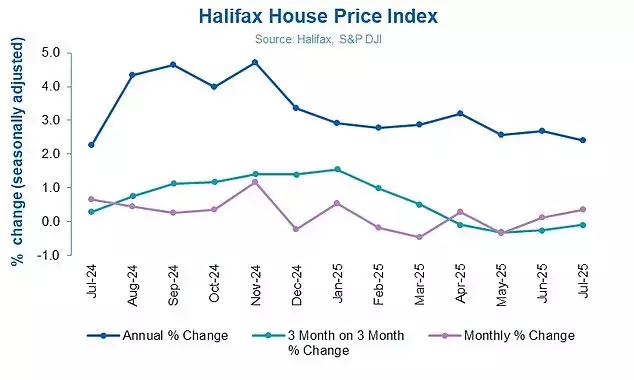

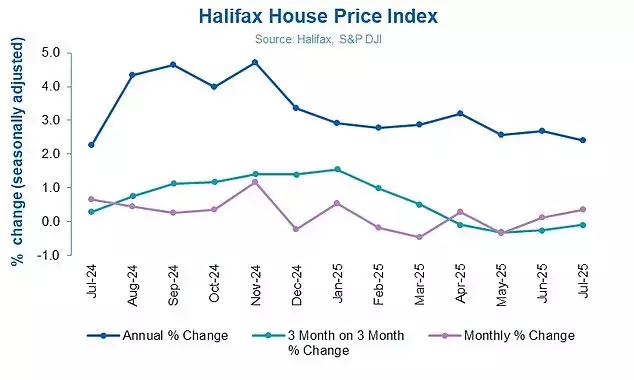

The British housing market is experiencing a notable upswing, with July witnessing the largest monthly surge in property values this year, as reported by Halifax. This positive momentum is largely attributed to the continuous reduction in mortgage interest rates and a more flexible approach by lenders in offering larger home loans. While the annual growth rate has seen a minor deceleration, the overall outlook for the housing sector remains robust, with expectations of continued, albeit modest, gains throughout the remainder of the year.

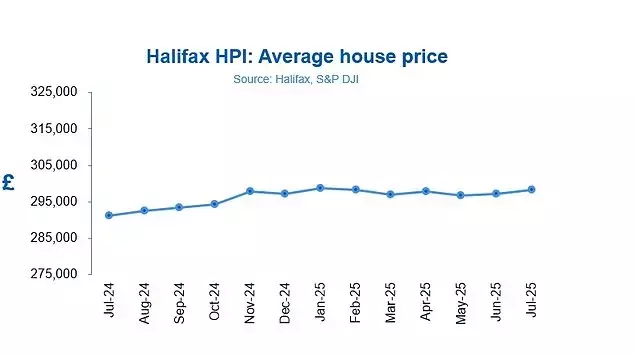

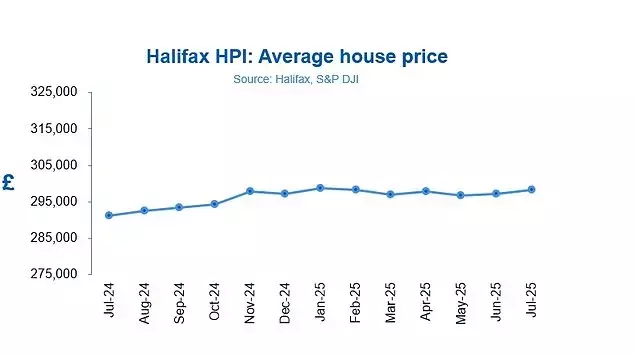

Halifax, a prominent mortgage provider, announced that the average cost of a home climbed by 0.4 percent in July, pushing the typical property value to £298,237. This marks an increase from the £297,157 recorded in June. The last time a more substantial monthly rise was observed was in November 2024, when prices jumped by 1.2 percent, driven by buyers rushing to finalize purchases before a stamp duty hike in April 2025. Over the past twelve months leading to July, property values have appreciated by 2.4 percent, a slight dip from the 2.7 percent growth seen in June.

This upward trend in house prices is primarily fueled by the gradual decrease in mortgage interest rates. Furthermore, recent adjustments by lenders to allow individuals to borrow a greater multiple of their income, sometimes up to six times, have played a significant role. Lenders have also revised their 'stress rates,' which evaluate a borrower's capacity to manage mortgage payments if rates were to increase, thereby broadening access to credit. For instance, the average two-year fixed residential mortgage rate currently stands at 5 percent, with the five-year fixed rate at 5.01 percent; however, competitive deals below 4 percent are available for those with substantial deposits or equity.

The Bank of England's forthcoming decision on interest rates, widely anticipated to result in a reduction from 4.25 percent to 4 percent, is expected to further contribute to a decline in mortgage rates. While the market often preempts such changes, a definitive cut will reinforce the trend of increasing mortgage affordability. Amanda Bryden, head of mortgages at Halifax, noted that despite ongoing challenges for prospective homeowners, improving affordability, coupled with more adaptable lending assessments, has ensured the housing market's resilience and sustained activity levels.

Looking ahead, Bryden cautioned about the impact on individuals nearing the end of their fixed-rate mortgage terms. Those on five-year deals, especially ones secured during the pandemic-era property boom when rates were exceptionally low, might face significantly higher repayments. Conversely, homeowners ending two-year fixed-rate deals locked in during the peak rates following the 2022 mini-Budget might see their payments decrease. This dynamic could influence market behavior, potentially causing some to delay home moving plans due to tighter budgets, but it is not expected to have a major impact on overall house prices.

Geographically, Northern Ireland leads the charge in house price appreciation, with a 9.3 percent increase over the last year, bringing the average home value to £214,832. Scotland followed with a 4.7 percent rise to £215,238, and Wales saw a 2.7 percent increase to £227,928. In England, the North West and Yorkshire and the Humber regions reported the highest annual growth, both up by 4 percent, reaching average prices of £242,293 and £215,532 respectively. London and the South East experienced more modest growth at 0.5 percent, with the South West trailing at 0.2 percent. Property expert Tom Bill from Knight Frank anticipates low single-digit house price growth by the end of 2025, contingent on the outcomes of the autumn Budget, as potential tax increases could cause buyers to hesitate.

The current market conditions, characterized by easing mortgage rates and more accommodating lending policies, are fostering an environment where property values can continue to climb. This demonstrates a robust response to economic shifts, providing a more stable and accessible housing landscape for many.