When considering investments in the dynamic technology sector, exchange-traded funds (ETFs) offer a streamlined approach to gain exposure while mitigating individual stock risks. Among the prevalent choices for tech-oriented investors are the Invesco QQQ Trust and the Vanguard Information Technology ETF. Both aim to capitalize on the growth within the technology sphere, yet they present distinct characteristics regarding their composition and historical returns. Understanding these differences is crucial for making an informed investment decision, particularly for those looking for sustained growth and risk management within their portfolios.

This analysis will dissect the core focus of each ETF, examining their underlying assets and how these contribute to their overall investment profiles. Furthermore, a comparison of their past performance will shed light on which fund has historically delivered superior returns. Ultimately, the discussion will weigh the advantages and disadvantages of each ETF, guiding investors toward a choice that aligns with their long-term financial objectives and risk tolerance in the ever-evolving tech landscape.

Dissecting the Core Tenets of QQQ and VGT

The Invesco QQQ Trust, commonly known as QQQ, primarily tracks the Nasdaq-100 Index, which comprises the 100 largest non-financial companies listed on the Nasdaq stock exchange. While not exclusively a technology ETF, the technology sector constitutes over 60% of its holdings, making it a significant player in the tech investment space. This composition offers a blend of dominant tech giants alongside other large-cap companies, providing a degree of diversification beyond pure technology. In contrast, the Vanguard Information Technology ETF (VGT) is a specialized tech ETF, exclusively investing in companies within the information technology sector. It holds a broader range of companies, including large, mid, and small-cap tech firms, offering a more concentrated exposure to the technology industry's nuances and growth drivers. Both ETFs employ a market-cap weighting strategy, meaning that larger companies significantly influence their overall performance. Noteworthy is the substantial overlap in their top holdings, with Nvidia, Microsoft, Apple, and Broadcom featuring prominently in both portfolios, reflecting the current dominance of these mega-cap tech entities in the market.

A closer look at the allocation within these ETFs reveals key differences. For instance, Nvidia, Microsoft, Apple, and Broadcom collectively represent a substantial portion of VGT's assets, accounting for approximately 48%. This high concentration in a few bellwether tech stocks renders VGT highly sensitive to the performance fluctuations of these specific companies. While this concentration has been a boon during periods of strong growth for these market leaders, it also introduces a higher degree of risk if these stocks face a downturn. QQQ, while also heavily weighted in these same tech giants, benefits from its inclusion of non-tech companies within the Nasdaq-100. This broader exposure means that QQQ's performance is not solely tethered to the tech sector's movements. Should the technology sector experience a period of stagnation or decline, the non-tech components in QQQ could potentially offer a buffer, contributing to a more stable performance profile over the long term. This structural difference in diversification is a critical factor for investors to consider when evaluating the risk-reward profiles of QQQ and VGT.

Performance Trajectories and Investor Considerations

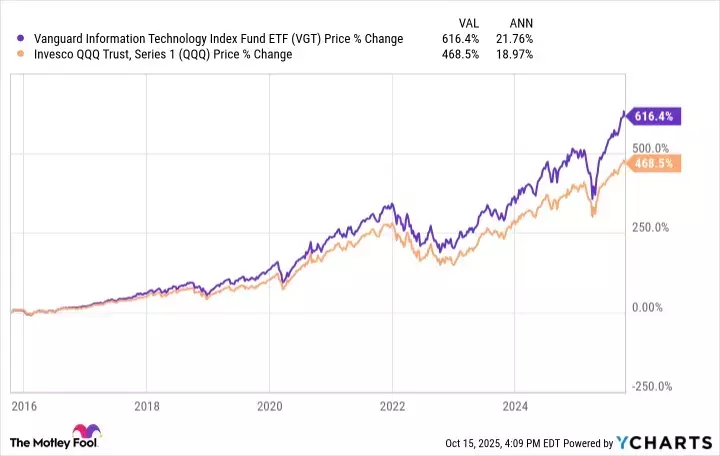

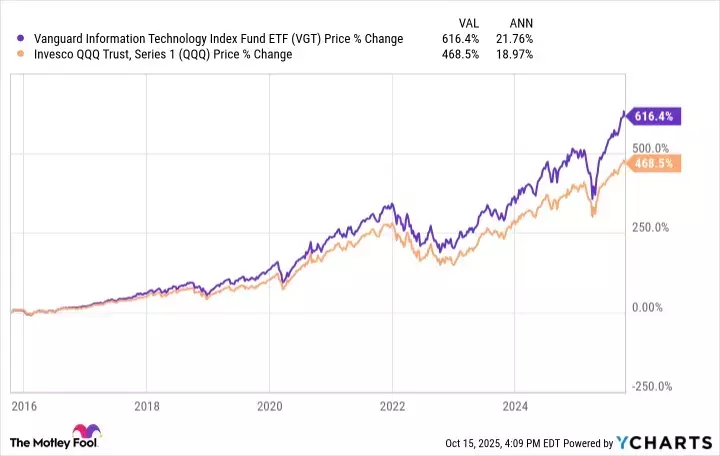

Over the last decade, both QQQ and VGT have delivered impressive returns, largely fueled by the sustained growth of the technology sector. However, VGT has demonstrated a notable edge in performance, outperforming QQQ with a 616% return compared to QQQ's 468% over the same period. This translates to annualized returns of 21.8% for VGT and 19% for QQQ, highlighting VGT's stronger historical growth. A significant portion of VGT's recent outperformance can be attributed to the explosive growth of companies like Nvidia, which holds a more substantial weighting within VGT's portfolio. Beyond performance, cost efficiency is another critical factor for investors. VGT boasts a lower expense ratio of 0.09% compared to QQQ's 0.2%. While this difference may appear minimal annually, it accumulates significantly over time. For example, a monthly investment of $500 with a 10% annual return would result in over $4,200 more in fees paid for QQQ over a 20-year span, underscoring the long-term impact of expense ratios on overall returns.

Despite VGT's superior historical performance and lower expense ratio, QQQ is often considered a more prudent choice for long-term investors due to its enhanced diversification. The concentrated nature of VGT, with nearly half of its assets invested in just four companies (Nvidia, Microsoft, Apple, and Broadcom), poses a heightened risk. While this concentration has propelled VGT during bullish phases for these tech titans, it also exposes the fund to significant vulnerability during potential market corrections or underperformance by these specific companies. QQQ, while still having substantial exposure to these mega-cap tech stocks, includes a broader array of companies from various sectors within the Nasdaq-100. This wider net provides a built-in mechanism for risk mitigation. In periods where the tech sector might be struggling, the non-tech holdings within QQQ can help stabilize returns and prevent severe drawdowns. Therefore, for investors prioritizing a balance between growth potential and risk management, QQQ's broader market exposure makes it a more resilient option, ensuring that portfolio performance is not overly reliant on the fortunes of a select few technology enterprises.