Navigating the Shifting Tides: A Comprehensive Market Outlook

As the third quarter of the year draws to a close, the financial markets are experiencing a dynamic shift, with various asset classes showcasing a mix of gains and losses. From the resilient S&P 500 to the fluctuating bond yields and commodity prices, the landscape is constantly evolving, presenting both opportunities and challenges for investors. This comprehensive market analysis delves into the key trends and insights that are shaping the current market environment, empowering readers to make informed decisions in the weeks and months ahead.Unlocking the Potential: A Multifaceted Market Perspective

Equities: Riding the Wave of Resilience

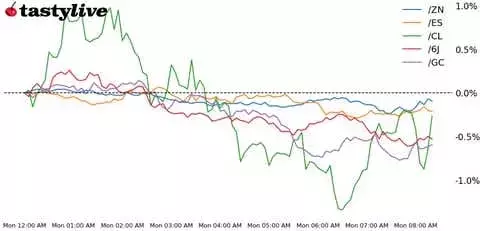

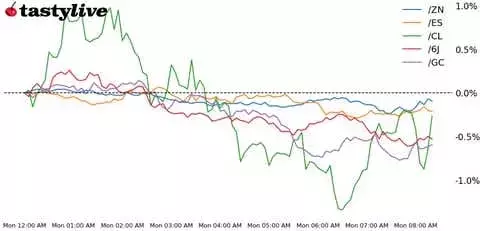

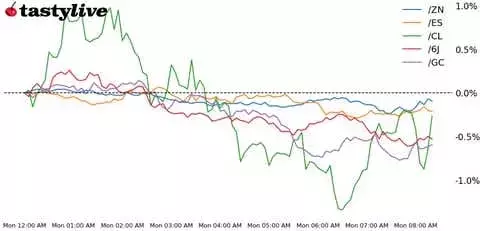

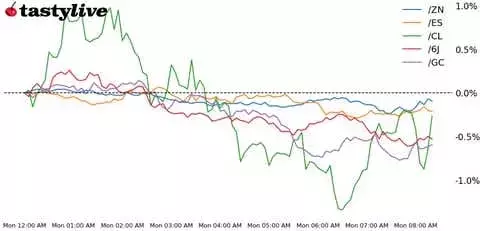

The S&P 500 has continued its impressive run, with the index poised to wrap up the third quarter with gains of over 4% – the seventh time in the past eight quarters that such a feat has been accomplished. This remarkable performance has been fueled by a combination of factors, including the ongoing stimulus efforts from the Chinese government, which have supercharged the performance of emerging market equities, particularly Chinese stocks. Despite the geopolitical tensions in the Middle East, the commodities market has remained largely unaffected, showcasing its resilience in the face of global uncertainties.As the S&P 500 enters October, it could be doing so with a year-to-date gain of over 20%, which, in the context of presidential election years, may set up a potential seasonal headwind for the month. Investors will be closely monitoring the upcoming October seasonality report, which is set to be released later today, for insights into the potential market dynamics in the coming weeks.Bonds: Navigating the Shifting Yield Landscape

The bond market has also been a focus of attention, with 10-year T-note futures (/ZN) experiencing a slight decline to start the week. However, the instrument remains on track to record a gain for September, marking the fifth consecutive monthly advance. The chances for a 50-basis point rate cut at the November Federal Open Market Committee (FOMC) meeting have dropped from just above 50% last week to around 37% this morning, as strong economic indicators have emerged.This shift in the rate cut expectations may slow the movement in the bond market, leading some to wonder whether treasuries could be due for a small retracement in October. Investors will be closely monitoring the upcoming economic data, particularly the purchasing managers' index (PMI) figures and the U.S. jobs report, which could reshape the narrative surrounding the bond market.Commodities: Navigating the Ebb and Flow

The commodities market has also been a focal point, with gold futures (/GC) experiencing a pullback as the dollar moderated and Chinese equity performance acted as a headwind. Despite this morning's decline, gold prices are set to record a third consecutive monthly gain, as the metal remains near all-time highs. Investors will be closely watching the upcoming PMI figures and the U.S. jobs report, which could potentially reshape the narrative surrounding the precious metal.In the energy sector, crude oil futures (/CL) are poised to record the biggest monthly loss since October, down over 7.5% with less than one full trading day left. The market remains focused on OPEC's upcoming decision to roll back its production cuts later this year, despite the softer prices. Geopolitical tensions in the Middle East have so far failed to materialize in the oil market, as traders believe that Iran will opt for a measured response to the recent strikes against Hezbollah leadership.Foreign Exchange: Navigating Currency Fluctuations

The foreign exchange market has also been a point of interest, with the Japanese yen (/6J) retracing some of its gains from Friday after yen bulls pushed the currency higher on news of fiscal support measures from the government. These measures are aimed at supporting household wages, which could potentially aid the country's central bank in its path to higher interest rates.The U.S. dollar, with the upcoming U.S. jobs report, is likely to be the primary driver for the currency markets this week. Investors will be closely monitoring the economic data and its potential impact on the Federal Reserve's monetary policy decisions, which could in turn influence the performance of various currencies.Overall, the financial markets are navigating a complex and ever-changing landscape, with various asset classes showcasing a mix of gains and losses. Investors must remain vigilant, closely monitoring the economic data, policy decisions, and geopolitical developments that are shaping the current market environment. By staying informed and adaptable, market participants can position themselves to capitalize on the emerging opportunities and navigate the shifting tides with confidence.