In an era marked by escalating living expenses and mortgage rates, the pursuit of reasonably priced housing in desirable areas has become increasingly challenging for many aspiring homeowners. However, recent analyses reveal a silver lining: a notable segment of the British housing market, specifically 12% of listed properties, remains accessible for £150,000 or less. This insight offers a beacon of hope for budget-conscious individuals and families aiming to enter the property market or seeking more economical alternatives.

For those navigating the complexities of the current real estate landscape, certain regions within Britain stand out as havens for affordability. The North East and Scotland, in particular, emerge as prime examples where a substantial number of residences are priced below the £150,000 threshold. This geographical distribution of lower-cost properties signifies that despite broader market pressures, opportunities for securing a home at a reasonable price still exist.

Among the leading locations for cost-effective housing, Sunderland in the North East takes a prominent position, with nearly half of its available properties listed at or below £150,000. This makes it an attractive destination for potential buyers prioritizing value. Similarly, Aberdeen in Scotland presents a compelling case, boasting that 49% of its homes for sale are within this budget-friendly category, highlighting the region's strong affordability. Other cities that consistently feature in the top ten list for affordable homes include Darlington in Yorkshire and the Humber, where a significant 38% of properties meet the criteria, alongside areas such as Blackpool, Swansea, Lincoln, Wolverhampton, Plymouth, and Peterborough, which collectively offer diverse options for buyers with restricted budgets.

The disparity in affordability across Britain is starkly evident when comparing the North East and Scotland with more densely populated regions. While 41% of all homes on the market in the North East and 30% in Scotland are priced under £150,000, London and the South East tell a different story. In the capital, a mere 2% of properties are available within this price bracket, increasing marginally to 7% across the broader South East. This pronounced contrast underscores the geographic variations in housing accessibility and cost.

Even within the less affordable southern regions, pockets of relative value can be found. Croydon, for instance, distinguishes itself in the South East by offering a higher proportion of budget-friendly options, with 7% of its listings under £150,000. This suggests that diligent research and a willingness to explore various localities can still yield favorable outcomes for buyers.

Experts in the property sector emphasize the advantages of these affordable locales. They highlight that such areas not only provide lower price points but also offer a wider array of choices for consumers. The increasing flexibility in work arrangements and improvements in national transport networks are empowering more individuals to consider relocating to these cost-effective regions, thereby enhancing their lifestyle without financial strain. Cities like Sunderland, with their unique blend of coastal charm and urban amenities, exemplify the attractive qualities of these emerging property hotspots.

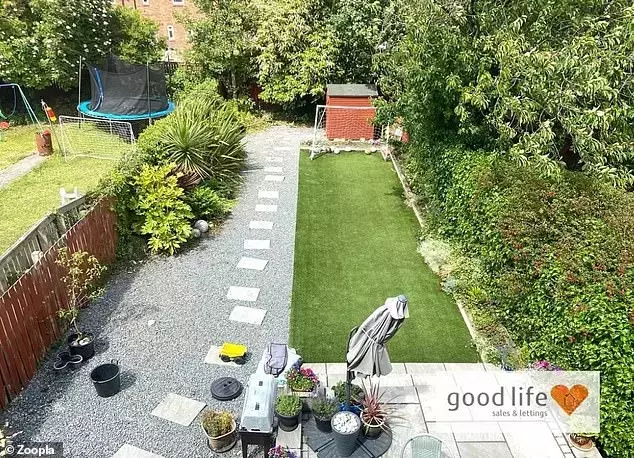

The type of dwelling one can acquire for £150,000 varies considerably across the UK. In the North East and Wales, this budget often allows for two or three-bedroom houses, providing ample space for families. Conversely, in London and the South of England, the market for homes under £150,000 is predominantly composed of flats, often single-bedroom units, with a significant portion being shared ownership schemes. This trend underscores the persistent challenge for first-time buyers in the more expensive southern regions, where entry into the housing market often means smaller properties or alternative ownership models. Recent discussions among policymakers and mortgage lenders aim to address these hurdles, including exploring options for larger mortgage loans and simplifying lending regulations, potentially offering more pathways to homeownership for those on tighter budgets.

Despite the prevailing economic headwinds and the complexities of the property market, the data clearly indicates that opportunities for homeownership within a modest budget still exist across Britain. Buyers willing to broaden their search beyond traditional hotspots and explore regions such as the North East and Scotland will discover a selection of affordable and suitable properties. This geographical shift in housing accessibility, coupled with evolving work patterns, offers a renewed sense of possibility for many looking to establish roots without overextending financially, proving that the dream of owning a home in the UK remains attainable for a significant portion of the population.