Wall Street Rollercoaster: Navigating the Quarterly Gains and Losses

The stock market has been on a wild ride, with all three major indexes fluctuating between gains and losses. Despite the volatility, the indexes are poised to end the quarter on a high note, showcasing the resilience of the market. Meanwhile, China-based stocks continue to surge, driven by the country's recent stimulus measures. As investors navigate this dynamic landscape, it's crucial to stay informed and make strategic decisions.Unlocking the Secrets of Wall Street's Quarterly Performance

Navigating the Quarterly Gains and Losses

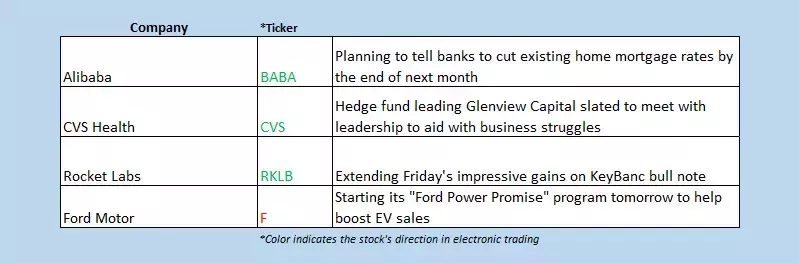

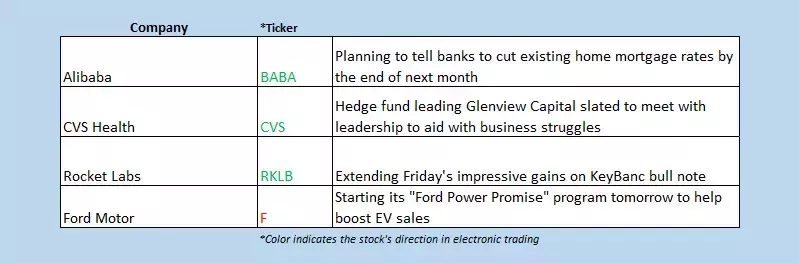

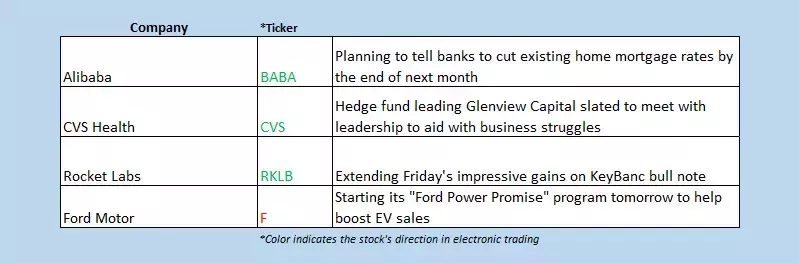

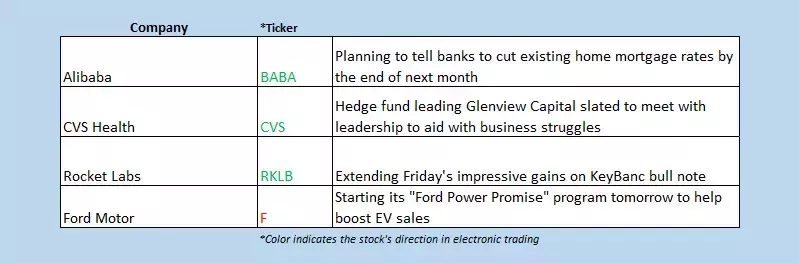

The stock market has been a rollercoaster ride in recent weeks, with all three major indexes fluctuating between gains and losses. Despite the volatility, the indexes are poised to end the quarter on a high note, showcasing the resilience of the market. The S&P 500 (SPX) and the Dow Jones Industrial Average (DJI) are both on track for their fifth consecutive monthly gains, a testament to the market's ability to weather the storm.One of the key factors driving this performance is the recent stimulus measures implemented by China. The country's purchasing managers' index (PMI) for September came in at a better-than-expected 49.8, while the Caixin PMI posted a lower-than-expected manufacturing reading of 49.3 for the month. These positive economic signals have fueled a surge in China-based stocks, with the Hang Seng adding 2.4% and the Shanghai Composite surging an impressive 8.1%.However, the market is not without its challenges. European markets are moving lower, with auto stocks leading the decline as traders digest the latest Chinese economic data. The FTSE 100 in London is off 0.6%, the CAC 40 in France is down 1.7%, and the DAX in Germany has lost 0.7%.Navigating the Bearish September

Despite the historical reputation of September as a bearish month, the current market environment has defied expectations. The S&P 500 and the Dow Jones Industrial Average are both on track for their fifth consecutive monthly gains, a remarkable feat considering the traditional challenges of this time of year.One of the key factors contributing to this resilience is the continued strength of the US economy. The latest economic data, including a beat in retail sales for August, has provided a solid foundation for the market's performance. Additionally, the Cboe Options Exchange (CBOE) saw a significant volume of call and put contracts exchanged on Friday, indicating a high level of trading activity and investor interest.However, the market is not without its risks. The automaker Stellantis NV (NYSE:STLA) has lowered its full-year forecast, citing a "global industry backdrop" as a contributing factor. This news has sent the company's stock down 13.4% in premarket trading, underscoring the ongoing challenges facing the automotive industry.Navigating the Surge in China-Based Stocks

One of the standout stories in the current market landscape is the surge in China-based stocks. Following the country's recent stimulus measures, several China-based exchange-traded funds (ETFs) have experienced their best week ever, showcasing the market's appetite for these investments.This trend is particularly evident in the performance of Nio Inc – ADR (NYSE:NIO), the electric vehicle (EV) maker that has received a $2 billion investment from its parent company and state-backed investors. The stock is up 14.3% in premarket trading, a significant boost that could signal a turnaround for the company after a challenging year-to-date performance.The strength of China-based stocks is not limited to the EV sector. The Hang Seng index in Hong Kong added 2.4%, while the Shanghai Composite surged an impressive 8.1%. These gains reflect the market's confidence in the Chinese economy and the impact of the country's stimulus measures.However, the performance of China-based stocks is not without its risks. The Caixin PMI for September posted a lower-than-expected manufacturing reading of 49.3, indicating a potential slowdown in the country's industrial activity. Investors will need to closely monitor the ongoing economic developments in China to assess the sustainability of the current stock market surge.Navigating the Quarterly Gains and Losses: A Closer Look

As the quarter draws to a close, investors are closely watching the performance of the major indexes. Despite the volatility and the historical reputation of September as a bearish month, the S&P 500 and the Dow Jones Industrial Average are both on track for their fifth consecutive monthly gains.This resilience is particularly noteworthy given the challenges facing the market, including the ongoing trade tensions between the US and China, the uncertainty surrounding the Federal Reserve's monetary policy, and the potential impact of the upcoming US presidential election.One of the key factors contributing to the market's performance is the strength of the US economy. The latest economic data, including a beat in retail sales for August, has provided a solid foundation for the market's performance. Additionally, the Cboe Options Exchange (CBOE) saw a significant volume of call and put contracts exchanged on Friday, indicating a high level of trading activity and investor interest.However, the market is not without its risks. The automaker Stellantis NV (NYSE:STLA) has lowered its full-year forecast, citing a "global industry backdrop" as a contributing factor. This news has sent the company's stock down 13.4% in premarket trading, underscoring the ongoing challenges facing the automotive industry.As investors navigate this dynamic landscape, it's crucial to stay informed and make strategic decisions. The surge in China-based stocks, the resilience of the major indexes, and the ongoing challenges facing the market all highlight the need for a nuanced and well-informed approach to investing.