In a significant move to address the financial strain faced by India's banking sector, the Reserve Bank of India (RBI) has taken decisive action by acquiring a substantial amount of government securities. This intervention comes at a critical juncture when the liquidity crisis has reached its most severe level in over a decade. The central bank's efforts aim to inject much-needed liquidity into the system, stabilizing the market and providing relief to financial institutions.

Details of the Central Bank's Intervention

In the heart of winter, as concerns about liquidity tightened, the RBI made a bold decision. According to data released after local trading hours on Friday, the central bank purchased government securities totaling 101.75 billion rupees ($1.2 billion) during the week ending January 17. This acquisition marks the highest weekly purchase since August 2021, highlighting the severity of the situation.

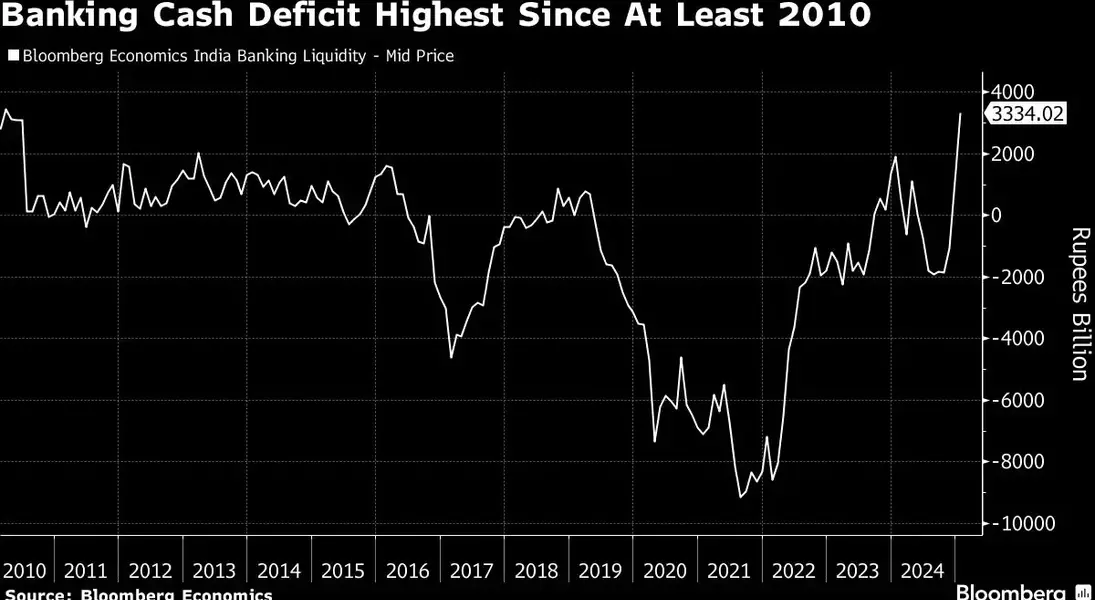

The cash deficit within the banking system, measured by banks' borrowings from the RBI, soared to 3.3 trillion rupees on Thursday. This is the highest level recorded since at least 2010, underscoring the magnitude of the liquidity crunch. Over the past year, the RBI has been actively selling dollars to support the weakening rupee, according to analysts at IDFC First Bank Ltd.

Amidst this challenging environment, speculation arose that the central bank was behind a large bond purchase on Thursday. Debendra Dash, a fixed income trader at AU Small Finance Bank Ltd. in Mumbai, noted that such purchases could introduce longer-term liquidity into the banking system. Reports indicate that lenders had recently urged the RBI to adopt stronger measures to ease the cash crunch.

Data from the Clearing Corporation of India Ltd. revealed that the 'others' category, which typically includes the monetary authority, insurance, and pension funds, made net purchases of government bonds worth 72.22 billion rupees on Thursday—the highest since June 2023. To further bolster liquidity, the RBI announced it would conduct daily variable repo rate auctions on all working days.

Financial markets responded positively to these measures. The yield on the 10-year note fell one basis point to 6.72% on Friday, marking a five-point decline for the week.

Upasna Bhardwaj, chief economist at Kotak Mahindra Bank, emphasized the need for the RBI to continue infusing liquidity proactively. She highlighted that bolder measures might be necessary to fully alleviate the ongoing cash crunch.

This intervention by the RBI underscores the central bank's commitment to maintaining financial stability. It serves as a reminder of the delicate balance between managing liquidity and supporting economic growth. As the RBI continues to monitor the situation, stakeholders across the financial sector will be closely watching for further developments.

From a journalist's perspective, the RBI's actions highlight the importance of proactive measures in addressing financial challenges. The central bank's timely intervention not only provides immediate relief but also sets a precedent for future responses to similar crises. This event emphasizes the need for robust communication and collaboration between financial institutions and regulatory bodies to ensure the health and stability of the economy.