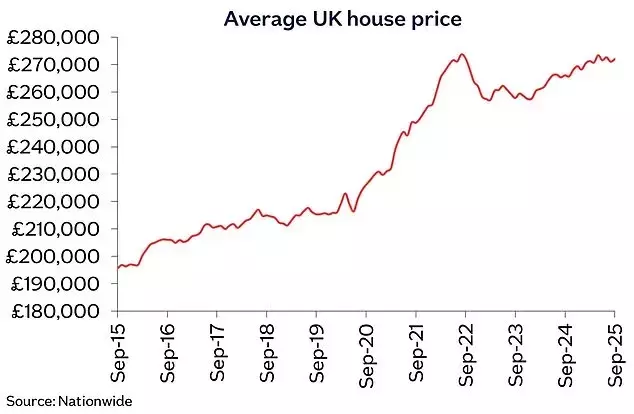

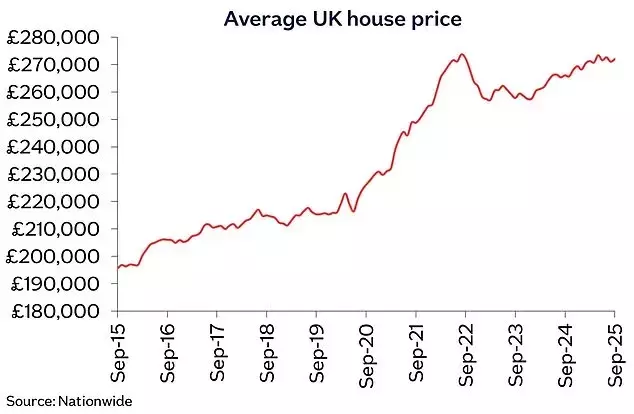

In September, the United Kingdom's housing market demonstrated resilience with a modest increase in property values, as reported by the Nationwide Building Society. This growth occurred despite prevailing rumors of potential adjustments to property-related taxes in the upcoming governmental budget. The overall average home value climbed by half a percentage point over the month, pushing the annual growth rate to 2.2%, a slight rise from the previous month. However, a clear divergence in performance was observed across the country, with the northern regions of England experiencing more robust growth compared to the southern areas. This regional disparity, coupled with buyer hesitancy influenced by tax reform speculation, points to a complex and evolving real estate landscape.

The Nationwide Building Society's latest data indicates that property values across the UK saw a 0.5% month-on-month increase in September, culminating in an annual rise of 2.2%, surpassing August's 2.1% growth. This upward trend defied expectations, as many anticipated a slowdown due to widespread speculation about impending property tax changes in the November 26th Budget, including potential alterations to stamp duty, capital gains tax, and council tax. Such rumors have reportedly led some prospective buyers and sellers to postpone their plans, creating a cautious market environment.

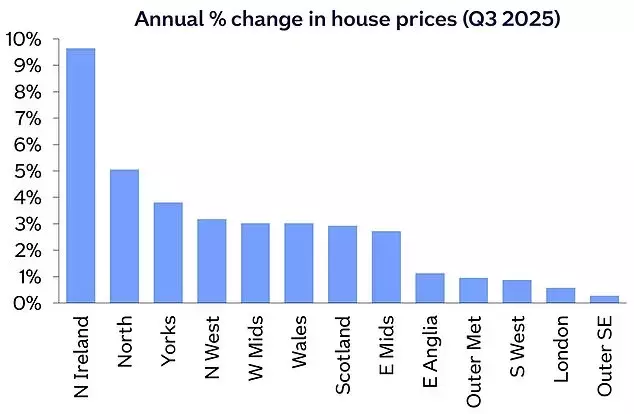

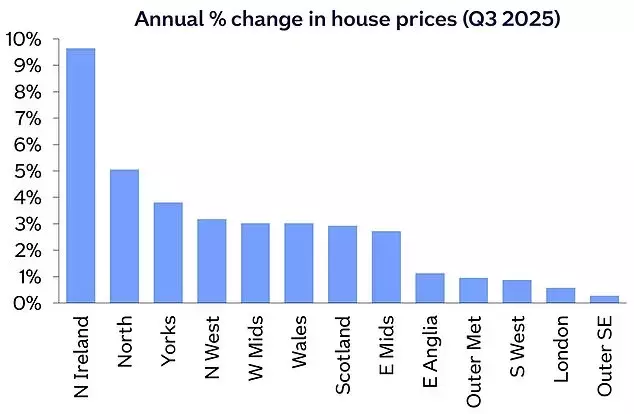

Geographically, Northern Ireland led the UK with an impressive 9.6% year-on-year increase in house prices. Wales and Scotland also recorded positive growth, with prices rising by 3% and 2.9% respectively over the same period. Within England, the North continued its strong performance, registering a 5.1% annual price increase in regions like Tyneside, Teesside, and Cumbria. In stark contrast, Southern England, encompassing areas such as the South West, South East, London, and East Anglia, saw a significantly lower average increase of just 0.7%.

Industry experts have attributed this slowdown in the South to buyer reluctance fueled by the uncertain tax landscape. Zoopla reported a 4% decrease in buyer inquiries for properties priced at £500,000 or more compared to the previous year, while Knight Frank, which recently revised its annual house price forecast downwards, noted a combination of high property supply and dwindling confidence. Tom Bill, head of UK residential research at Knight Frank, emphasized that stable mortgage rates earlier in the year had encouraged activity, but the current 'guess the tax rise' scenario is fostering hesitancy. He advised sellers in the increasingly buyer-centric market to set realistic asking prices.

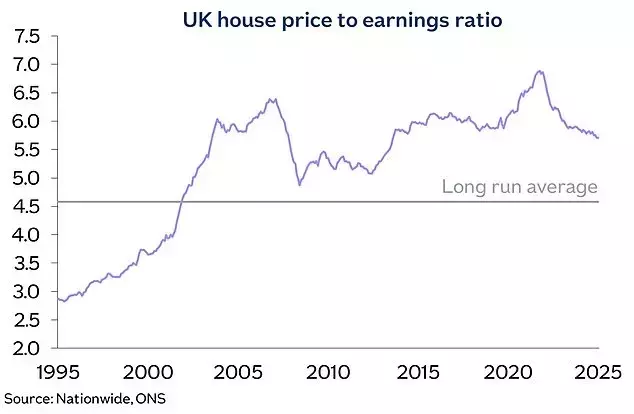

Despite these headwinds, Robert Gardner, chief economist at Nationwide, maintains a cautiously optimistic outlook for the housing market. He points to supportive underlying conditions for homebuyers, including low unemployment, healthy wage growth, strong household finances, and the expectation of moderate borrowing costs if the Bank Rate is lowered as anticipated. Gardner suggests that a sustained broader economic recovery would likely lead to a gradual strengthening of housing market activity in the coming quarters. However, Jonathan Hopper of Garrington Property Finders highlights the widening 'gulf' between the North and South, where an abundance of supply in the South is empowering buyers to dictate terms, leading to a price-sensitive autumn market where only pragmatic sellers are succeeding. He further observes that 'needs-based' buyers are proceeding with caution, while 'wealthier movers' are awaiting clarity on the Chancellor's budget announcements.

The latest market data reveals a nuanced picture of the UK property sector, characterized by overall growth tempered by regional disparities and buyer apprehension. While some experts foresee a strengthening market, the influence of upcoming fiscal policy decisions continues to shape immediate activity, particularly in the more expensive southern regions. The contrast between robust Northern growth and a more cautious Southern market underscores the varied dynamics at play within the national housing landscape.