Unlock Hidden Savings: Your Guide to Smarter Homeownership and Client Loyalty!

The Unforeseen Challenge of Property Tax Escalation

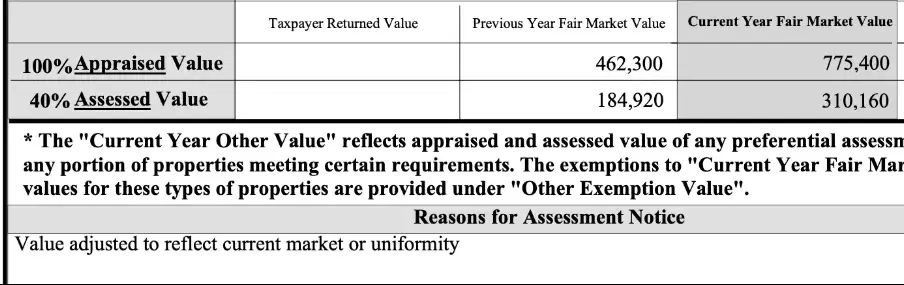

A common surprise for many new homeowners is the rapid appreciation of their property's assessed value, which directly impacts their annual tax obligations. While a rising home value can be advantageous for selling or refinancing, it can also lead to a substantial and sudden increase in property tax payments, potentially creating financial strain and, in extreme cases, risking tax foreclosure.

The Power of Homestead Exemptions: A Missed Opportunity for Many

A significant number of homeowners, particularly those who have resided in their properties for extended periods, are unaware of the homestead exemption. This exemption, available in most U.S. states, offers a valuable tax reduction for owner-occupants. Crucially, it's not automatically applied; homeowners must actively request it, underscoring the importance of proactive engagement with local tax authorities.

The Untapped Potential of Property Tax Appeals and Neighborly Wisdom

Observational data indicates that many homeowners could benefit from appealing their property tax assessments. In numerous instances, neighbors who successfully appealed their taxes achieved reduced rates for multiple years, a benefit often not widely publicized. This highlights a critical information gap, as many long-term residents are unaware of their right to appeal or the potential to freeze their property tax rates, preventing annual increases.

Timely Action: Navigating Deadlines and Opportunities in Property Tax Management

For residents in certain regions, such as Georgia, a unique opportunity exists. Even if the standard homestead exemption deadline has passed, it may be possible to file for it concurrently with a property tax appeal, typically with a specified deadline. This flexibility offers a vital window for homeowners to claim benefits they might have otherwise missed, underscoring the importance of staying informed about local tax regulations and deadlines.

Empowering Real Estate Professionals: Cultivating Client Loyalty Through Education

Real estate agents and mortgage brokers have a unique opportunity to build lasting client relationships by educating them on property tax matters. By proactively reminding clients about homestead exemptions, informing them of appeal deadlines, and sharing essential knowledge about tax benefits, professionals can demonstrate invaluable support. This not only fosters goodwill but also serves as an effective, long-term marketing strategy, transforming transactional relationships into enduring partnerships.