In the final month of 2024, residential construction activity witnessed a mixed performance. Permits experienced a slight decline, while housing starts saw a notable increase. However, the overall year reflected a cautious approach by builders, influenced by economic uncertainties and policy changes.

Navigating Uncertain Waters: Builders Adapt to Shifting Market Dynamics

Monthly Performance and Yearly Insights

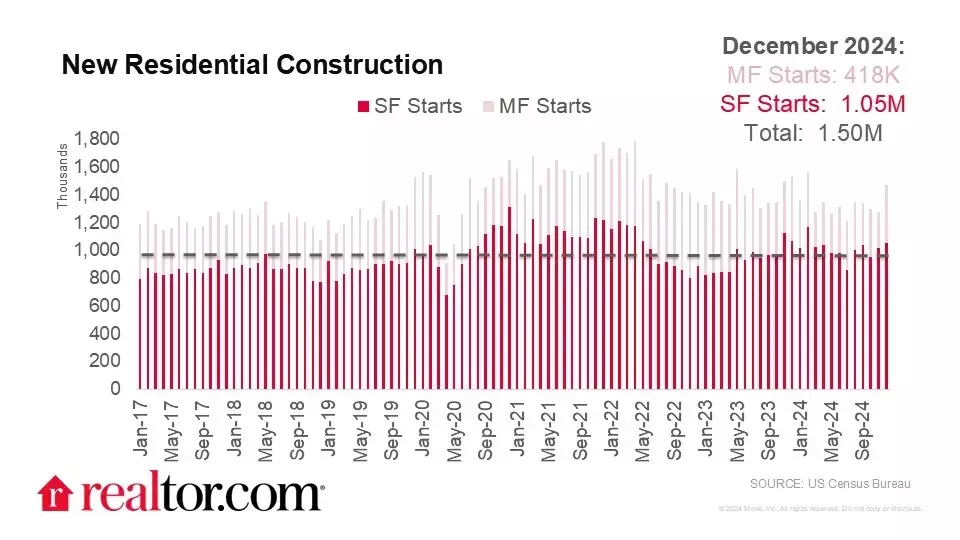

The closing month of 2024 brought varied outcomes for the residential construction sector. Despite a modest 0.7% drop in permits from November, housing starts surged by 15.8%, signaling renewed vigor. Yet, when viewed against the previous year, permits lagged by 2.6%, starts by 3.9%, while completions showed a robust 12.4% growth. This dichotomy underscores the cautious optimism of builders who are striving to balance project completion with the uncertain prospects of 2025.Policy shifts under the incoming Trump administration have introduced new variables into the equation. Proposed tariffs on imported construction materials and potential labor disruptions due to mass deportations have added layers of complexity. These factors have led many builders to prioritize finishing ongoing projects rather than initiating new ventures, reflecting a strategic shift toward risk mitigation.Regional Variations and Housing Segments

While the national trend points to a slowdown in permitting, regional disparities paint a more nuanced picture. The multifamily sector bore the brunt of this decline, with permits falling 5.8% month over month and 5.4% year over year. Conversely, single-family permits saw a modest 1.6% rise from November, though they remained 2.5% lower compared to December 2023. Interestingly, the market for smaller units like duplexes and townhomes gained traction, with permits growing 1.9% month over month and 5.9% year over year.Regionally, the Northeast emerged as a bright spot, posting a 14.0% increase in overall permits and a remarkable 19.2% jump in single-family permits. Meanwhile, the South, which has traditionally been a hub for construction, saw a 6.5% dip in total permits and a 2.8% decrease in single-family permits year over year. Despite this cooling, the South still accounted for over half of all permits issued.Starts and Completions: A Tale of Two Halves

Multi-family starts rebounded strongly from a weak November, rising significantly month over month but trailing behind December 2023 by 11.3%. Single-family starts also picked up by 3.3% from November, though they were 2.6% lower than last December. The Northeast led the charge with a 40.2% increase in total starts month over month, while the West saw a slight 0.7% drop from November, ending 26.2% below December 2023 levels.Completions, however, shone brightest in the West, where multi-family completions soared 20.9% from November and 34.7% from last December. Single-family completions in the region dipped 13.1% month over month but edged up 1.9% year over year. This divergence highlights the regional dynamics at play, with the West focusing on delivering multi-family units to meet demand.Implications for Homebuyers, Sellers, and the Market

Builders faced significant challenges in 2024, navigating political uncertainty and mortgage rates exceeding 7%. To mitigate risks, they diversified their projects geographically, moving away from the previously dominant South. Inventory levels in the South and West have nearly returned to pre-pandemic norms, whereas the Northeast and Midwest still lag behind, presenting opportunities for growth.For homebuyers, the strong completion figures for 2024 offer a silver lining. With 1,627,900 new homes entering the market, including 1,020,600 single-family homes, buyers may find more affordable options among these brand-new properties. This influx can alleviate some of the frustrations associated with the limited stock of existing homes for sale, providing a fresh avenue for those seeking to enter the market.