Unlock Portfolio Stability and Income: Your Smart Investment Beyond Tech!

Simplifying Investments: ETFs as a Core Strategy

For individuals preferring a less hands-on approach to managing individual company stocks, Exchange-Traded Funds (ETFs) offer a streamlined investment solution. These funds typically aggregate various stocks or assets under a single trading symbol, often concentrating on particular industries, investment philosophies, or tracking established stock market indices.

Introducing the Schwab U.S. Dividend Equity ETF (SCHD)

The Schwab U.S. Dividend Equity ETF (SCHD) is highlighted as an exceptional vehicle for investors prioritizing dividend income. This ETF is meticulously designed to mirror the performance of the Dow Jones U.S. Dividend 100 Index, making it a potentially wise choice for an initial investment, even as modest as $500.

Diversifying Beyond the Technology Sector

While predicting market movements is inherently challenging, it is prudent to acknowledge and respond to prevailing trends. The technology sector has experienced significant growth in recent years, leading to a substantial concentration within major indices like the S&P 500, where information technology and communication services now constitute a considerable portion. Such high concentration can introduce risks if the technology market experiences a downturn, reminiscent of past market corrections.

SCHD's Sectoral Allocation and Valuation Advantage

The Schwab U.S. Dividend Equity ETF deliberately minimizes its exposure to information technology and communication services, holding only about 13.5% in these areas. Instead, it strategically allocates investments across more diverse sectors, including energy (19.2%), consumer staples (18.8%), healthcare (15.5%), and industrials (12.5%). Furthermore, SCHD's valuation stands at approximately three times its book value, significantly lower than the S&P 500's current valuation of about five times its book value. This stark difference suggests a potentially more attractive entry point for value-conscious investors, particularly if the tech-driven market experiences a rebalancing.

The Power of a Robust Dividend Yield

A notable benefit of dividend-focused investing is the potential to establish a foundational income stream for your portfolio. Unlike capital gains, which are only realized upon selling assets, dividends provide direct payments regardless of stock sales, offering a degree of stability during volatile market periods. The Schwab U.S. Dividend Equity ETF boasts an attractive dividend yield of 3.9%, which is among its highest historical levels. This yield, combined with its diverse holdings of blue-chip companies, some of which have a long history of increasing dividends, helps mitigate the risks typically associated with high-yield investments. Prominent holdings include industry leaders such as AbbVie, Lockheed Martin, Cisco Systems, Altria Group, Chevron, and Coca-Cola, whose established dividend policies enhance the ETF's reliability.

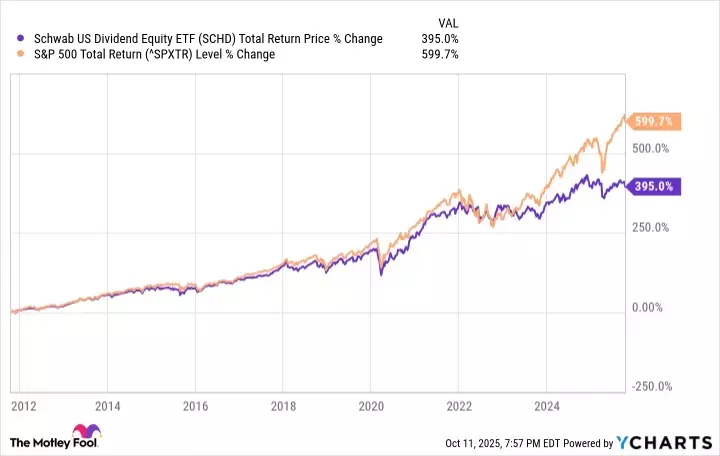

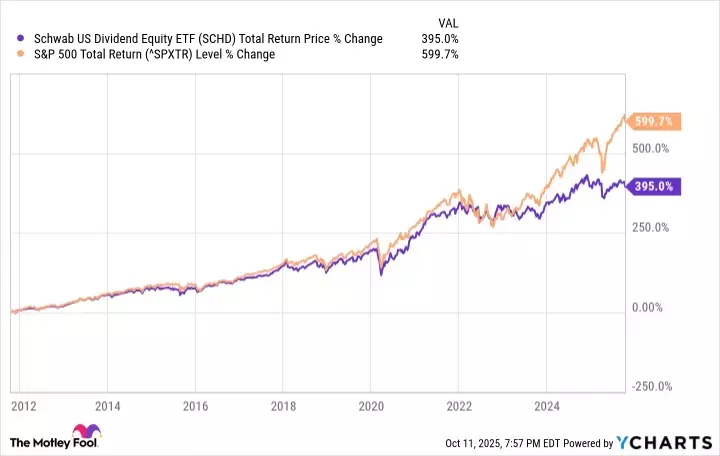

Strategic Positioning for a Post-AI Era

Investment performance is cyclical, with various strategies and sectors experiencing periods of ascendancy. Historically, the Schwab U.S. Dividend Equity ETF has closely paralleled the S&P 500, with intermittent phases of outperformance and underperformance. The recent surge in the S&P 500, largely driven by the AI boom since 2023, has created a notable gap between the two. However, it is reasonable to consider that this gap may eventually narrow, especially if investor focus shifts away from technology stocks. While the aim is not to predict precise market timing, diversifying a portfolio with SCHD can prepare investors for such a potential shift. The ETF's balanced composition, attractive dividend yield, and reduced reliance on technology make it an astute choice for investment, particularly for those looking to allocate new capital effectively.