In the wake of Donald Trump's impending presidency, the American construction sector is experiencing a mix of optimism and apprehension. After years of decline, recent trends indicate a resurgence in domestic manufacturing and infrastructure development. Key players in heavy engineering and construction have seen significant stock gains, driven by data center expansions and energy projects. However, concerns loom over potential policy reversals and economic challenges, leaving industry executives cautiously optimistic about the future.

Construction Industry Dynamics Under Trump’s New Administration

In the golden hues of autumn, as the leaves turned crisp, the construction sector witnessed a renaissance fueled by renewed interest in domestic manufacturing and infrastructure modernization. Companies like Quanta Services and Fluor Corporation, both headquartered in Texas, have experienced remarkable growth over the past few years. Quanta, specializing in energy projects, saw its stock rally by 53% in just one year, while Fluor, focused on refinery and liquefied natural gas facilities, nearly tripled since 2021. Argan, based in Rockville, Maryland, more than tripled in value within a single year, driven by its expertise in power and telecommunications projects.

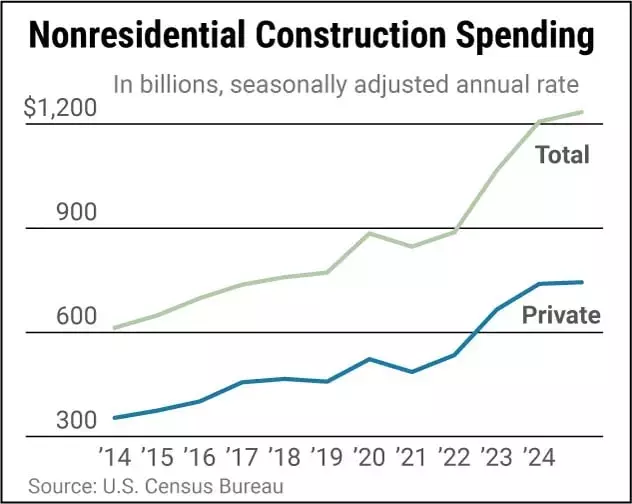

The incoming Trump administration has pledged to bolster U.S. manufacturing and streamline regulations, which could accelerate project approvals and reduce bureaucratic red tape. However, uncertainties remain regarding the fate of key legislation such as the Inflation Reduction Act (IRA), the Infrastructure Investment and Jobs Act (IIJA), and the CHIPS and Science Act. These acts collectively allocate $2.1 trillion for various infrastructure and manufacturing initiatives. While senior industry executives believe the risk of an IRA rollback is low, given the slim Republican control of the House, they remain wary of potential changes in federal support for renewable energy and alternative infrastructure projects.

Data centers, buoyed by advancements in cloud computing and artificial intelligence, continue to thrive. Major technology companies like Microsoft and Amazon have announced substantial investments in AI data centers, driving demand for specialized construction services. Grid infrastructure providers like Quanta are capitalizing on this trend by acquiring firms that can meet the unique electrical needs of these facilities. Meanwhile, oil and gas industries are also expanding their infrastructure, further boosting demand for heavy engineering and construction services.

Reflections on the Construction Sector's Future

From a journalist's perspective, the construction industry's cautious optimism reflects broader economic uncertainties. The sector's resilience, despite challenges like rising labor costs and material shortages, underscores its adaptability. As Trump prepares to take office, contractors hope for regulatory relief and faster project approvals, but they also fear the impact of stricter immigration policies and potential tariffs on imported materials. The coming months will be critical in determining whether the promised "builder president" can indeed revitalize America's infrastructure and manufacturing sectors without undermining recent progress. Only time will tell if the construction boom can sustain itself amidst these shifting political winds.