In the dynamic realm of real estate, understanding prevailing trends and strategic opportunities is paramount. This article encapsulates an in-depth conversation with Rob Dix, a distinguished figure in the property sector and co-founder of Property Hub. His insights traverse various facets of the housing market, from near-term price forecasts to long-term investment wisdom. Dix, also a prolific author and buy-to-let investor, offers a nuanced perspective on current market forces, mortgage considerations, and the socio-economic implications of housing policies. This dialogue aims to distill complex market dynamics into accessible knowledge, empowering both seasoned investors and aspiring homeowners with valuable foresight.

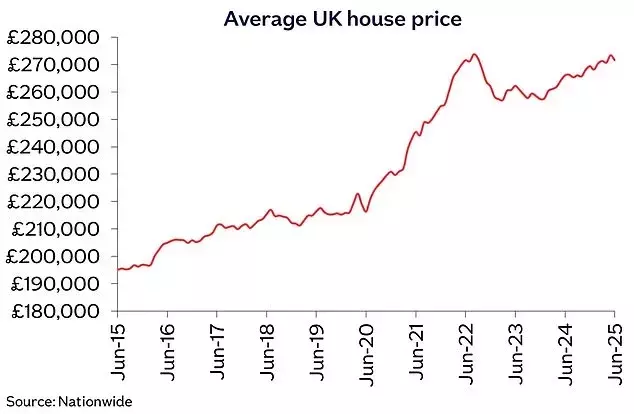

Dix anticipates a modest increase of at most 2% in average house prices over the coming year, continuing a pattern of slight inflation-adjusted declines. He foresees significant regional variations, with northern areas experiencing higher growth and smaller, more affordable properties outperforming larger, more expensive ones. Looking ahead a decade, Dix suggests that property values will likely mirror inflation or grow slightly faster, aligning with historical long-term trends. He acknowledges the cyclical nature of market booms and busts, though their timing remains unpredictable. Dix emphasizes that for mortgage holders, even consistent inflation-linked growth can yield substantial returns over a ten-year period.

Regarding mortgage rates, Dix projects that buy-to-let rates will likely stabilize in the four percent range, potentially half a percent lower than current levels. He explains his personal choice to rent in London, citing its cost-effectiveness compared to homeownership in the city. Beyond cost, his decision is driven by a desire for flexibility, as he is uncertain about his residential preferences in the next five years. Dix highlights that the substantial stamp duty expenses associated with purchasing a property in London would make buying an economically illogical choice for him. He further argues that renting is not a waste of money if one simultaneously invests in assets, drawing a parallel with paying mortgage interest.

For his buy-to-let portfolio, Dix consistently opts for interest-only mortgages, viewing them as a safer choice due to lower monthly payments that provide a buffer during periods of tenant vacancy. He also notes the flexibility of overpaying when circumstances allow. To enhance certainty and reduce fees, he typically fixes his mortgage rates for five-year terms, recommending shorter fixes only for those planning to extract equity from their investments. Dix identifies the scarcity of social housing as the most pressing property crisis, asserting that it places undue pressure on the private rental sector and undermines housing security for the most vulnerable. He dismisses so-called affordable housing initiatives as inadequate solutions to this fundamental problem.

On the political front, Dix expresses skepticism about any government's ability to meet housing construction targets, given historical precedents and the minimal construction of social housing. He asserts that house prices invariably reach an affordability ceiling, constrained by buyers' incomes. Therefore, a lack of productivity and wage growth would act as a significant brake on property appreciation. The only factor he believes could substantially impact house prices is the imposition of much stricter mortgage lending regulations, which he deems unlikely. Dix acknowledges the unpopularity of recent measures targeting the buy-to-let sector among investors but understands their rationale in professionalizing the industry. He anticipates continued disproportionate targeting of landlords, attributing it to low political risk. While recognizing the existence of unscrupulous landlords, he stresses that regulations to address them are already in place but are often poorly enforced.

Dix views buy-to-let as a sound long-term investment, particularly when leveraged with a mortgage. He points out that property allows for significantly greater acquisition through debt compared to other asset classes, with debt value naturally diminishing due to inflation. Furthermore, the stable, inflation-linked rental income stream and lower volatility make property a more comfortable investment for some compared to the stock market. His top investment pick for the next decade is any city or commuter town in the North West of England, citing the region's strong performance, projected future growth, affordability headroom, and robust rental growth. Conversely, he advises against investing in the South East, outside London, due to affordability constraints, limited potential for price appreciation, and low yields. He also suggests that despite central London's prime properties being below their 2014 peak, a strong rebound is unlikely, partly due to the UK's diminishing international appeal and high stamp duty costs. For first-time buyers, Dix, if he were Chancellor, would avoid schemes like 'Help to Buy' that inflate prices. Instead, he would consider tax exemptions on the first £100,000 of lifetime earnings, enabling individuals to save more effectively. He advises buyers to secure mortgage offers and solicitors early to demonstrate seriousness, noting that persistence is key as many transactions fall through. His overarching advice for first-time buyers is to avoid rushing into purchases unless committed to staying for at least five years, given the significant transaction costs and the non-recurring nature of first-time buyer stamp duty benefits. Sellers should conduct their own research and price their homes realistically, as overpriced properties tend to languish on the market. Dix cites a house purchased in Nottingham in May 2020 during the peak of COVID-19 panic as his best investment, securing a great price and consistent tenancy with minimal oversight. His worst investment was in Hull, where prices stagnated in less desirable areas and low rents were easily eroded by repair costs. If he inherited £100,000, Dix would use it to leverage a mortgage on a modest family home in a quality area of the Midlands or North, pricing the rent slightly below market value to attract a large pool of applicants, and then holding the property long-term for wealth generation.

Navigating the real estate landscape requires informed decision-making and a clear understanding of market dynamics. Rob Dix's comprehensive insights underscore the importance of strategic planning, whether one is a seasoned investor or a prospective homeowner. His views on regional disparities, the impact of government policies, and the intrinsic value of long-term investment provide a robust framework for approaching property. Ultimately, a prudent approach, coupled with an awareness of personal financial goals and market realities, remains the cornerstone of successful real estate engagement.