In the rapidly expanding realm of artificial intelligence, Broadcom is emerging as a formidable contender, with projections suggesting it could eclipse the combined market valuation of tech giants Amazon and Palantir by the year 2030. This outlook stems from Broadcom's integral position within the AI hardware supply chain, providing critical components such as data center networking equipment, specialized application-specific integrated circuits (ASICs), and advanced connectivity solutions that are indispensable for the operation of hyperscale AI infrastructures. Unlike companies primarily focused on AI applications or services, Broadcom's strength lies in enabling the foundational technology that powers the entire AI ecosystem. Furthermore, its strategically diversified business model, which includes a robust software division and various semiconductor operations, offers a stable counterweight to market volatilities, positioning the company for sustained growth amidst the AI revolution.

Nvidia, a leading chip designer, has experienced extraordinary growth over the last three years, propelled by the surge in artificial intelligence. Its graphics processing units (GPUs), initially developed for enhancing video game visuals, are now fundamental computing elements across diverse AI applications, from data center training to humanoid robotics and autonomous vehicles. The demand for Nvidia's chips continues to exceed supply, indicating its sustained dominance in the AI chip sector. However, the next five years are expected to bring forth new leaders in AI computing infrastructure. Experts predict that Broadcom, in particular, has the potential to surpass the combined market capitalization of Amazon and Palantir Technologies by 2030. This growth is anticipated to be fueled by an escalating need for the networking capabilities, connectivity solutions, and custom silicon essential for supporting the AI revolution.

While Amazon and Palantir are strategically positioned to benefit from the ongoing AI trends, both companies face considerable obstacles that could hinder their medium-term valuation expansion. Amazon's primary involvement in AI is through its highly profitable Amazon Web Services (AWS), its cloud computing arm. However, AWS is up against intense competition from Microsoft Azure and Google Cloud, which are aggressively deploying AI-powered tools at a faster rate. Meanwhile, Amazon's consumer-focused AI initiatives, including robotics, logistics automation, and retail personalization, are still in their nascent stages and are not expected to significantly boost operating income in the near future. Therefore, despite the breadth of Amazon's AI endeavors, they are unlikely to generate explosive growth for a company already valued at approximately $2.3 trillion.

Palantir, renowned for its AI-driven data analytics and intelligence software, has garnered significant attention with its Artificial Intelligence Platform (AIP), built upon its Foundry, Gotham, and Apollo operating systems. This platform has driven accelerated revenue growth and consistent profitability. Yet, Palantir's valuation presents a different narrative, with its price-to-sales (P/S) multiple nearing 180. Such a premium valuation leaves little margin for error, as investors have already factored in many years of anticipated future success. Any deceleration in contract acquisitions or government spending could lead to substantial multiple compression. Consequently, between now and 2030, it is more probable that Palantir's valuation will stabilize rather than continuing its rapid ascent.

Broadcom, often not the first company that comes to mind when discussing AI investments, possesses a uniquely compelling position within the industry. It plays a critical role at the confluence of the AI hardware supply chain, manufacturing data center networking equipment, specialized application-specific integrated circuits (ASICs), and essential connectivity solutions that underpin hyperscale AI clusters. Broadcom has become a crucial provider for major technology firms like Amazon, Alphabet, Microsoft, Oracle, and IBM. The CEO, Hock Tan, previously indicated that just three of its hyperscale clients could contribute between $60 billion and $90 billion in revenue by fiscal year 2027, offering a clear view into the company's strong business prospects and order backlog. Recently, management also announced a new $10 billion chip contract, though the client's identity was not disclosed. These developments underscore a broader trend: as AI workloads evolve, the demand for specialized processors, beyond Nvidia’s GPUs, is rapidly expanding.

The strategic diversification of Broadcom's business model further reinforces its stability. Its software division, significantly strengthened by the 2023 acquisition of VMware, generates a consistent stream of recurring revenue from enterprise cloud customers. Concurrently, its semiconductor operations encompass 5G networking, broadband, Wi-Fi, and storage connectivity, providing multiple revenue streams that are not directly tied to the AI market. This balanced approach allows Broadcom to maintain resilience across various economic cycles while simultaneously leveraging the AI infrastructure boom. The company is poised to benefit substantially from the enduring AI trends without being overly exposed to their inherent volatility.

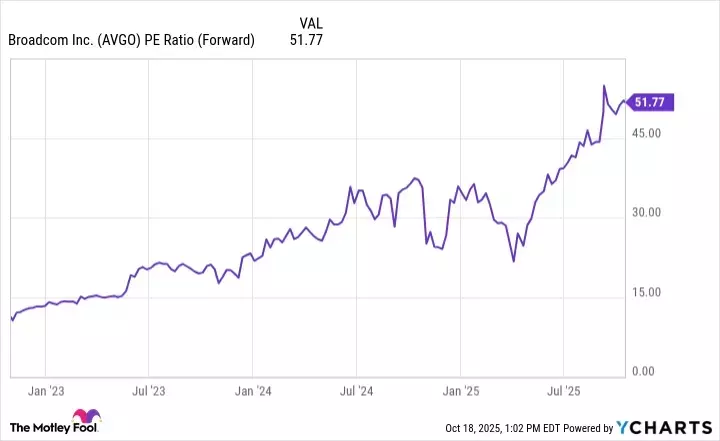

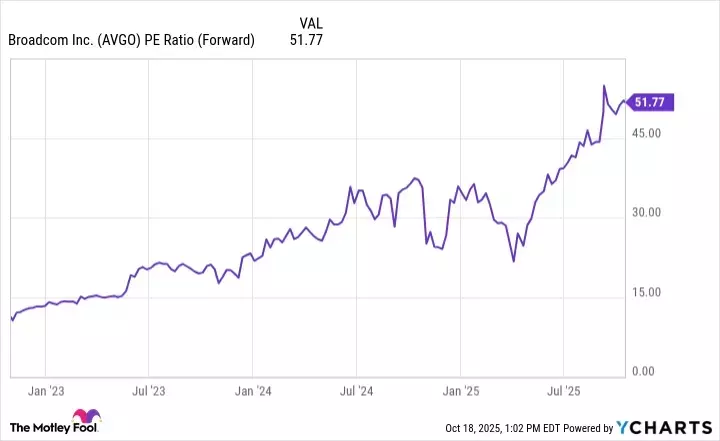

Over the last three years, Broadcom's stock has achieved an impressive 700% return, significantly surpassing both the S&P 500 and Nasdaq Composite. This remarkable ascent has been largely driven by the AI revolution, propelling Broadcom into the exclusive trillion-dollar club. Although its forward price-to-earnings (P/E) ratio of 51 might seem high, the company's growth prospects remain robust. Industry analysts estimate that AI infrastructure spending could exceed $7 trillion in the coming years. As hyperscale providers continue to invest heavily in data center expansions and custom silicon development, Broadcom is expected to benefit from both earnings growth and valuation expansion through the end of the decade. For investors seeking AI stocks with compounding potential, it may be prudent to consider companies beyond the frequently highlighted names. Broadcom, while perhaps lacking the widespread recognition of Nvidia or the brand power of Amazon and Palantir, holds a deeply entrenched and indispensable role in the AI supply chain, essential for maintaining the functionality of the digital world.