In the rapidly evolving landscape of artificial intelligence, a compelling argument emerges for Taiwan Semiconductor Manufacturing Company (TSMC) to potentially eclipse the combined market valuations of tech giants Nvidia and Palantir Technologies. While Nvidia and Palantir have garnered significant attention and achieved remarkable growth due to the AI revolution, TSMC's indispensable position as the leading fabricator of advanced processors places it at the very core of this technological transformation. Its unparalleled manufacturing capabilities are the bedrock upon which the most demanding AI workloads are built, suggesting a future where its strategic importance could translate into an even greater market presence.

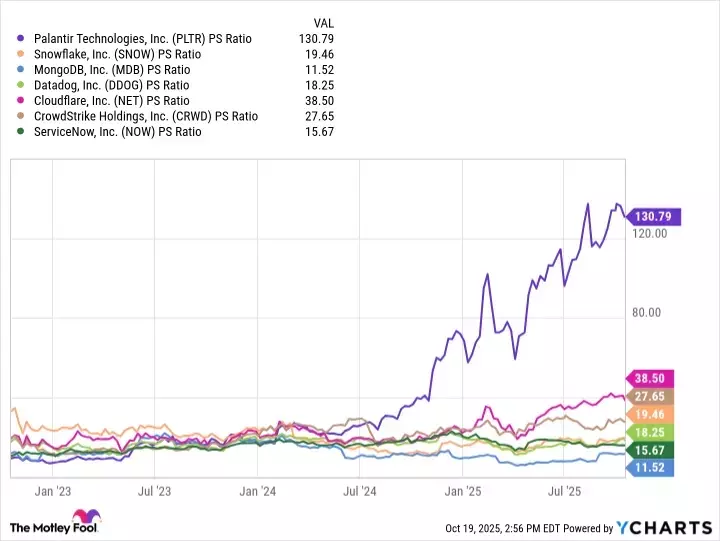

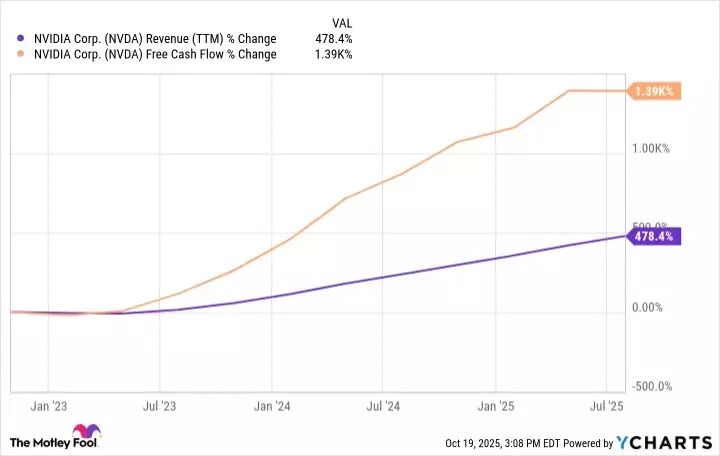

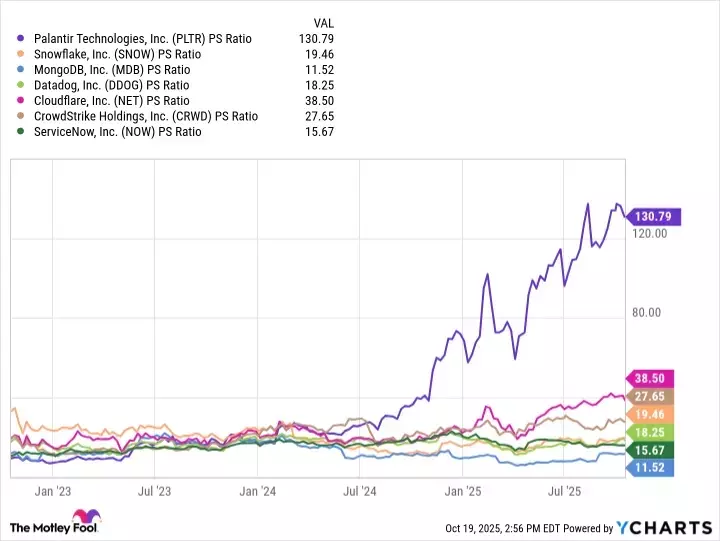

Nvidia’s dominance in AI chip design and its robust software ecosystem are undeniable, having propelled it to the forefront of the global market. However, even such explosive growth faces inherent limits, with a potential shift in AI infrastructure spending from initial buildouts to optimization, and increasing competition from alternative chip designs and custom silicon from major tech companies. Similarly, Palantir, a leader in AI-powered data analytics, is navigating an increasingly crowded software market. The proliferation of open-source AI models and growing competition from enterprise software providers integrating generative AI could lead to a normalization of Palantir's valuation as the market matures and capabilities become more commoditized.

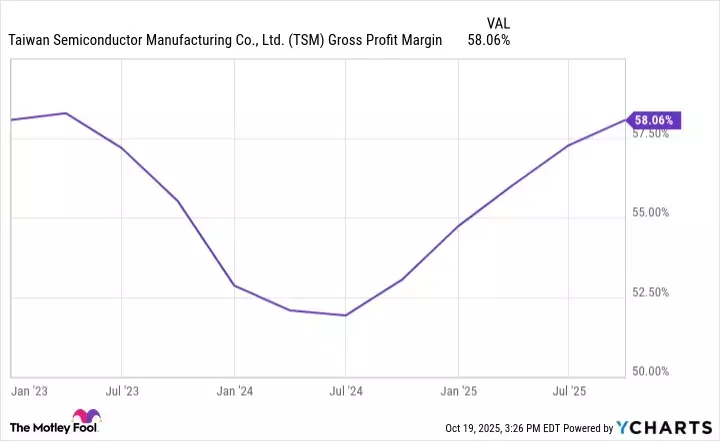

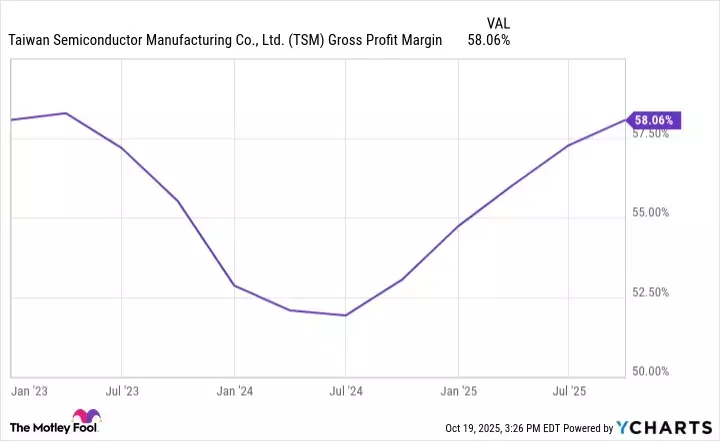

Amidst these dynamics, TSMC's role becomes even more critical. As the primary manufacturer for nearly 90% of the world's advanced processors, TSMC is an essential partner for companies like Nvidia, AMD, Apple, and Tesla. The company's ongoing expansion of fabrication plants globally, including in the U.S., Japan, and Germany, not only enhances supply chain resilience and mitigates geopolitical risks but also cements its strategic significance to the global economy. This unparalleled control over advanced chip manufacturing, combined with its high gross margins and robust customer base, positions TSMC to potentially outpace its peers in market valuation as the demand for AI continues its relentless acceleration.

The possibility of TSMC's market value surpassing the combined worth of Nvidia and Palantir by the end of the decade, while ambitious, is grounded in its fundamental and indispensable role within the AI ecosystem. For this scenario to materialize, sustained global investment in AI infrastructure, stable supply chains, and a de-escalation of geopolitical tensions, particularly regarding the Taiwan Strait, are crucial. If these conditions persist, TSMC's near-monopoly on the fabrication of the most advanced chips could provide it with unparalleled strategic leverage, allowing it to achieve a valuation that rivals or even exceeds today's market leaders, underscoring the profound impact of foundational technology on the future of innovation and economic growth.