According to the latest U.S. Census Construction Spending data, private residential construction spending witnessed a significant uptick in October. This development holds great importance for the construction industry and has far-reaching implications for various stakeholders.

Unveiling the Trends in Private Residential Construction Spending

Residential Improvements: A Driving Force

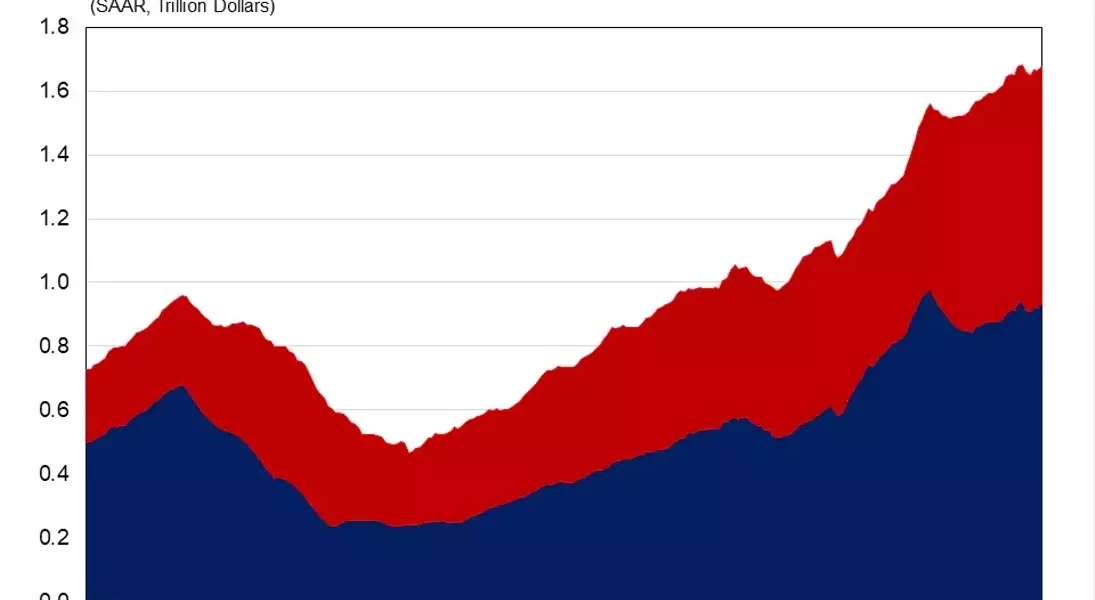

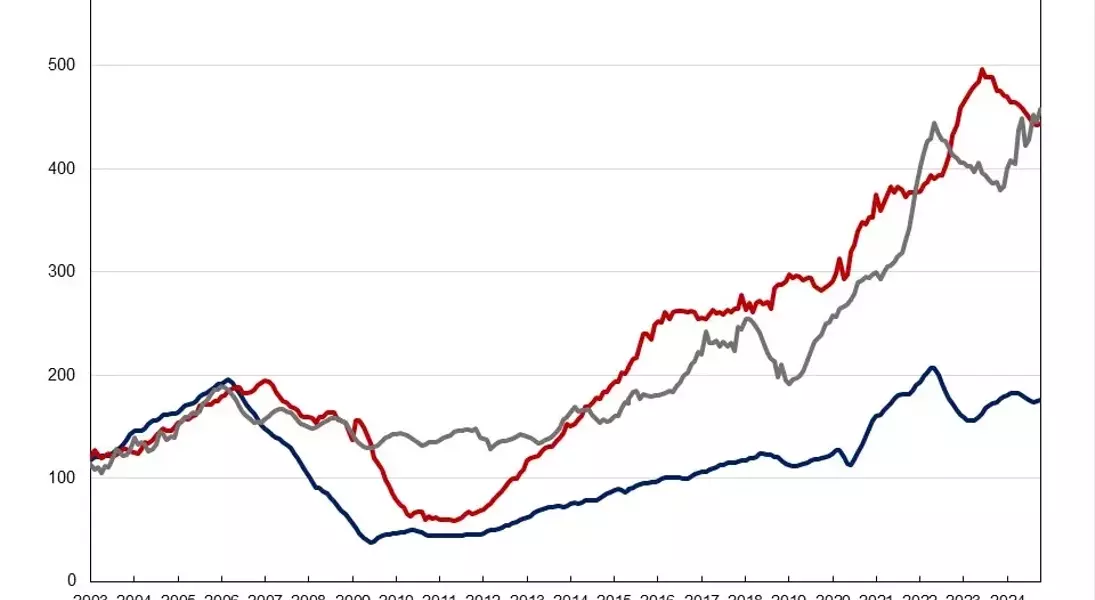

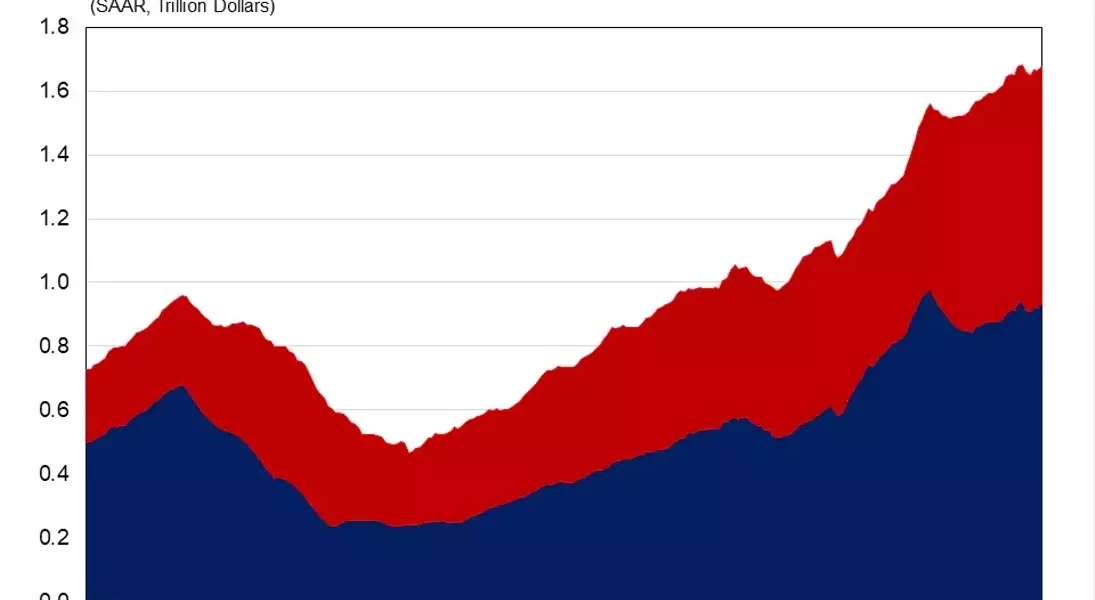

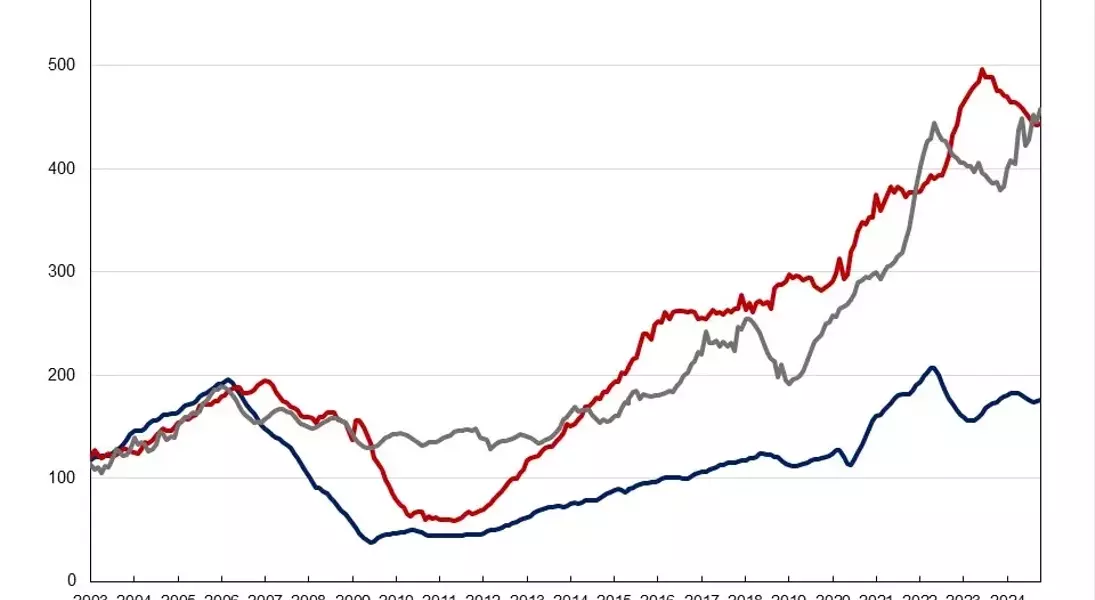

In October, the monthly increase in total private construction spending was predominantly fueled by higher outlays on residential improvements. These improvements saw a remarkable surge of 2.7%, marking a substantial 18.5% growth compared to the same period last year. This indicates a strong demand for enhancing and upgrading residential properties, which is likely to have a positive impact on the housing market and related industries. 1: The rise in residential improvement spending showcases the evolving preferences of homeowners. They are investing more in making their homes more comfortable, energy-efficient, and aesthetically pleasing. This trend not only benefits the homeowners directly but also stimulates economic activity in sectors such as home improvement stores, construction materials suppliers, and renovation services. 2: Moreover, the continuous growth in residential improvement spending suggests a sense of confidence among homeowners. They are willing to make significant investments in their properties, indicating a positive outlook for the housing sector. This could potentially lead to increased property values and a more vibrant real estate market.Single-Family Construction: A Steady Growth

Spending on single-family construction inched up by 0.8% during the month. This marks a continuation of the growth trend that began after a five-month decline from April to August. Interestingly, compared to a year ago, spending on single-family construction was 1.3% higher. This indicates that the single-family housing market is gradually recovering and gaining momentum. 1: The steady growth in single-family construction is a positive sign for the housing industry. It suggests that demand for single-family homes is on the rise, which could lead to increased construction activities and job opportunities in the sector. Builders are showing confidence in the market and are actively investing in new projects. 2: Additionally, the alignment of single-family construction spending with the rising builder confidence indicates a healthy balance between supply and demand. This is likely to result in a more stable housing market, with fewer fluctuations and a more sustainable growth trajectory.Multifamily Construction: A Turning Point

Meanwhile, multifamily construction spending ended its streak of ten consecutive monthly declines and edged up by 0.2% in October. Although the monthly gain was relatively small, it is a significant development as it indicates a potential turnaround in the multifamily housing sector. However, it is important to note that multifamily construction spending still remains 6.8% lower compared to a year ago. 1: The end of the consecutive decline in multifamily construction spending is a welcome sign. It suggests that the market conditions for multifamily housing are gradually improving. Builders are starting to show more interest in this segment, which could lead to increased construction activities and the addition of more rental units in the market. 2: Despite the slight monthly gain, the fact that multifamily construction spending is still lower than a year ago highlights the challenges faced by this sector. Factors such as high interest rates and changing rental market dynamics have affected the growth of multifamily construction. However, with the recent positive trend, there is hope for a more robust recovery in the future.Private Nonresidential Construction: A Solid Increase

Spending on private nonresidential construction was up 3.5% over a year ago. This annual increase was mainly driven by higher spending in the manufacturing class ($32.9 billion) and the power category ($6.4 billion). These sectors are witnessing significant growth and are contributing to the overall expansion of the nonresidential construction market. 1: The increase in private nonresidential construction spending reflects the ongoing economic activities and the need for infrastructure and commercial development. The growth in the manufacturing and power sectors is particularly noteworthy as it indicates a strong demand for these types of facilities. 2: This growth in private nonresidential construction is likely to have a multiplier effect on the economy. It will create jobs in various construction-related fields and stimulate other sectors such as engineering, architecture, and equipment manufacturing. It also showcases the resilience and adaptability of the nonresidential construction market in the face of economic challenges.You May Like