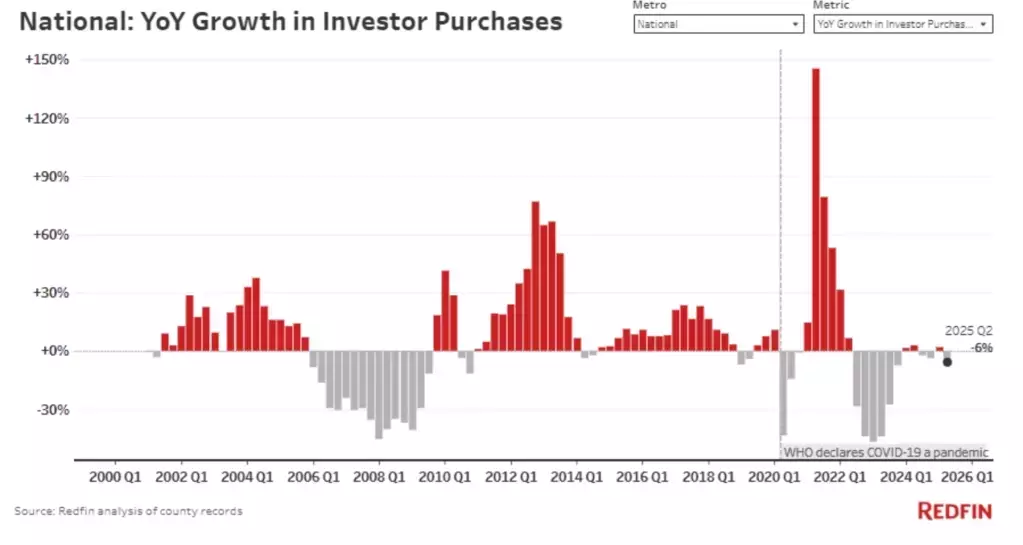

The U.S. real estate market observed a notable decrease in investor activity during the second quarter of 2024. Data from Redfin indicates that approximately 52,000 residential properties were purchased by investors, a figure not seen this low for a second quarter since 2020. This downturn signifies a 6% reduction compared to the previous year, representing the most substantial annual decline since the close of 2023. This trend reflects the broader challenges faced by the housing sector, including elevated interest rates and ongoing economic uncertainties. Investors, encompassing both large corporations and smaller individual entities, are becoming more selective in their acquisitions, largely due to diminishing potential returns from both property flipping and rental incomes. The softening of asking rents and a cooling in short-term rental markets in various urban areas further contribute to this cautious approach, making current market conditions less favorable for rapid capital appreciation.

This shift underscores a re-evaluation of investment strategies within the real estate landscape. While investors still account for a considerable portion of home sales—nearly one in five homes—their reduced purchasing volume suggests a strategic pause rather than a complete withdrawal. The market is adapting to a new equilibrium where the financial feasibility of investments is under closer scrutiny. This period demands a more discerning eye from investors, as the easy gains of previous years are less attainable. The current environment necessitates a thorough analysis of costs versus potential profits, leading to a more conservative investment climate across the residential property spectrum.

Condominium Market Faces Significant Headwinds

The demand for condominiums among real estate investors experienced a sharp decrease, declining by 13% year-over-year. This marks the most significant drop across all property types and represents the lowest second-quarter investor activity in the condo market since 2013, excluding the pandemic era. In contrast, investor purchases of single-family homes and townhouses saw a more modest 4% reduction, while multifamily properties decreased by 2%. The reduced appeal of condominiums is primarily linked to escalating homeowners' association (HOA) fees, unforeseen special assessments, and rising insurance costs. Additionally, investors who traditionally acquired condos for rental purposes are now encountering slower rent growth and increased vacancy rates. This situation is compounded by the fact that condo values typically appreciate at a slower pace compared to single-family residences, making them a less attractive investment option in the current economic climate.

Market experts highlight the unprecedented slowness in the condominium sector, with buyers expressing reluctance to commit due to the continuous rise in associated costs. This includes not only the aforementioned fees and insurance premiums but also stricter lending conditions and potentially higher mortgage rates for condominium units. For investors, the financial viability of owning condos has become increasingly challenging, as the prospect of generating substantial profits has diminished. The confluence of these factors creates a difficult environment for condominium investments, prompting a re-evaluation of their role within diversified real estate portfolios. The market is witnessing a clear shift in preferences, favoring property types with more stable cost structures and greater appreciation potential over the long term.

Regional Shifts in Investor Activity Reflect Market Dynamics

Investor activity in the U.S. real estate market has shown significant regional variations, with Florida experiencing the most pronounced declines. Cities such as Orlando and Fort Lauderdale saw investor purchases fall by 25% and 21% respectively, with smaller but still notable drops in Jacksonville, West Palm Beach, Tampa, and Miami. This regional downturn in Florida suggests that specific local market conditions, possibly influenced by changes in population dynamics, insurance costs, or local economic factors, are playing a crucial role in shaping investor decisions. These areas, previously popular for real estate investment, are now facing challenges that deter new capital. The substantial decrease indicates a strong response to perceived risks or reduced profitability in these regions, signaling a broader adjustment in investment strategies.

Conversely, several West Coast cities, including Seattle (51%), San Francisco (24%), and Portland, Oregon (14%), witnessed an increase in investor purchases. This divergence suggests that despite the overall slowdown, certain markets continue to offer attractive opportunities, possibly due to unique economic resilience, tech-driven growth, or relatively stable housing fundamentals. The disparity in regional performance highlights the fragmented nature of the U.S. real estate market, where local economic conditions and demographic trends significantly influence investment flows. Overall, investors acquired 17% of U.S. homes sold in the quarter, a share that remained largely consistent with the previous year. This stability in market share, despite declining transaction volumes, implies that investor activity is contracting at a similar rate to the broader housing market, indicating a synchronized response to prevailing economic headwinds rather than a targeted exit from specific segments.