Unleashing the Potential: How Healthcare PE is Redefining Investment Strategies

Regional Deal Dynamics

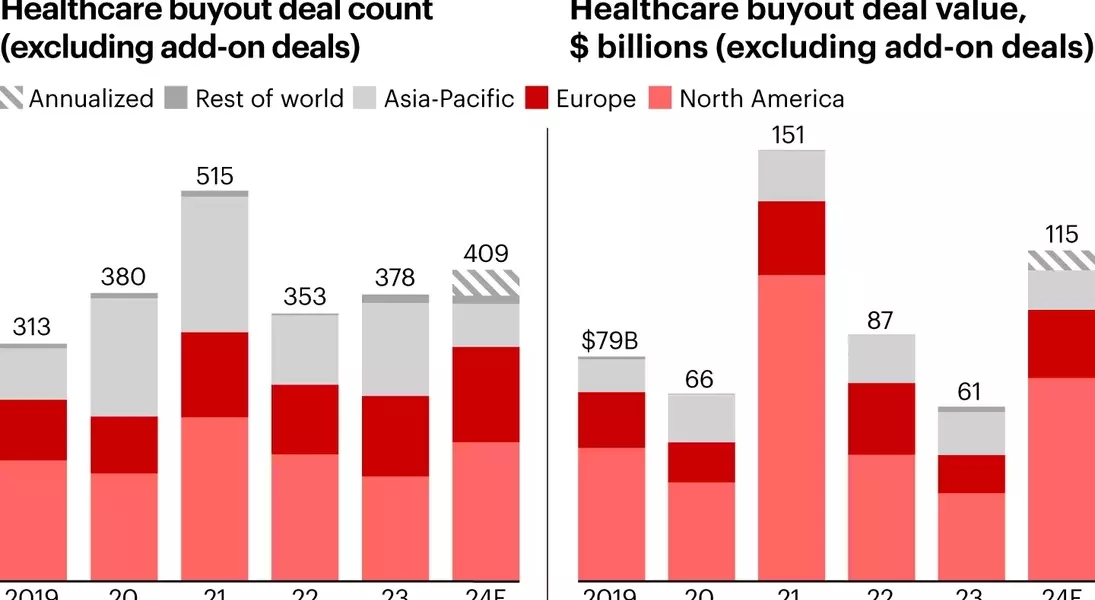

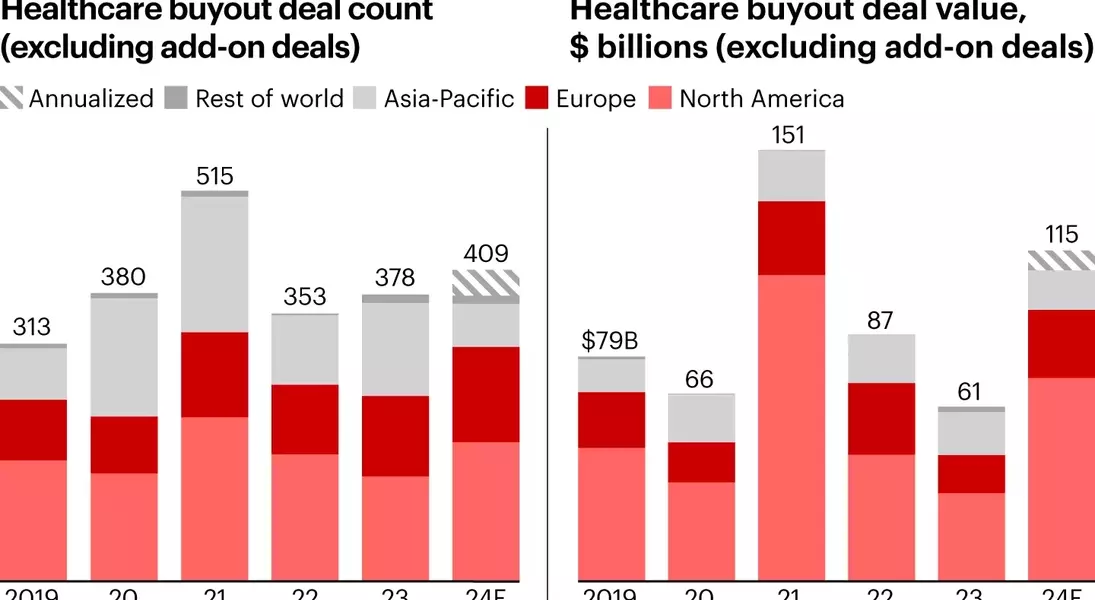

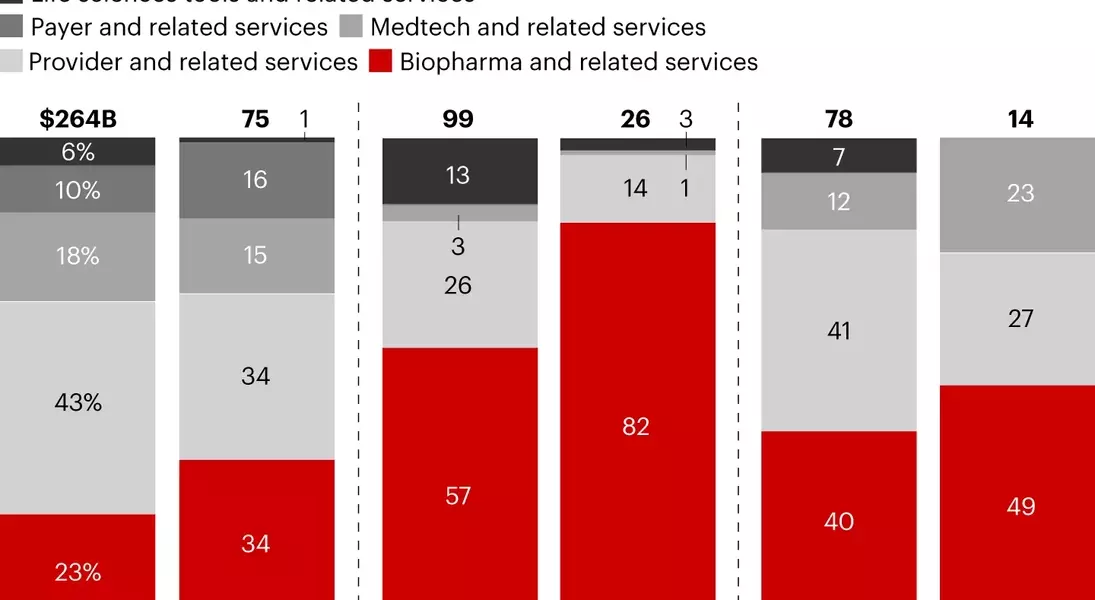

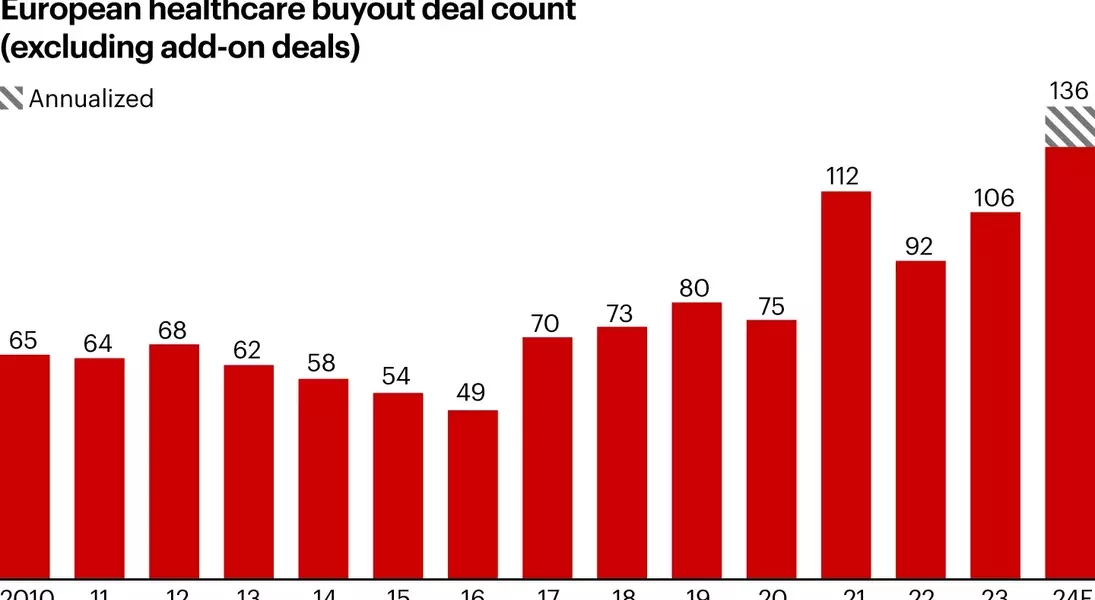

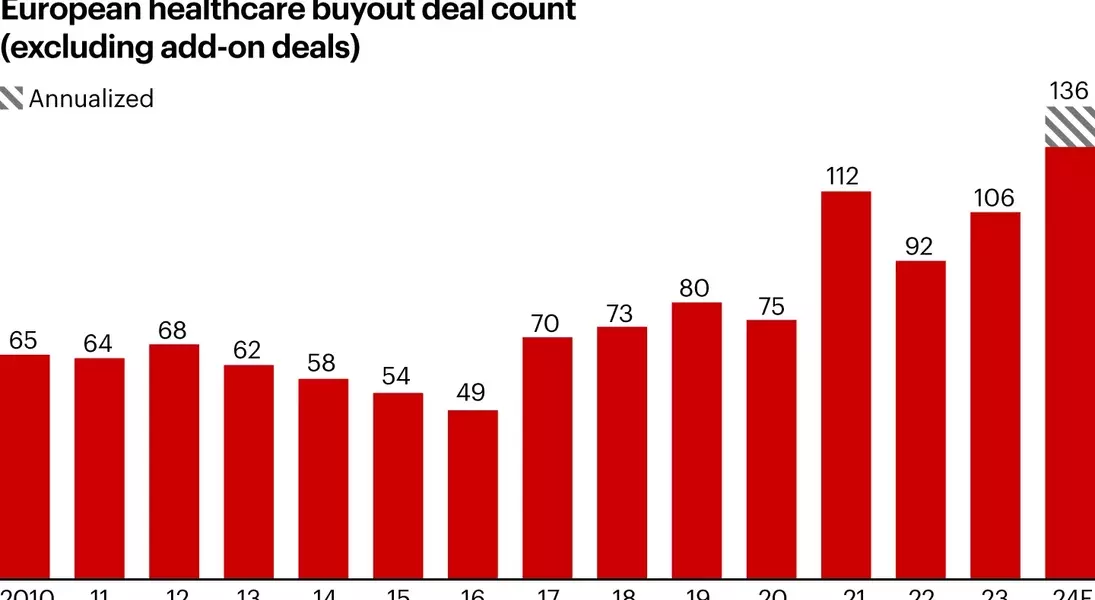

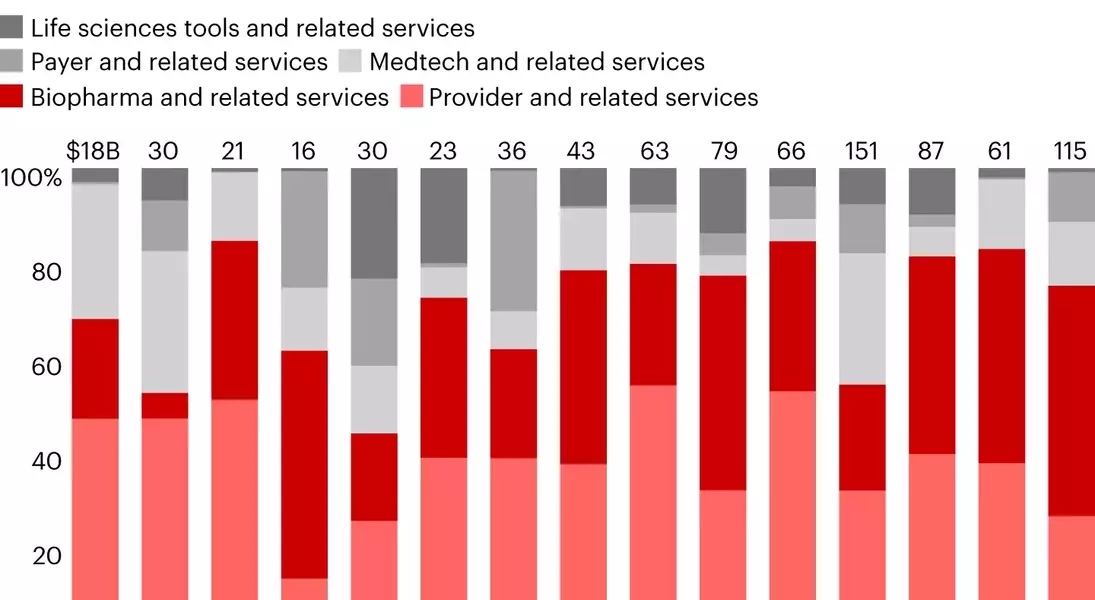

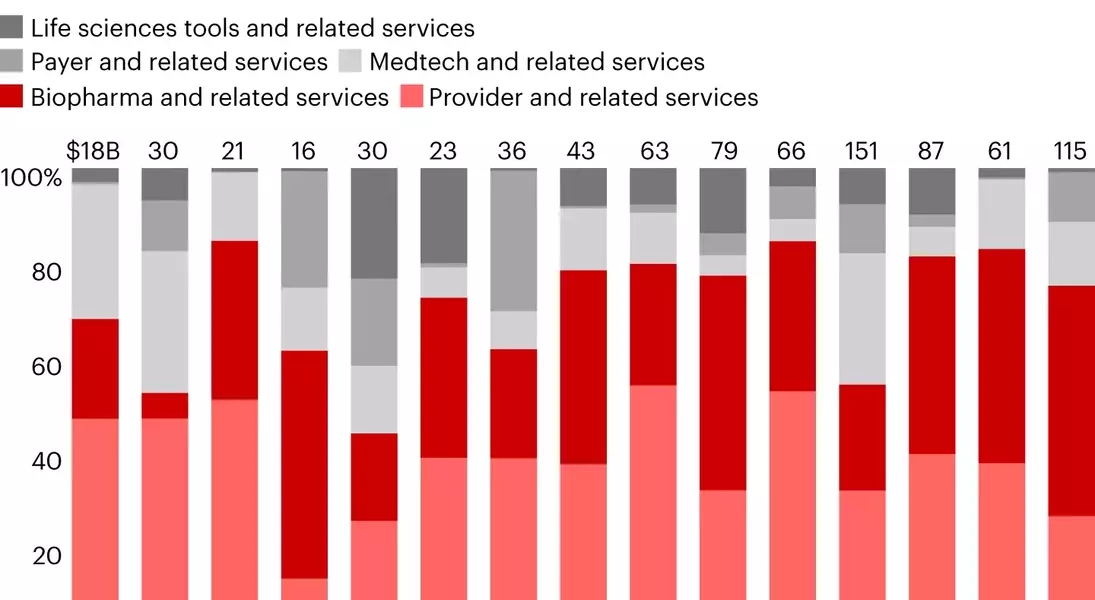

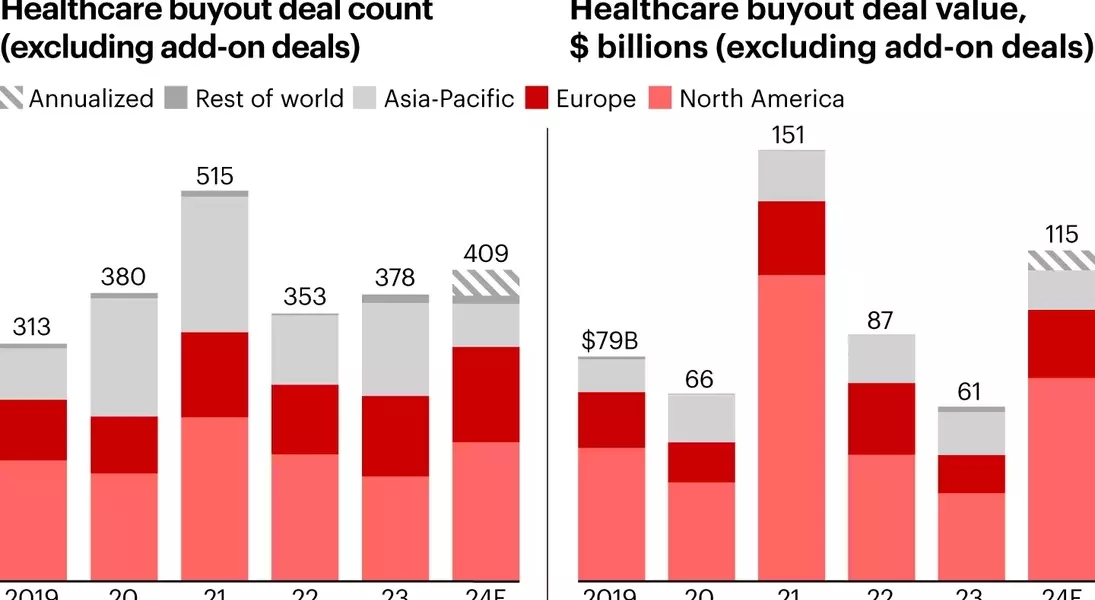

The landscape of global healthcare private equity has been reshaped by regional variations in deal activity. In North America, deal volumes remained robust, fueled by a wave of activity that offset declines in other regions. European markets saw a resurgence, surpassing their 2021 peak with a focus on smaller deals early in the year. Biopharma and medtech sectors were particularly active, with firms investing in companies that offer critical equipment and raw materials. Meanwhile, Asia-Pacific faced challenges, with a 49% decline in deal volume since 2023, although India, Japan, and South Korea emerged as new focal points.In North America, the market witnessed a steady influx of large-scale investments, bolstered by derivative services that enhanced provider deals. For instance, GI Partners' investment in eClinical Solutions exemplified the growing emphasis on clinical trial IT infrastructure. In contrast, Asia-Pacific focused on hospital chains, clinics, and senior living facilities, reflecting a different set of priorities within the region.

Europe's rebound was marked by increased attention to smaller deals and strategic acquisitions. Novo Holdings' acquisition of Single Use Support highlighted the trend towards investing in companies that provide essential equipment for pharmaceutical production. Ardian’s purchase of Masco Group further underscored this shift, emphasizing high-purity water systems and facility solutions. These investments aimed to build scale and capitalize on regional strengths.

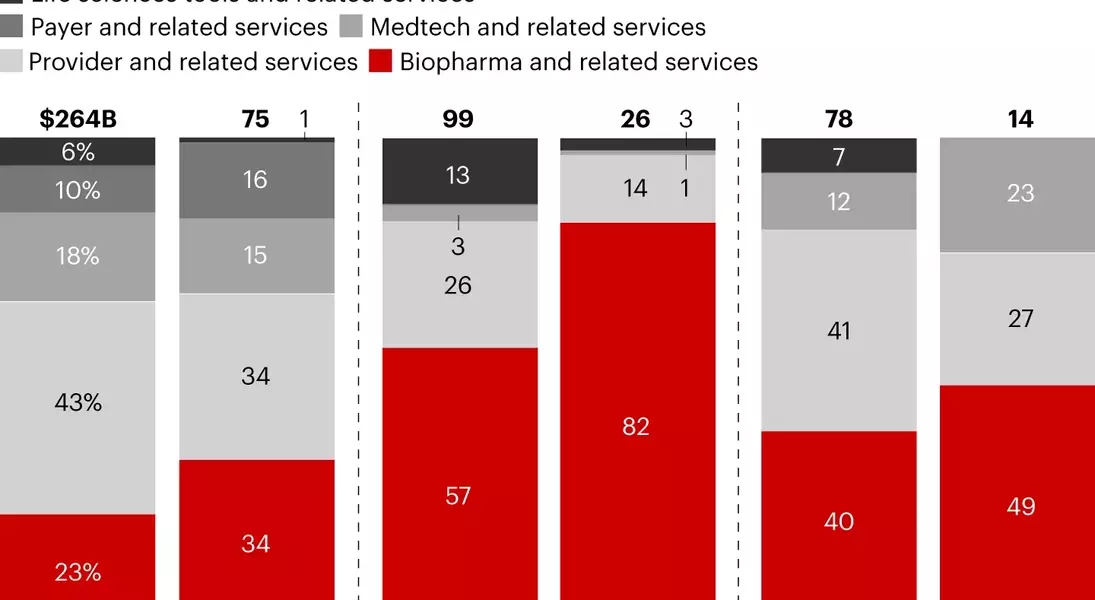

Sector-Specific Trends

Biopharma emerged as the frontrunner in deal value, driven by major acquisitions like Catalent's $16.5 billion deal and Sanofi's recent announcement of a $17.3 billion transaction. These deals not only underscored the sector's importance but also reflected broader trends in R&D spending and portfolio rationalization. Despite the overall growth, bid-ask spreads and reduced pharma services spending presented challenges, leading to stalled or broken deals.Healthcare IT saw a resurgence in 2024, driven by providers seeking to enhance efficiency and payers aiming to improve payment integrity. TPG’s acquisition of Surescripts, an electronic prescription network, exemplified the growing interest in workflow improvements. Cotiviti’s recapitalization with Veritas and KKR further highlighted the sector's potential, achieving an enterprise valuation of around $11 billion. Generative AI played a transformative role, enabling automation and cost reduction across all three sectors.

Within the provider IT segment, revenue cycle management (RCM) became a focal point, with TowerBrook and CD&R acquiring the R1 RCM platform. Core systems of record, such as Epic Systems and WellSky, also gained prominence, supporting both payers and providers on risk adjustment. In the biopharma sector, limited funding and higher capital costs led to investments in clinical trial IT infrastructure, exemplified by Arsenal Capital Partners’ acquisition of Endpoint Clinical and EQT’s acquisition of CluePoints.

Emerging Trends and Strategic Shifts

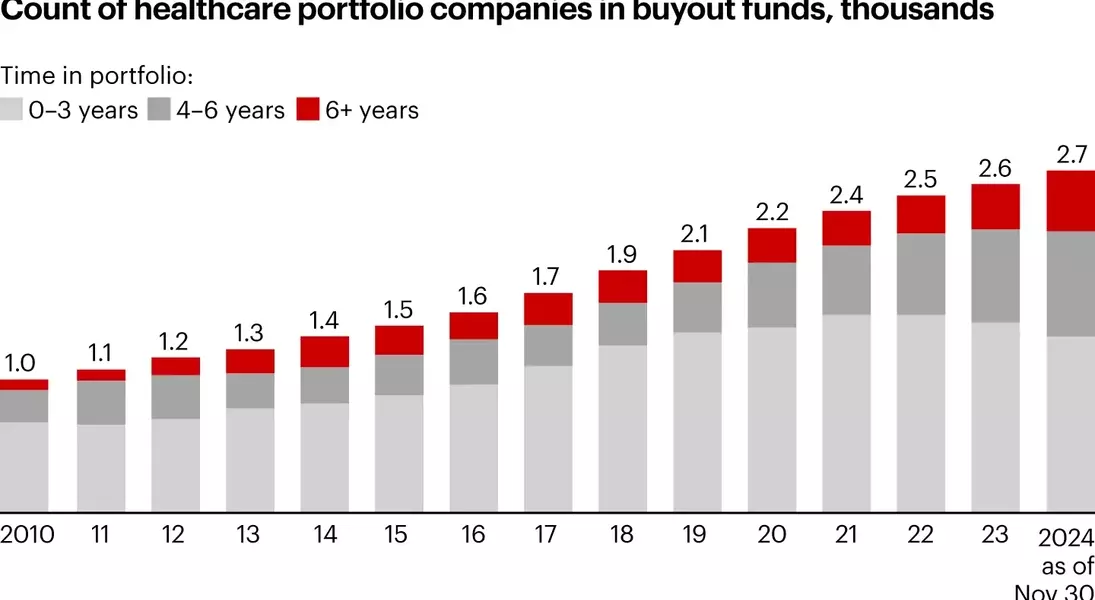

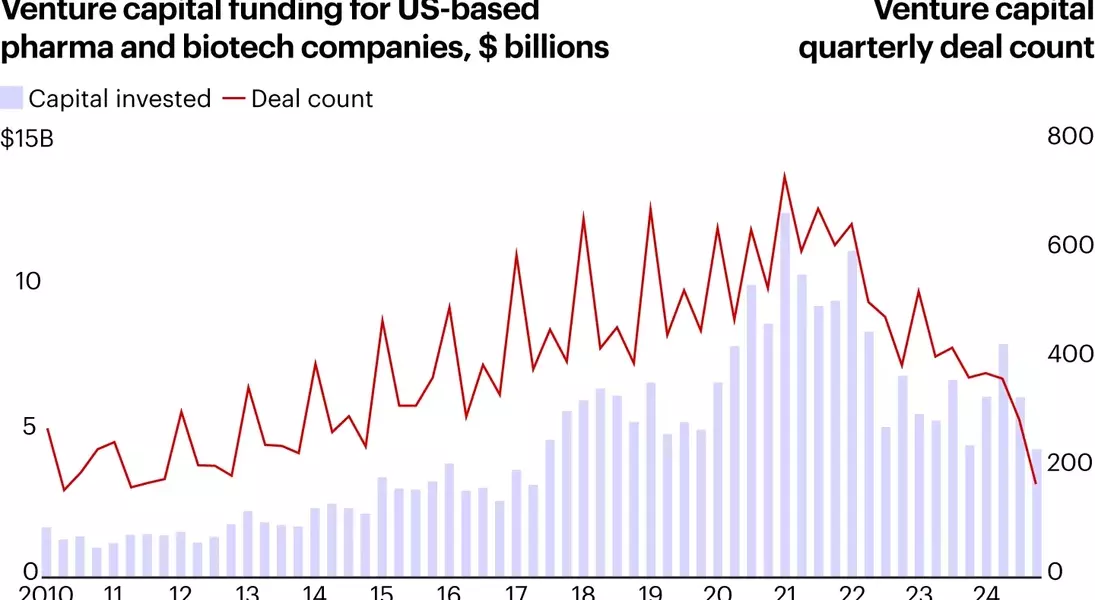

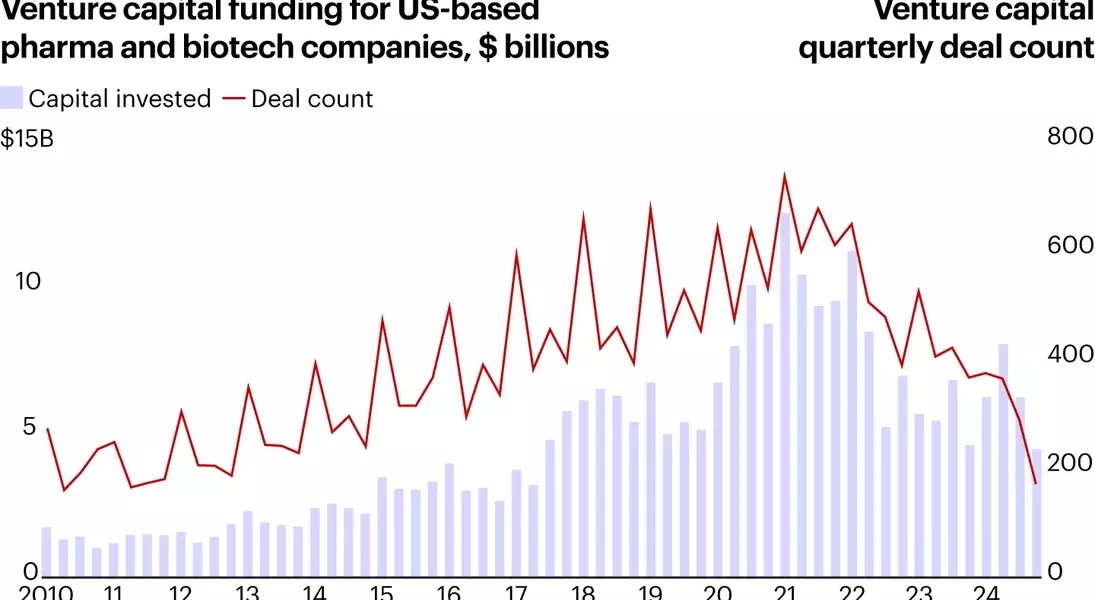

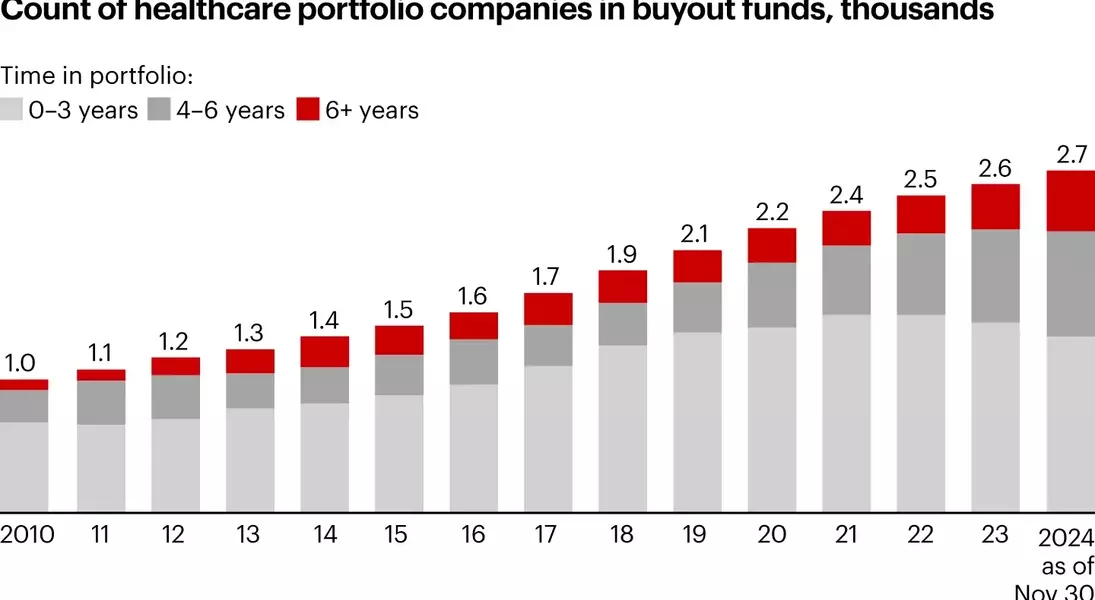

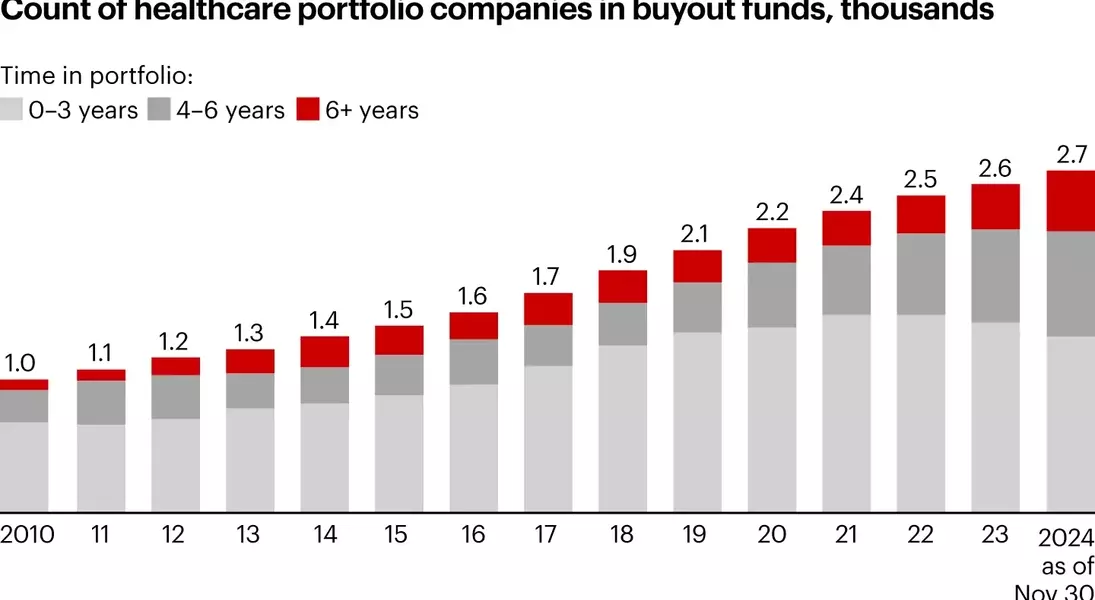

Several key trends have reshaped the healthcare PE landscape. Mid-market funds continue to innovate, demonstrating higher returns and evolving investment strategies. Carve-outs are gaining traction as alternative sources for deal volume, especially in tight markets. Exit value maximization has become a strategic imperative, with sellers focusing on comprehensive value-creation strategies. Additionally, Asia-Pacific investment has shifted towards India, Japan, and South Korea, driven by favorable macroeconomic conditions.Deal multiples are beginning to plateau, paving the way for better bid-ask alignment and increased tradable assets. The US Federal Reserve's rate reductions in the second half of 2024 have lowered borrowing costs, reflecting confidence in the economy. Japan and India have seen stable economic growth, creating favorable investment conditions. Asset buildup in PE portfolios, coupled with pressure from limited partners (LPs) for liquidity, suggests an imminent increase in sponsor exits.

To prepare for the future, investors must address several critical questions. Will bid-ask convergence accelerate as multiples stabilize? How will macroeconomic factors impact long-term biopharma investing? How will sponsors exit aging assets, and who might be the most likely buyers? Will partnerships with corporate entities increase to purchase or build provider assets? Finally, how will regulatory changes affect innovation, supply chains, and care delivery, particularly in the largest healthcare market?

Future Outlook and Key Considerations

The outlook for healthcare private equity remains optimistic, with deal multiples stabilizing and the base of tradable assets growing. Investors should consider the implications of bid-ask convergence, sponsor competition for assets, and the need for LP liquidity. Increased investment in early-stage biotech and clinical trials could alleviate potential slowdowns in the biopharma sector. Regulatory changes and macroeconomic factors will also play a crucial role in shaping the future of healthcare PE.As the healthcare landscape evolves, investors must remain agile and adaptable. The rise of generative AI, shifting regional dynamics, and emerging trends in healthcare IT present both opportunities and challenges. By staying informed and strategically aligned, investors can navigate the complexities of the healthcare PE market and capitalize on emerging opportunities.

In conclusion, the healthcare private equity sector stands at a pivotal juncture, poised for continued growth and transformation. As investors explore new avenues for value creation and respond to evolving market conditions, the future promises both challenges and unprecedented opportunities.