Navigating Currency Currents: Secure Your Financial Future Amidst Dollar Shifts

The Current State of the U.S. Dollar: A Comprehensive Overview

The U.S. dollar has indeed shown signs of weakening, particularly since 2024, a development that has captured significant media attention. The U.S. Dollar Index (DXY) registered a decrease of approximately 10.5% in the first half of 2025. However, it's crucial to understand that currency valuations are inherently dynamic. Economists emphasize the importance of analyzing these changes within a broader long-term context rather than reacting solely to immediate shifts.

Factors Contributing to the Dollar's Depreciation: An In-depth Analysis

Several interconnected elements contribute to the U.S. dollar's loss of value. Reports indicate that a combination of economic shifts, prevailing interest rates, and the performance of other international currencies are driving the current weakening. Economic uncertainties, fueled by evolving trade policies and tariffs, have prompted some international investors to seek opportunities elsewhere due to perceived higher risks within the U.S. economy. Geopolitical dynamics also play a role; as other major global currencies strengthen, the dollar's relative value may decline. Furthermore, decisions made by the Federal Reserve regarding interest rates significantly impact the dollar. While higher rates typically attract international investment, the future direction of Fed policy remains a key determinant of the dollar's trajectory.

The Repercussions of a Weaker Dollar: Economic and Personal Impacts

A depreciating dollar has various implications, some adverse and others potentially beneficial, depending on one's economic position. For American consumers, international travel becomes more expensive, as a weaker dollar translates to less purchasing power abroad. Similarly, imported goods may see price increases, although this can simultaneously make U.S. exports more competitive on the global market, potentially benefiting domestic businesses. There's also the risk of increased inflation, as businesses might pass on higher import costs to consumers. Moreover, economic uncertainties can lead to market volatility, causing concern among investors about their financial portfolios.

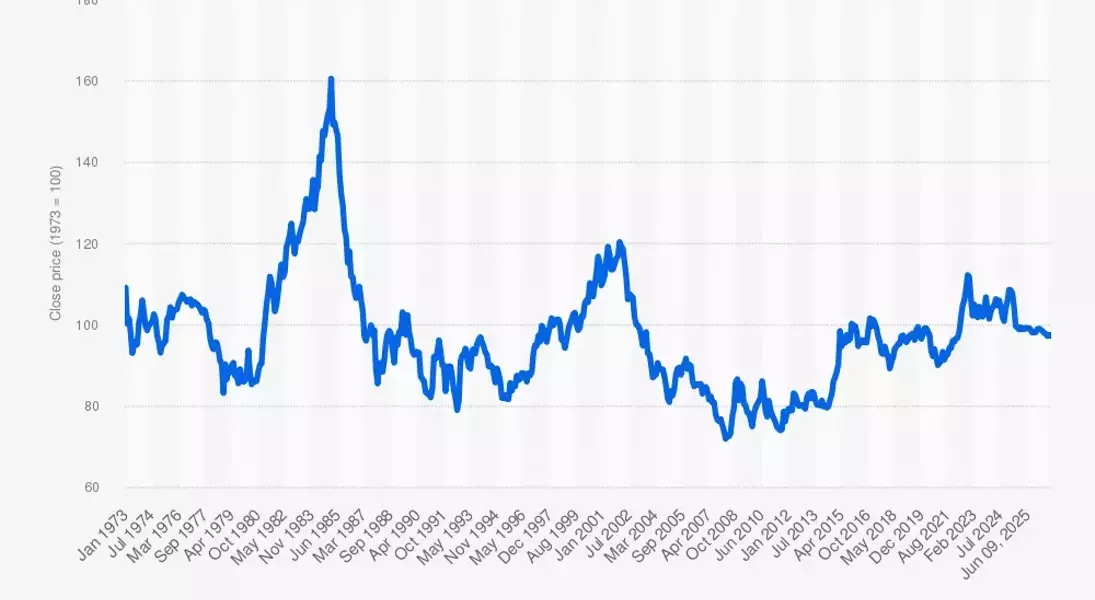

Historical Patterns of Dollar Fluctuations: A Look Back

The dollar's value, much like any other currency, experiences natural cycles of appreciation and depreciation. While daily exchange rates constantly adjust, certain historical periods stand out for significant declines. Notable drops occurred during the financial crises of 2008 and 2009, as well as in 2011, 2018, and during the COVID-19 pandemic in 2019 and 2020. Interestingly, the dollar's current value remains higher than during these past significant downturns, which may offer some reassurance. Conversely, the dollar reached peak strength in 1985, 2002, and 2022, driven by factors such as coordinated international interventions, robust U.S. economic growth, and post-pandemic interest rate adjustments.

Global Currency Dynamics: A Comparative Perspective

Globally, various currencies are experiencing differing fortunes. While the U.S. dollar has weakened, some currencies have also seen depreciation, such as the Japanese yen, Turkish lira, Indonesian rupiah, and the Australian dollar. Conversely, other major currencies have strengthened against the dollar in 2025, including the Swiss franc, the Euro, and the Russian rouble. The Chinese yuan, while historically strong, has experienced depreciation in recent years.

Forecasting the Dollar's Future: Potential Paths Forward

Currency values are inherently subject to change, and the dollar's future strength will largely depend on forthcoming economic policies. For instance, positive employment reports can bolster confidence in the U.S. economy, leading to a temporary rise in the dollar's value. However, ongoing factors such as interest rate decisions, trade tariffs, and geopolitical tensions will continue to exert influence. While some economists anticipate further weakening of the dollar in the near term, it's crucial to monitor long-term trends using reliable indicators like the U.S. Dollar Index rather than being swayed by short-term headlines.

Mitigating Concerns: Addressing the Weakened Dollar's Impact

While a depreciated dollar can increase the cost of imports and international travel, it is important to remember that a complete collapse of the U.S. dollar is highly improbable. The dollar retains its status as one of the world's most resilient currencies, offering a degree of stability even amidst current fluctuations.

Strategies for Asset Protection: Navigating Currency Volatility

Individuals can take proactive steps to safeguard their assets during periods of dollar fluctuation. Diversifying investment portfolios across various asset classes, including stocks, bonds, real estate, and commodities like gold, can provide a buffer against market downturns. Reducing high-interest debt is another crucial step, as a weaker dollar can make debt repayment more challenging over time. Maintaining an adequate cash reserve, or emergency fund, is also vital for addressing unexpected expenses and mitigating the impact of inflation. Finally, staying informed through credible news sources is paramount for making sound financial decisions, distinguishing factual information from sensationalized reportin