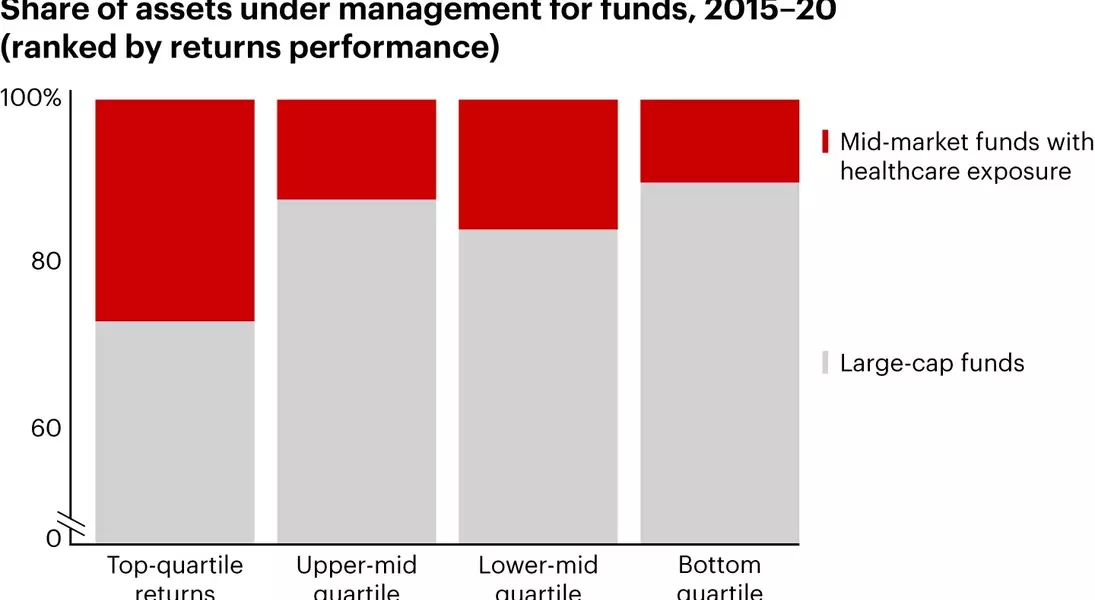

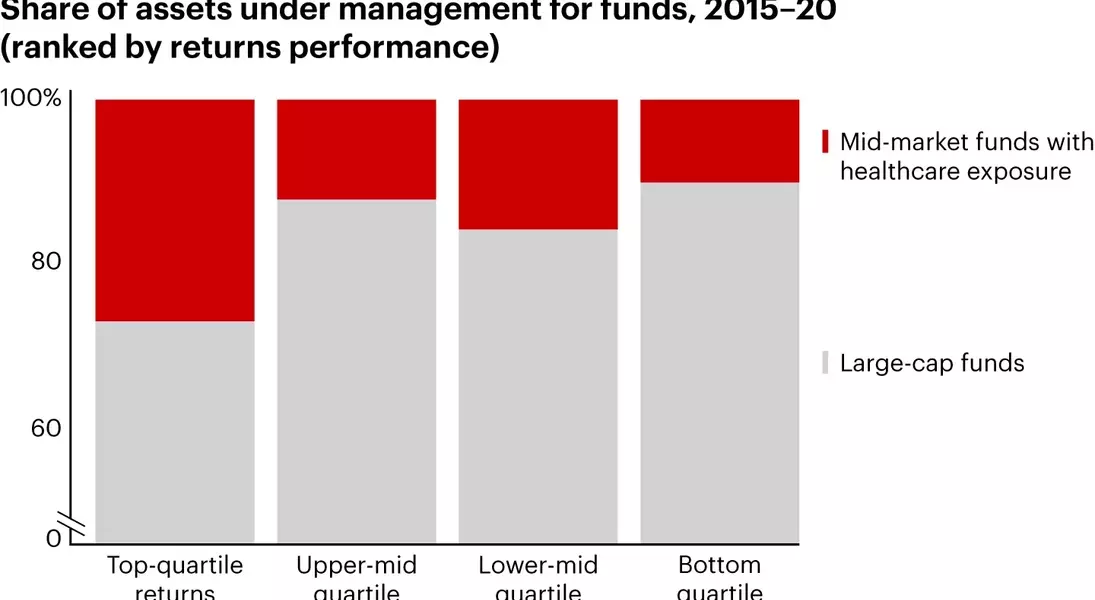

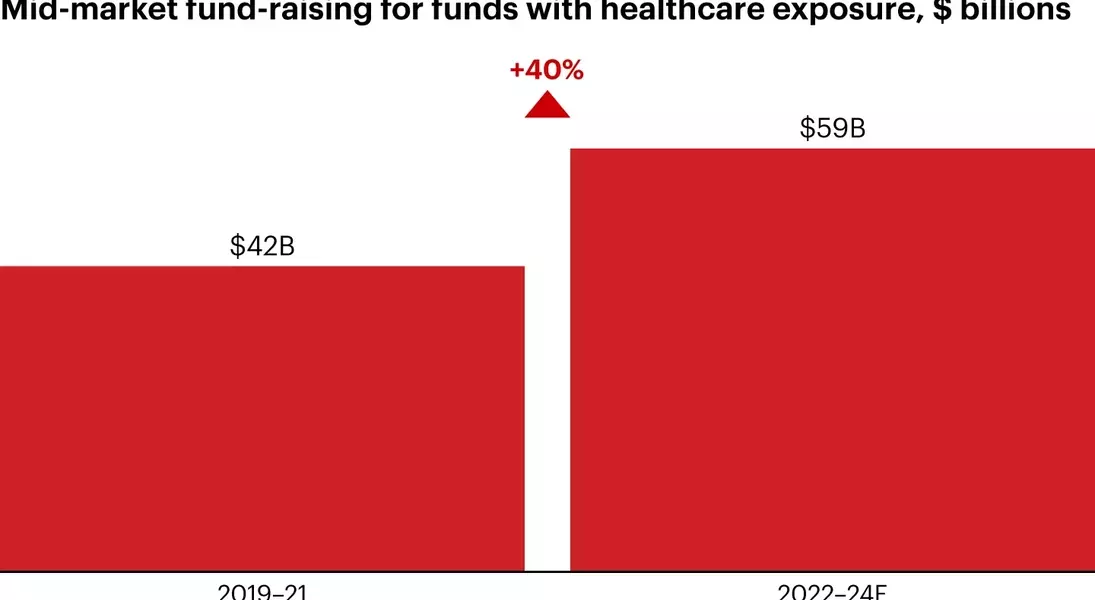

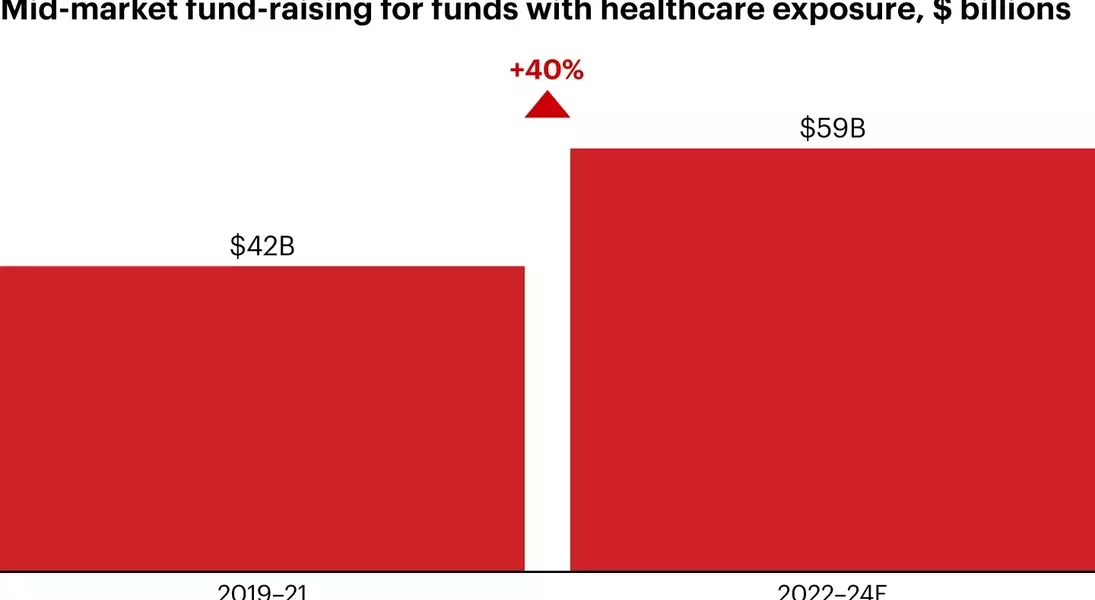

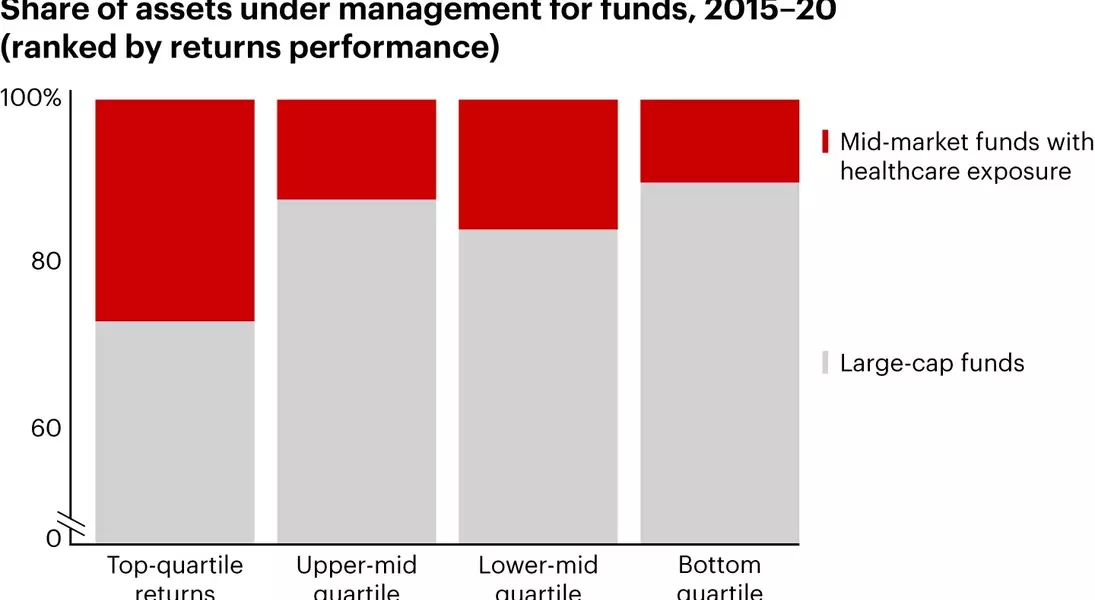

In recent years, mid-market healthcare-focused private equity funds have demonstrated exceptional performance, outpacing the broader market through innovative and adaptive strategies. These funds, managing assets between $500 million and $4 billion, have not only maintained robust buyout activities but also achieved successful exits despite market challenges. This success has translated into significant fundraising, with approximately $59 billion raised since 2022, marking a substantial increase compared to previous years. The shift in focus from traditional provider deals to more diversified sectors like healthcare IT and biopharma reflects an evolving investment landscape, driven by changing market conditions and strategic foresight.

Shifting Focus: Mid-Market Healthcare Funds Adapt to New Opportunities

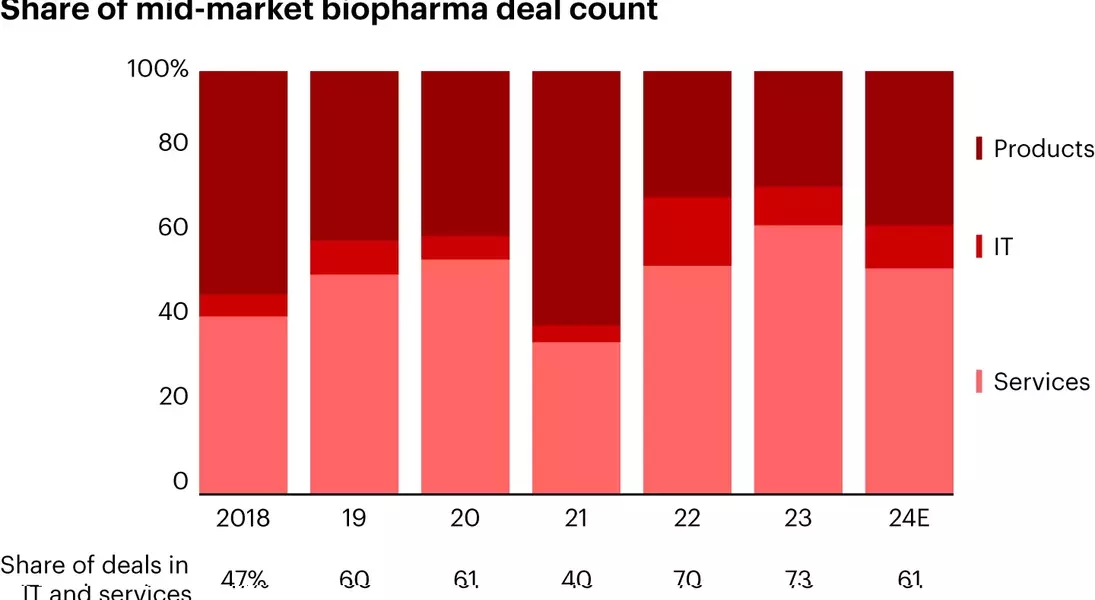

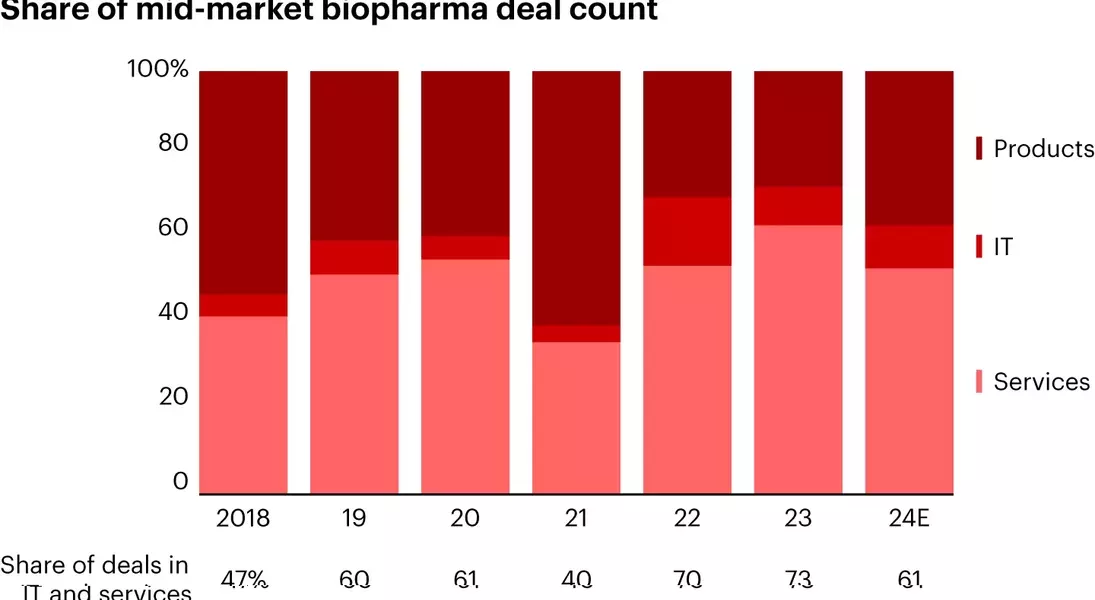

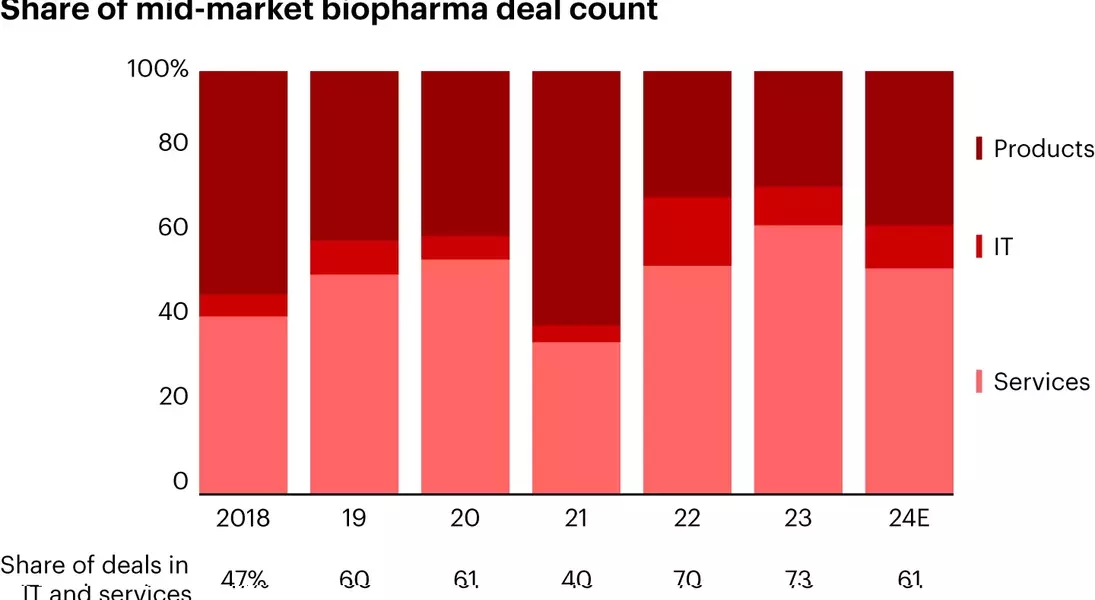

In the dynamic world of healthcare private equity, mid-market funds are redefining their strategies to stay ahead. Historically, these funds have excelled by focusing on physician groups and retail health providers. However, as market dynamics change, they are now pivoting towards derivative acquisitions in areas such as healthcare services and IT. For instance, investments in healthcare staffing, supply distribution, and lab services have gained momentum. Additionally, there is a growing interest in biopharma and medtech sectors, where specialized knowledge allows firms to capitalize on high-quality assets and support emerging technologies. Notable acquisitions in healthcare IT, such as Altaris' purchase of Sharecare, highlight this trend toward platforms that enhance digital infrastructure and operational efficiency.

The year 2022 saw a compound annual growth rate (CAGR) of about 36% in deal volume for these derivatives, underscoring the increasing attractiveness of these sectors. Moreover, mid-market PE firms are exploring opportunities beyond traditional buy-and-build strategies, focusing on value-creation levers like centralized infrastructure and capacity expansion. Physician practices, for example, can expand into ancillary services or improve operational efficiencies through centralized billing and IT systems. Similarly, contract research organizations (CROs) and contract development manufacturing organizations (CDMOs) benefit from additional capacity and new capabilities, leading to enhanced efficiency and cost reductions.

To thrive in this competitive environment, mid-market firms must deepen their internal expertise, especially in tech-focused areas like generative artificial intelligence (AI). Investors need tailored strategies that address the unique challenges and opportunities within each subsegment, ensuring sustained success in an ever-evolving market.

From a reader's perspective, the resilience and adaptability of mid-market healthcare funds offer valuable insights into how businesses can thrive amidst uncertainty. The ability to pivot and innovate while maintaining a strong financial foundation is crucial for long-term success. As the healthcare industry continues to evolve, these funds serve as a testament to the power of strategic foresight and agility in achieving remarkable outcomes.