For agricultural producers, a well-defined strategy for marketing their corn harvest is vital for achieving optimal financial outcomes. Instead of making a singular sale, staggering the release of corn into the market from October through April can lead to enhanced profitability. This approach is supported by historical data which shows favorable pricing trends during these months, even when factoring in the expenses associated with commercial storage and interest. Understanding regional price variations and projections from key agricultural reports like the World Agricultural Supply and Demand Estimates (WASDE) can further refine these sales decisions. Ultimately, the goal is to navigate market complexities and capitalize on periods of higher demand and better prices to secure the best possible return on investment for the 2025 corn crop.

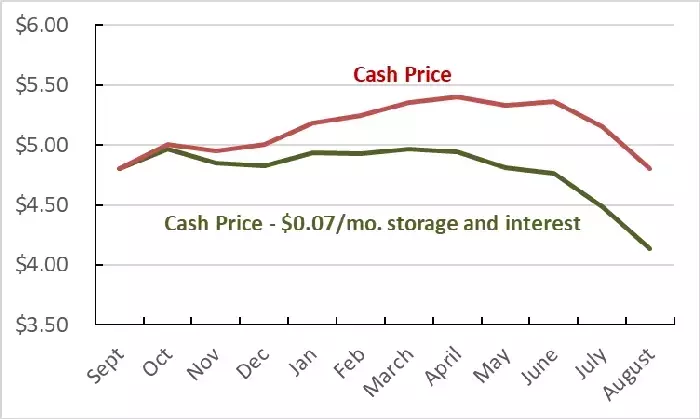

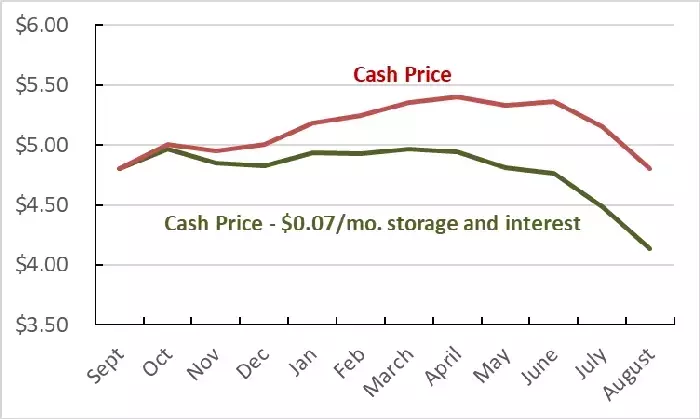

Historical market analysis reveals distinct patterns for corn prices. Typically, the most advantageous periods for selling corn stored commercially are October, followed by the span from January through April. This pattern has been consistent over the past 15 years, where net returns after accounting for storage and interest costs (estimated at 7 cents per bushel per month) have shown these months to be the most lucrative. For example, October has historically seen an average price of $4.97, with January to April maintaining a similar range of $4.94 to $4.97. Farmers with on-farm storage facilities may experience even lower costs, potentially leading to slightly higher net gains.

Regional disparities in corn prices are also a significant consideration. Over the last decade and a half, corn prices in Texas have, on average, exceeded national U.S. prices by approximately 45 cents per bushel, and Oklahoma prices by about 15 cents. Specific localities like Perryton, Texas, typically see prices that are about 15 cents less than the broader Texas average, yet still 50 cents higher than those in Pond Creek, Oklahoma. These regional differences highlight the importance of localized market awareness when devising selling strategies.

Current projections for the 2025 harvest season suggest an optimistic outlook. Forward-contract prices for harvest delivery in Perryton, Texas, are currently around $4.50, implying an average Texas harvest price of $4.65. This often includes a risk premium, suggesting actual harvest prices could be higher. The July WASDE report estimates the 2025-26 marketing year corn price at $4.20 nationally. Converting this to regional figures, the projected average price for Perryton during this period is around $4.50.

Furthermore, global and domestic supply and demand dynamics play a crucial role. The WASDE report projects U.S. corn production at 15.7 billion bushels, an increase from previous years, with global production also seeing a rise. Despite increased production, the world's corn stocks-to-use ratio is projected at 21.5%, while the U.S. ratio is at 10.8%. These figures, particularly the U.S. ratio, are indicative of sustained demand, supporting prices that are average to above average. Another favorable factor is the recent depreciation of the U.S. dollar, which makes U.S. corn more competitive and affordable in international markets, thereby boosting export potential and domestic prices.

Given the inherent unpredictability of agricultural markets, a staggered sales strategy for corn harvested in 2025, specifically focusing on sales in October and from January through April, appears to be the most prudent course of action. This method helps mitigate risks associated with market volatility and leverages historical pricing trends to optimize revenue for producers.