Navigating the Storm: How Budgetary Fears Are Reshaping the Housing Landscape

Anticipated Market Correction: Signs of Cooling in the Property Sector

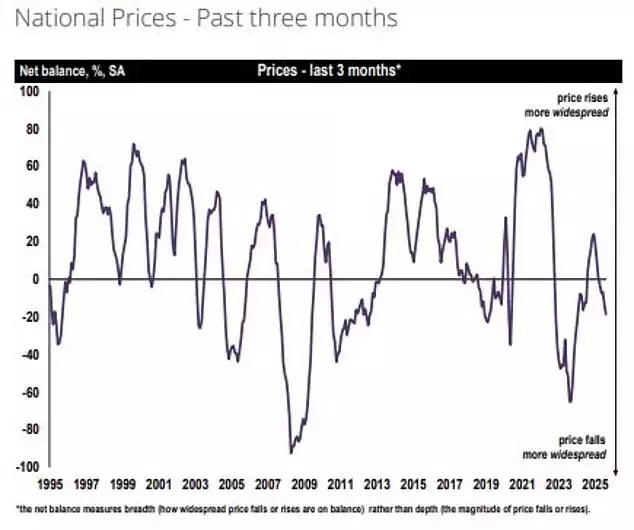

Real estate market analysts are forecasting a decline in housing prices in the coming months, largely due to concerns among potential buyers regarding proposed tax adjustments expected in the upcoming Budget. A recent comprehensive survey conducted by the Royal Institution of Chartered Surveyors (RICS) indicates a notable shift in market sentiment. More RICS members have reported price reductions in their respective areas during August compared to those observing price increases. This trend is particularly pronounced in regions such as East Anglia and the South West of England, where a significant majority of surveyors noted falling prices. The prevailing outlook suggests that this downward pressure on prices will continue for the next three months, marking the most pessimistic sentiment among RICS members since December 2023 when considering a 12-month horizon for modest price recovery.

The Budgetary Ripple Effect: Tax Speculation and Market Stagnation

A significant contributor to the current negative sentiment stems from recent rumors suggesting that the Labour party might introduce substantial reforms to property taxes within the Autumn Budget. This uncertainty is already causing a slowdown in market activity, which is expected to persist until the Budget is officially presented in late November. Property experts highlight that many agents are attributing sluggish activity to the holiday season, but there's a deeper underlying concern that the market is genuinely cooling. Further unfavorable announcements from the Chancellor could lead to even weaker demand. Additionally, discussions around potential changes to stamp duty and capital gains tax are contributing to the reluctance of buyers and sellers, further stalling market momentum.

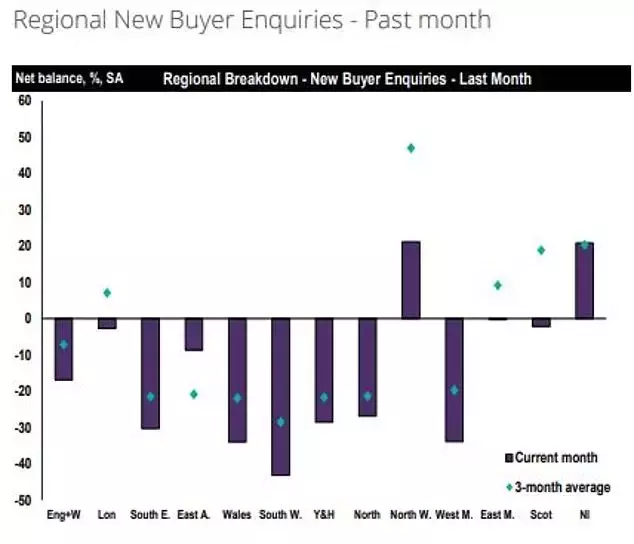

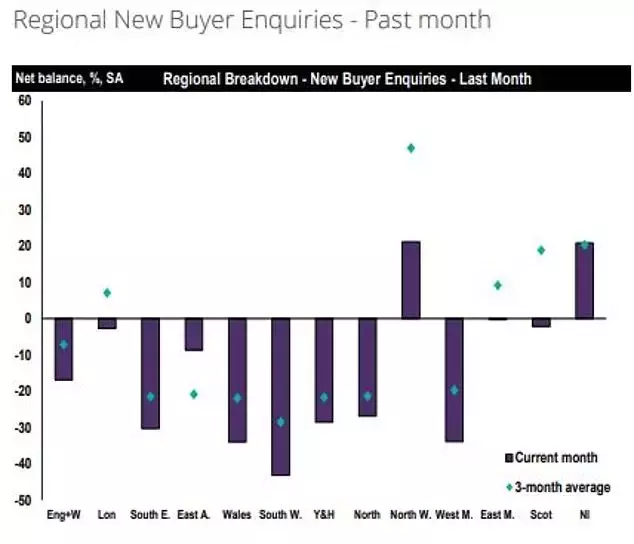

Disrupted Transactions and Diminished Buyer Interest: A Widespread Phenomenon

A key factor contributing to the slowdown in sales is the increasing breakdown of property chains, with potential buyers withdrawing at the last minute due to heightened apprehension. This trend signifies a broader erosion of buyer confidence, evident in reduced inquiries from prospective homebuyers for the second consecutive month in August. Consequently, the volume of agreed sales has also seen a sharper decline compared to the previous month. The consensus among market participants is that sales activity will likely remain stagnant over the next year. Reports from various regions confirm this pervasive sentiment, with lowered confidence and an oversupply of available properties exacerbating the challenges faced by the market.

Rising Mortgage Costs: An Additional Hurdle for Homebuyers

Compounding the market's challenges is the renewed upward trend in mortgage rates. Major lenders, including HSBC, Halifax, Nationwide Building Society, and Santander, have recently announced increases in their rates. The trajectory of fixed-rate mortgages is heavily influenced by expectations regarding future interest rate movements in financial markets. Following a recent decision where the Bank of England maintained a historic deadlock, it is widely anticipated that there will be no further interest rate cuts this year, with any potential reductions pushed back to next Spring. This combination of factors is casting a shadow over the entire property market, impacting nearly all regions and making homeownership increasingly challenging.

Guidance for Mortgage Seekers Amidst Market Fluctuations

For individuals seeking a new mortgage due to an expiring fixed-rate deal or for those purchasing a home, it is advisable to explore available options without delay. This proactive approach is equally crucial for buy-to-let landlords. Collaborating with a mortgage broker is highly recommended to compare rates and understand suitable deals. Homeowners have the flexibility to secure new mortgage terms several months in advance, often without immediate commitment. Many mortgage products allow for fees to be incorporated into the loan, with charges only applied upon completion, offering financial flexibility. However, it's important to consider that accruing interest on these fees over the loan's duration may not be optimal for everyone. For those acquiring property, securing rates promptly is key to establishing predictable monthly payments. Buyers should exercise caution to avoid overextending themselves financially, acknowledging the potential for property value adjustments as higher mortgage rates impact borrowing capacity. Buy-to-let landlords, particularly those with interest-only mortgages, face potentially larger increases in monthly expenses, making timely refinancing even more critical. Consulting with a broker is the most effective way to identify competitive deals across a wide range of lenders and secure the most advantageous mortgage terms.