor, and significantly higher stamp duty charges. The increase in stamp duty now accounts for a substantial portion of potential gross profit, making many flipping ventures unprofitable once all expenses are factored in.

This dramatic reduction in property flipping activity underscores the challenges faced by investors in the current housing market. While many flipped homes are still sold at a higher price, the net profit after accounting for increased stamp duty and renovation costs has severely diminished. Aneisha Beveridge of Hamptons points out that stamp duty bills can now be higher than the cost of renovations themselves, effectively eliminating the financial incentive for many flippers. This, coupled with the rising costs of construction materials and labor, and in some areas, falling house prices, has transformed what was once a profitable endeavor into an increasingly risky and challenging business, leading to a marked decline in such speculative investments.