Emeth Value Capital's 2025 performance review, though marked by a net return of -3.79% against the MSCI ACWI Index's 22.41%, offers profound insights into investment philosophy and operational resilience. The firm stresses that short-term fluctuations hold minimal significance when viewed against a multi-year investment horizon. Drawing from a decade of experience and past missteps, the capital firm meticulously dissects the common threads woven through its less successful ventures. Key among these are the inherent fluidity of market share in certain industries, the deceptive allure of asset-light models, the critical importance of leverageable assets, and the compounding disadvantages of being on the wrong side of scale. The report emphasizes the necessity of scrutinizing industries where market share can swiftly shift and the inherent risks when a business, while growing, has historically benefited from such volatility. It cautions against underestimating the potential fragility that can arise when growth lacks substantial capital intensity. Furthermore, the firm underscores that a business's capital structure should allow for a comfortable level of leverage, even if not fully utilized, indicating an appreciation from credit markets that equity owners might overlook. The report also highlights the dangers of being outmaneuvered by larger, more resourced competitors who can compound advantages in R&D and product experience. Finally, it notes that the most significant losses occurred when investment theses were 'directionally wrong' – investing in businesses fundamentally deteriorating, underscoring that a low price is rarely sufficient for a declining enterprise. The firm's best investments, conversely, exhibit clarity in business trajectory, minimal risk of fundamental misdirection, and inherent value that is already largely established.

Insightful Investment Strategies and Business Transformation at Superior Plus

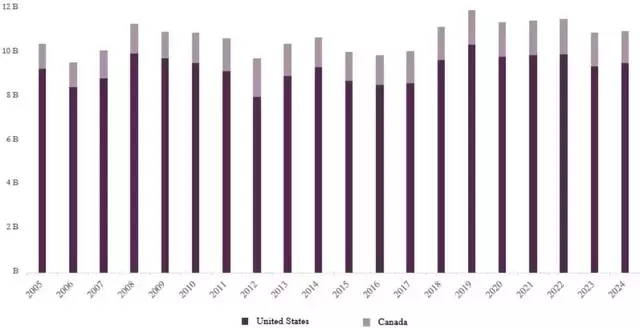

In a detailed analysis, Emeth Value Capital sheds light on the compelling investment case for Superior Plus, a prominent North American propane distributor. This company aligns with the capital firm's refined investment principles, operating within an industry characterized by enduring customer relationships and offering essential services that generate predictable cash flows. Superior Plus boasts a significant market presence, delivering approximately one billion gallons of propane annually to 750,000 residential and commercial clients across Canada and the U.S. Notably, it stands as North America's largest and most profitable propane distributor on a per-gallon basis, and it holds a substantial 40% market share in compressed natural gas (CNG) delivery.

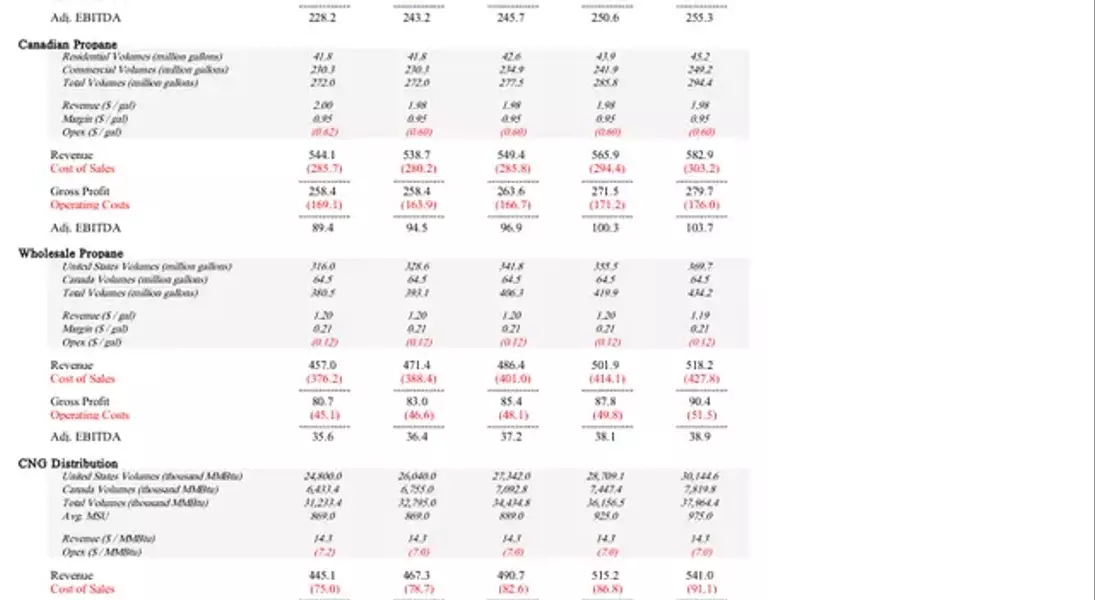

Superior Plus's market dominance in Canada, where it has held a leading position since the 1980s, was solidified through strategic mergers, including the pivotal 1998 acquisition of ICG Propane. This expansion propelled its market share to approximately 30%, delivering 375 million gallons annually. Despite a period of diversification into specialty chemicals, construction products, and aluminum manufacturing—which ultimately proved value-destructive and distracting—the company refocused on its core energy distribution business. Today, its Canadian operations serve nearly 200,000 customers, delivering 270 million gallons annually, with 95% company-owned tanks, ensuring high customer stickiness and contributing $90 million in annual EBITDA.

Superior Plus entered the U.S. market in 2009, initially through acquisitions in attractive Northeast markets with a heavy emphasis on fuel oil. A transformative acquisition of NGL Energy's retail propane assets in 2018, valued at $900 million, quadrupled its U.S. propane business. This was followed by over 40 additional acquisitions totaling $1.1 billion. These strategic moves positioned Superior Plus with 65% of its U.S. volumes in the Northeast, capitalizing on fuel oil conversion trends, and maintaining an 89% company-owned tank position. Its U.S. operations now deliver 350 million gallons annually to over 500,000 customers, generating $240 million in annual EBITDA.

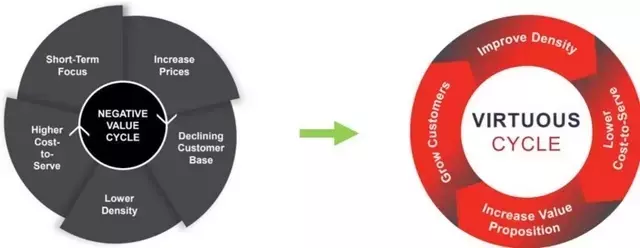

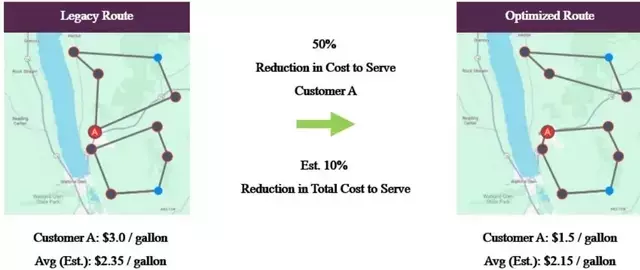

Under the new leadership of CEO Allan MacDonald, Superior Plus initiated the "Superior Delivers" transformation program in November 2024. This comprehensive overhaul aims to boost EBITDA by $70 million by 2027 through two primary avenues: enhancing the "cost to serve" and accelerating "customer growth." The program addresses antiquated and manual processes by implementing a new analytics platform for real-time pricing, dynamic route optimization, and asset utilization management. This includes calculating customer-specific marginal costs, which revealed that 5% of deliveries were unprofitable, leading to strategic adjustments in pricing or customer retention. Asset utilization has been optimized by mapping unit costs and reconfiguring the network, resulting in the elimination of over a third of bulk plants in some regions, despite an increase in travel miles. Furthermore, a sophisticated routing and scheduling technology, powered by AI, uses real-time consumption data from tank monitoring sensors (covering 75% of deliveries) to forecast demand weeks in advance, optimizing delivery routes and minimizing inefficiencies. For example, moving a customer from one driver's route to a neighboring one reduced that customer's service cost by 50% and lowered average costs across both routes by 10%. These cost-to-serve initiatives are projected to contribute $40 million in incremental EBITDA annually.

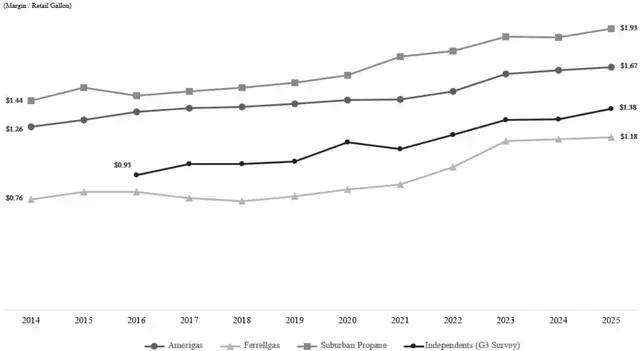

The second pillar, customer growth, leverages these cost advantages. Historically, Superior Plus relied on a small marketing team and inbound calls. Now, under Chief Commercial Officer Deena LaMarque Piquion, the company uses data-backed pricing to target specific customer groups and explores new lead generation channels. To combat its mid-to-high single-digit gross churn (compared to an industry benchmark of low-to-mid single digits), Superior Plus has halted all price increases for 18 months, leading to improved customer retention. A new centralized team, equipped with analytics, proactively identifies at-risk customers by analyzing login activity, usage patterns, and service issues, enabling targeted retention efforts. These customer growth initiatives are expected to add $30 million in annual EBITDA by 2027, equating to approximately 2% net customer growth per year.

Superior Plus also benefits from its unique wholesale propane business, encompassing Superior Gas Liquids in Canada and Kiva United Energy in the U.S. This segment manages over one billion gallons of propane annually, two-thirds of which support its own retail operations, reducing procurement costs and ensuring supply security. The remaining third comprises third-party sales to over 300 customers, including other distributors and industrial users, enhancing infrastructure utilization and further lowering overall company costs. Kiva United Energy's expanded role to supply all U.S. retail operations in 2025 creates new growth opportunities in markets like the Northeast. This wholesale operation generates $35 million in annual EBITDA.

Another significant asset is Certarus, acquired in 2022 for $785 million, North America's leader in over-the-road compressed natural gas (CNG) delivery. Certarus serves customers beyond pipeline reach, offering a cost-effective alternative to diesel. Its business, partially driven by oil and gas wellsite services, accounts for half of its revenues and maintains a dominant 50% market share in key U.S. basins like the Permian. Certarus has diversified into utility resiliency markets, providing dedicated mobile storage units (MSUs) to prevent blackouts, and transports alternative fuels such as Hydrogen and renewable natural gas (RNG), a rapidly growing segment. More recently, Certarus has leveraged the hyperscale data center boom, offering temporary and long-term bridge solutions for AI infrastructure, which demands significant power in areas with grid connection challenges. Its industrial segment, serving diverse commercial and industrial clients, grows at over 20% annually. Certarus contributes $140 million in annual EBITDA to Superior Plus, representing 30% of its profits.

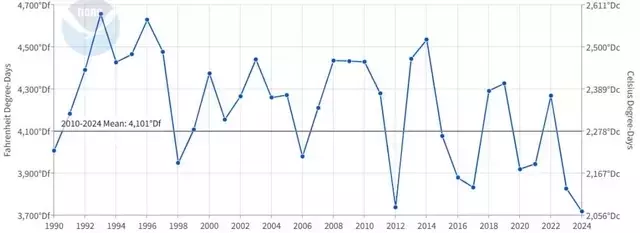

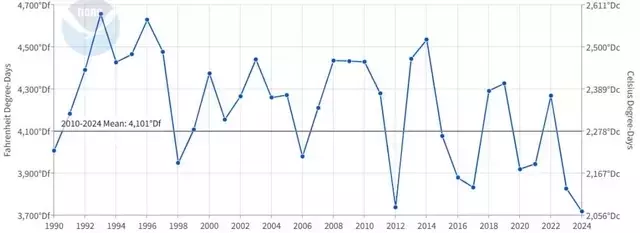

Emeth Value Capital's valuation model suggests a fair value of C$17.79 (US$12.81) per share, indicating a 153% upside. This projection is underpinned by conservative assumptions, including the realization of only 60% of the "Superior Delivers" program's target EBITDA and highly achievable unit margin improvements. The company's unique pricing dynamics, where 90% of customers lease tanks, create significant switching costs and customer inertia, reinforcing margins. With an aggressive share buyback program and the potential to call Brookfield's perpetual preferreds, Superior Plus is poised to generate more free cash flow than its current market capitalization within five years. The industry's fragmented nature presents M&A opportunities, allowing Superior Plus to consolidate smaller distributors and realize predictable synergies, further accelerating its flywheel of increased density, lower costs, and competitive pricing. Even in 2024, an exceptionally warm year, Superior Plus generated $455 million in EBITDA, demonstrating its resilience.

This detailed narrative of Superior Plus highlights a company poised for substantial growth and value creation through strategic operational improvements, market dominance, and smart capital allocation. It exemplifies how thoughtful investment principles, combined with robust business strategies, can navigate market complexities and deliver long-term returns.

Beyond the Numbers: The Enduring Power of Foundational Businesses in an AI-Driven World

This report from Emeth Value Capital offers a compelling reminder that while the allure of innovation is strong, true long-term value often resides in foundational businesses that are adept at adapting and leveraging new technologies. The firm's reflections on past mistakes provide invaluable lessons: market fluidity can be a double-edged sword, asset-light models carry hidden risks when fortunes turn, and being on the wrong side of scale can lead to compounding disadvantages. The importance of investing in businesses with highly leverageable assets and clear, predictable cash flows, even if growth is modest, stands out as a core tenet for stability and sustained returns. The "directionally wrong" pitfall is a particularly insightful warning, emphasizing that no price is low enough for a fundamentally deteriorating business. This brings to mind the old adage: "When you find yourself in a hole, stop digging."

Superior Plus serves as a powerful case study in operational transformation and strategic resilience. Its journey from a period of diversified missteps back to a focused, efficient energy distribution powerhouse, particularly through the "Superior Delivers" program, demonstrates the critical impact of strong leadership and a clear vision. The company's commitment to leveraging data analytics and AI for route optimization, customer-specific pricing, and churn reduction is a blueprint for how traditional industries can innovate to drive efficiency and enhance customer value. The strategic moves, such as aggressive share buybacks and the potential refinancing of preferred securities, underscore a proactive approach to capital allocation that directly benefits shareholders. The ability of Superior Plus to not only survive but thrive amidst industry fragmentation, seasonality, and intense competition, offers a tangible example of value creation through operational excellence.

From a broader perspective, the report's conclusion on the role of AI is particularly thought-provoking. While software companies grapple with AI's disruptive potential, businesses grounded in physical activities, like propane distribution, seem more insulated from wholesale displacement. Yet, AI's profound impact on organizational processes and efficiency means that even these traditional sectors must embrace technological adoption. The idea that relative scale will be more important than ever for capturing AI's benefits is crucial; larger, better-resourced companies are better positioned to make the necessary investments and integrate these advanced tools. Furthermore, the identification of companies like SoftwareOne as "clear AI beneficiaries" highlights the indirect yet immense opportunities that emerge from technological shifts. As AI adoption scales, specialized partners guiding enterprises through this complex landscape become indispensable. This report, therefore, encourages investors and business leaders to not only scrutinize a company's direct exposure to technological change but also its capacity to adapt, its foundational resilience, and its ability to capitalize on the ecosystem of innovation that new technologies create.