For many generations, homeownership has been central to the American ideal—a symbol of stability and prosperity. However, in today's economic climate, this long-held aspiration is undergoing a significant shift. With the median national home price now surpassing $426,000, as reported by the National Association of Realtors (NAR), the focus for many Americans has moved from simply owning a home to finding affordable shelter. This evolving landscape necessitates a fresh perspective and innovative approaches to homeownership.

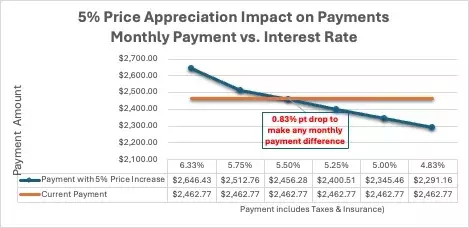

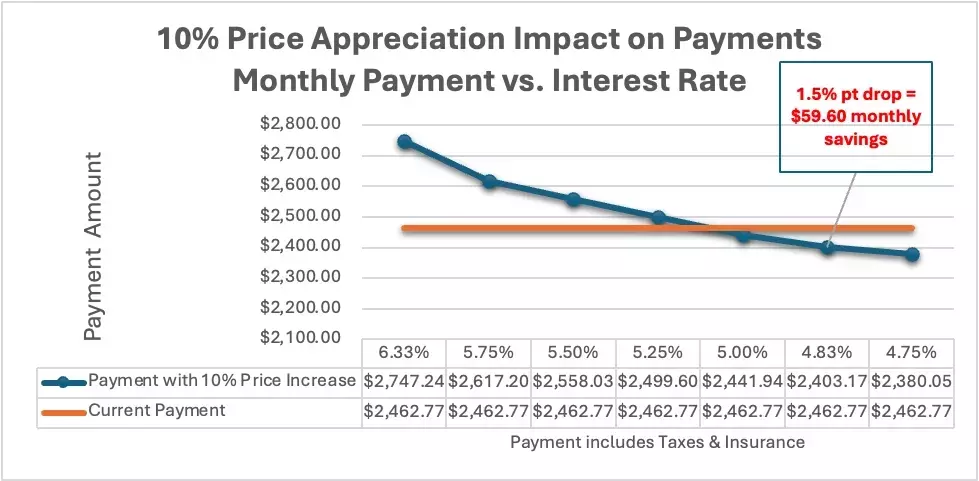

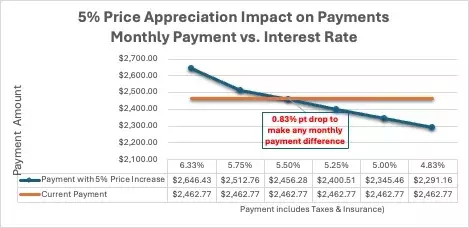

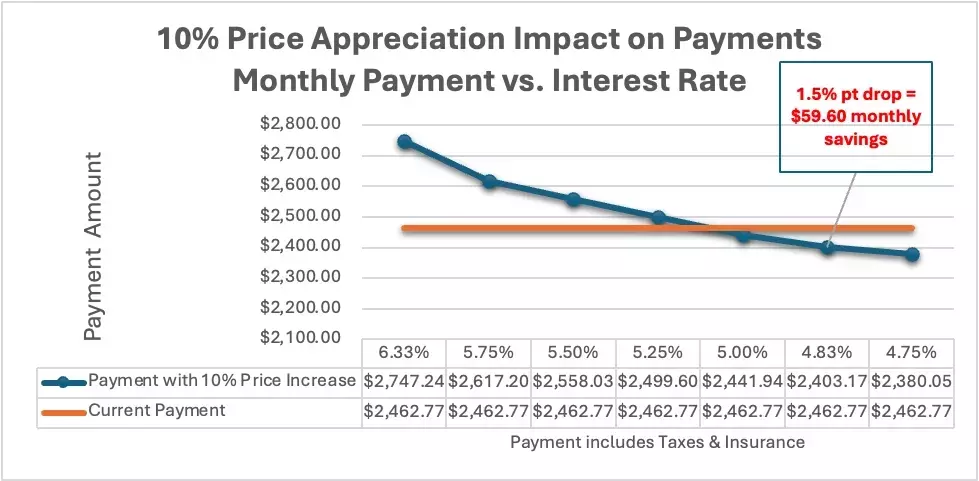

While interest rates frequently dominate headlines and discussions about housing affordability, they represent only one component of a much broader and more intricate issue. Many believe that lowering interest rates is the ultimate solution for first-time buyers, but this perspective is often misleading. Although rate reductions can stimulate economic activity and encourage refinancing, they alone cannot resolve the underlying affordability crisis. Historical data shows that home prices have surged dramatically, with some markets experiencing double-digit annual increases. Additionally, property taxes, which typically follow these price hikes, are catching up, adding further financial strain. Even when interest rates temporarily decreased earlier this year, the relief was short-lived, as the market quickly overheated, and buyers, facing high prices and stagnant wages, began to withdraw. This illustrates that a sustainable solution requires addressing multiple factors beyond just interest rates.

The current economic realities paint a clear picture of the challenges faced by prospective homeowners. To purchase a typical home at $426,000, an individual would generally need an annual income of approximately $105,500 and a down payment of around $85,000, excluding additional costs like moving expenses or closing fees. While options exist for lower down payments, these often result in higher monthly payments and require an even greater income, pushing the threshold to about $127,800 annually. These figures highlight the substantial barriers many first-time buyers encounter. Therefore, if traditional homeownership becomes increasingly unattainable, it is crucial to redefine the concept of 'home.' This calls for practical steps such as embracing multifamily units—condominiums, townhouses, and row homes—as more accessible starter homes, and exploring flexible financing options like hybrid adjustable-rate mortgages and balloon loans to reduce initial payments. Furthermore, innovative models such as shared equity and creative amortization structures can ease the financial burden of upfront costs and monthly payments, making homeownership more attainable for a wider range of individuals. These comprehensive approaches are essential to ensure that future generations can still achieve the dream of property ownership.

In conclusion, the American Dream of homeownership is not diminishing but rather adapting to new economic realities. By fostering collaborative solutions and embracing innovative models that extend beyond conventional approaches, we can ensure that future generations have equitable opportunities to build wealth, stability, and community through diverse paths to owning a home. This collective effort will allow the dream to evolve, creating new and accessible pathways for everyone.