Taiwan Semiconductor Manufacturing (TSMC), a global leader in semiconductor fabrication, is expected to experience a substantial surge following its third-quarter earnings announcement. The company's remarkable performance in 2025, driven by the booming demand for artificial intelligence (AI) chips and a diverse customer base including major tech giants like Apple, positions it to exceed revenue projections. Strategic price adjustments for its advanced process nodes, particularly the 3-nanometer and upcoming 2-nanometer technologies, are anticipated to bolster its financial results and investor confidence. This strong outlook, coupled with an appealing valuation, suggests that TSMC remains a compelling investment opportunity in the dynamic semiconductor market.

TSMC's trajectory of growth over the past couple of years has been largely propelled by the escalating demand for artificial intelligence (AI) chip technology. As the dominant contract chipmaker worldwide, holding an estimated 70% market share according to TrendForce, TSMC plays a pivotal role in the global tech ecosystem. The company's extensive client portfolio includes industry heavyweights such as AMD, Nvidia, Broadcom, Apple, Qualcomm, and MediaTek. This broad spectrum of customers enables TSMC to capitalize on the surging demand for AI chips across various applications, from data centers to smartphones and personal computers. Consequently, TSMC has consistently outperformed its own internal projections throughout the current year.

The company recently disclosed its September revenue figures, revealing a 31% year-over-year increase. This brought its total quarterly revenue to $32.5 billion, slightly surpassing the midpoint of its guidance and exceeding Wall Street's expectations. With a year-to-date revenue growth of over 36%, TSMC is well on its way to surpassing its ambitious 2025 revenue guidance of 30%. A significant factor contributing to this robust performance is the reported 20% price increase for its highly sought-after 3-nanometer (nm) process node. This advanced node is crucial for powering the latest generation of smartphones, a segment that contributed 27% to TSMC's revenue in the second quarter of 2025, with 3nm chips alone accounting for 24%.

Apple, a major client, manufactures its newest iPhone processors using TSMC's 3nm technology. With the latest iPhone models experiencing stronger-than-expected consumer demand, TSMC stands to benefit significantly from both increased production volumes and favorable pricing by year-end. Reports from Morgan Stanley suggest that Apple might escalate its iPhone production to over 90 million units, up from an initial forecast of 84 to 86 million. Given that Apple reportedly accounts for 20% of TSMC's total revenue, any boost in iPhone output, combined with the implemented price hikes, could lead to TSMC providing an even more optimistic guidance for the fourth quarter.

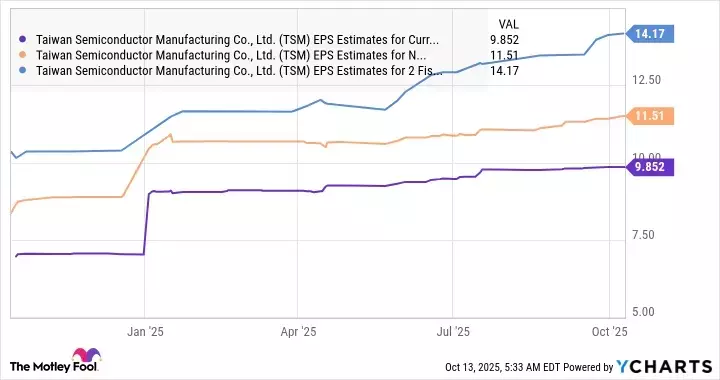

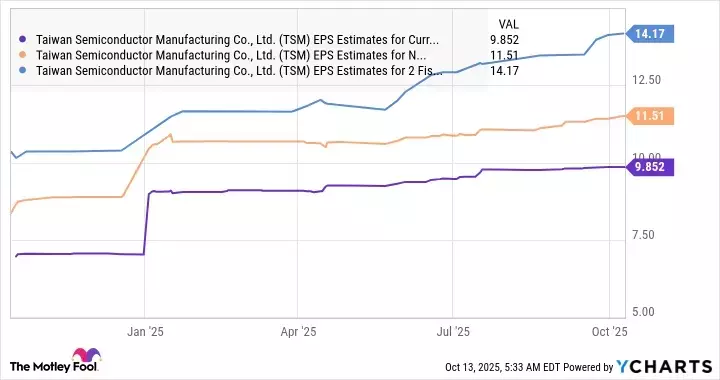

Looking beyond the current year, TSMC is set to further enhance its chip manufacturing capabilities in 2026 with the introduction of its 2-nanometer node. This technological advancement will allow for even more powerful and energy-efficient chips. Key industry players, including Apple, Nvidia, AMD, and MediaTek, are anticipated to be the first adopters of this cutting-edge 2nm technology next year. With 2nm chips expected to command a premium of 10% to 20% over the 3nm process node, TSMC's earnings growth in 2026 could potentially outpace current consensus estimates. While analysts currently project a 17% earnings growth rate for 2026, the combined impact of existing 3nm price increases and higher pricing for the new 2nm node could drive these figures upwards. TSMC's consistent ability to exceed expectations and maintain strong growth, fueled by the enduring demand for AI in the semiconductor market, represents a significant advantage for this dynamic growth stock.

In summary, TSMC's strategic positioning at the forefront of semiconductor innovation, coupled with its strong market share and diversified customer base, underpins its continued financial success. The company's aggressive pursuit of advanced process technologies and its ability to implement favorable pricing structures are critical drivers of its robust revenue and earnings growth. As the digital economy continues its rapid expansion, particularly in areas like artificial intelligence, TSMC is well-placed to leverage these trends, making its stock a compelling option for investors seeking long-term growth in the technology sector.