PepsiCo, a prominent global player in the consumer-packaged goods sector, continues to present a compelling investment case for those seeking stability and consistent returns. Despite recent market skepticism stemming from perceived sales volume pressures, the company's strategic adaptations and diversified global operations underscore its inherent strength. By actively managing its brand portfolio and leveraging its international presence, PepsiCo demonstrates an impressive capacity to mitigate localized challenges and sustain growth. Its long-standing commitment to increasing dividends further enhances its appeal as a reliable, long-term holding for a balanced investment portfolio.

Headquartered in Purchase, NY, PepsiCo's journey began humbly with a single product, Pepsi-Cola, in New Bern, NC. Following a change of ownership due to bankruptcy, the brand found its enduring home in New York. Since relocating in 1970, PepsiCo has evolved into a vast international enterprise, boasting an extensive array of beverage and food brands. This strategic diversification has been pivotal in its enduring success and ability to weather various economic climates.

Recent financial disclosures for the third fiscal quarter of 2025 initially showed a 1% decline in sales volume across both beverages and convenient foods, with North America experiencing a more pronounced dip. This led some investors to speculate on factors such as consumers opting for cheaper alternatives, a shift towards healthier choices, or even the impact of weight-loss medications on appetite. Consequently, PepsiCo's stock experienced a 23% drop from its peak two years prior, reflecting investor apprehension.

However, a deeper analysis reveals a more optimistic picture. PepsiCo has been proactively refining its brand portfolio, which includes the sale of Rockstar Energy to Celsius and the transition of its case pack water business to a third-party partner. These deliberate adjustments, while impacting headline sales figures, are strategic moves designed to optimize the company's offerings. When these changes are factored in, North American beverage volumes actually show growth, indicating positive momentum in a critical market segment with core products.

Furthermore, the company's extensive international footprint provides a crucial buffer against regional challenges. While North American sales have faced headwinds, both Latin America and Asia have consistently shown rising sales volumes for food and beverages. This geographical diversification is a significant advantage, ensuring that even if one part of the business encounters difficulties, other segments can compensate and maintain overall performance. This robust operational structure positions PepsiCo as a resilient entity capable of navigating diverse market conditions.

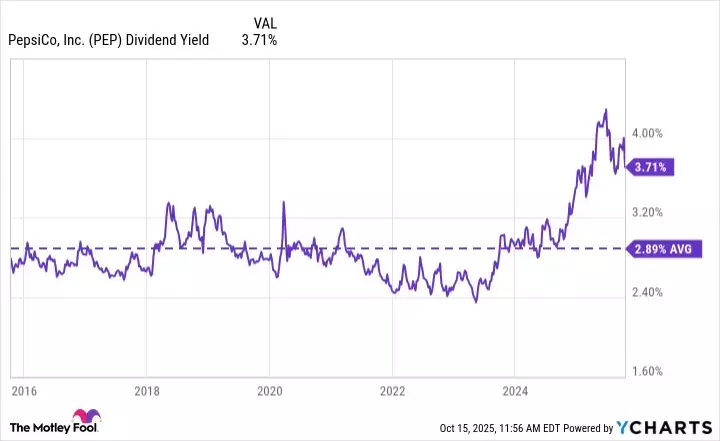

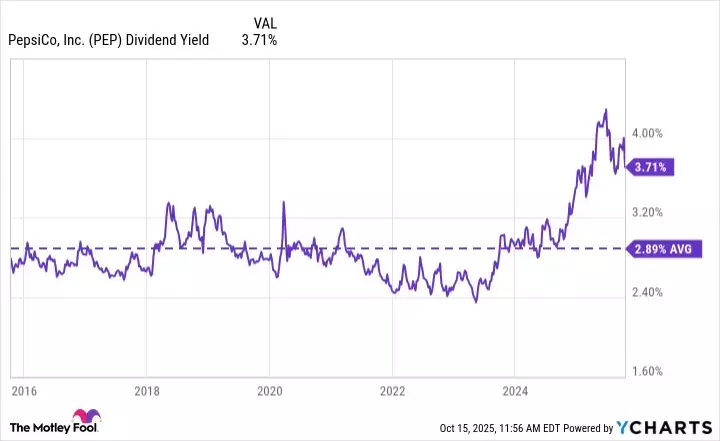

PepsiCo is classified as a Dividend King, an elite group of companies that have consistently paid and increased their dividends for at least 50 consecutive years. With an impressive record of 53 years of dividend increases, PepsiCo demonstrates a steadfast commitment to returning value to its shareholders. The recent pullback in the stock price has created an opportunity for dividend investors to acquire shares at an attractive yield, potentially boosting their long-term returns. This consistent dividend growth, coupled with the company's adaptive business model, makes PepsiCo an appealing option for investors prioritizing both income and capital preservation.

In summary, PepsiCo's strategic portfolio management, strong international presence, and unwavering commitment to shareholder returns through its dividend program solidify its position as a valuable long-term investment. While not a high-growth stock, its stability, resilience, and capacity for adaptation make it an excellent choice for diversifying any investment portfolio, promising steady returns with relatively low risk.