Recent data reveals a notable change in lunch consumption patterns among Americans. Over the past year, there has been a 3% decline in lunches purchased from eateries and other establishments. Meanwhile, grocery store sales of food intended for work or home consumption have seen a modest 1% increase. These trends highlight evolving consumer preferences influenced by economic factors such as rising costs and inflation.

Changing Consumer Behavior Amid Rising Costs

In the vibrant yet challenging economic landscape of recent years, dining habits have undergone significant transformations. According to reports, during the transition from 2023 to 2024, purchases of meals from restaurants saw a noticeable dip. Specifically, last year witnessed a total of 19.5 billion lunches bought, marking a decrease compared to pre-pandemic levels when remote work became widespread.

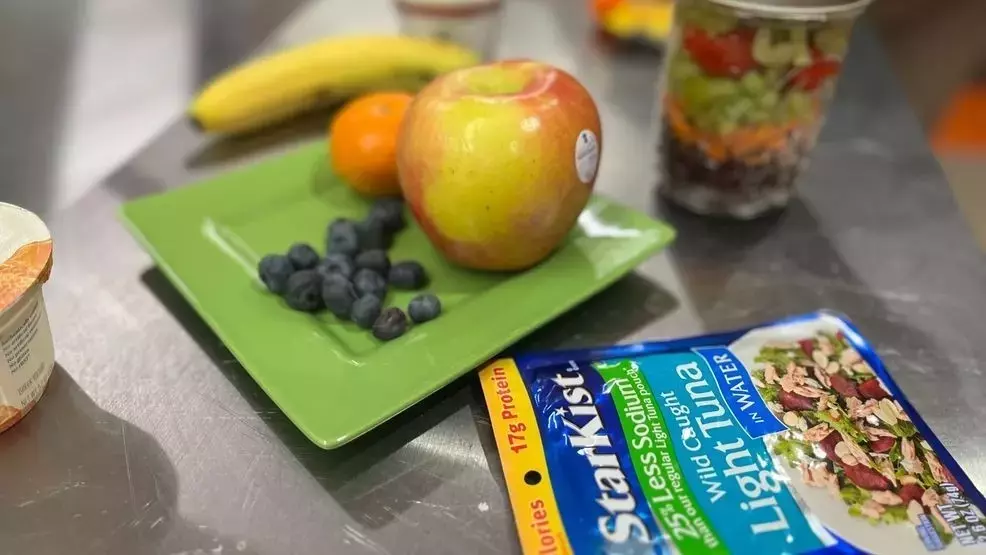

Interestingly, while restaurant visits declined, there was an uptick in grocery shopping for meal preparation at home. Data from Black Box Intelligence further underscores this trend, showing that visits to fast-casual eateries fell by approximately 7.9% in the first quarter of the year, with fast-food chains experiencing a 4.2% drop in foot traffic. Surveys indicate that many Americans now find cooking at home more economical than dining out, citing increasing prices as a deterrent to frequent fast-food consumption.

Furthermore, economic indicators like the Consumer Price Index reflect these shifts, revealing minimal changes in inflation rates over specific months. Some experts attribute higher living costs partly to tariffs on imported goods, although debates persist about their overall impact on American wealth.

From a journalistic perspective, this analysis highlights how economic pressures can profoundly influence daily choices, encouraging individuals to reassess spending priorities. As prices rise, people are increasingly opting for cost-effective solutions, like preparing meals at home, signaling a broader shift toward financial prudence in personal lifestyles.