The field of artificial intelligence is currently undergoing a significant transformation, moving into a new stage known as AI inference. This phase is characterized by a critical need for substantial computing capabilities. Nvidia, a prominent player in the AI semiconductor sector, appears well-prepared for this evolution, with its latest Blackwell product enjoying strong market interest. Nevertheless, IonQ, a company specializing in quantum computing, offers a formidable challenge, claiming its quantum systems can revolutionize AI inference through enhanced efficiency and performance, especially when dealing with limited data sets. This analysis explores the distinct advantages of both organizations to ascertain which presents a more promising investment in the burgeoning AI domain.

Nvidia's Dominance in the AI Inference Era

Nvidia has cemented its position as a leader in the artificial intelligence sector, a testament to its innovation and strategic foresight. The company's financial performance has been stellar, with sales skyrocketing by 114% year-over-year to a record $130.5 billion in its fiscal year 2025. This remarkable growth is expected to continue into fiscal year 2026, with first-half revenues already reaching $90.8 billion. Nvidia's operating income has also seen a significant boost, increasing by over 40% to $50.1 billion during the first half of fiscal 2026. This financial success is largely driven by the global demand for its AI semiconductor products, enabling the company to become the first publicly traded entity to achieve a $4 trillion market capitalization. Nvidia's preparedness for the AI inference era is evident with its Blackwell platform, designed to meet the escalating computational demands of this new phase.

Nvidia's journey to the forefront of AI is a narrative of strategic innovation and relentless execution. The company's substantial revenue and operating income growth underscore its market leadership and its ability to capitalize on the increasing global appetite for AI infrastructure. With the AI industry transitioning from model training to inference, the computational requirements have intensified. Nvidia's Blackwell product line is specifically engineered to address these heightened demands, positioning the company as an indispensable partner for enterprises and governments worldwide. The British government's intent to acquire 120,000 Blackwell chips and OpenAI's multi-year partnership involving millions of Nvidia chips highlight the widespread recognition of Blackwell's capabilities. This strategic alignment with major players like OpenAI further solidifies Nvidia's trajectory for sustained growth and its continued dominance in the evolving AI landscape. The company's established profitability and robust demand for its cutting-edge technology make it a compelling investment, particularly when contrasted with newer market entrants.

IonQ's Quantum Leap in AI Capabilities

IonQ is carving out a unique niche in the technological landscape by concentrating on the advancement of quantum computing chips and network solutions, aiming to construct the \"next generation of the internet,\" a vision that inherently includes artificial intelligence. The company has showcased the transformative potential of its quantum computers in enhancing AI inference. Notably, AI models trained using IonQ's quantum technology have demonstrated superior performance compared to those developed on traditional computers, along with achieving significant energy savings. This capability is particularly crucial in scenarios with limited data, where conventional AI models often struggle to maintain accuracy. Quantum computers, leveraging the distinct principles of quantum mechanics, possess the unique ability to uncover intricate relationships within sparse data, a task that proves challenging for classical systems. This technological edge has led to the adoption of IonQ's solutions by various organizations globally, mirroring the rapid sales expansion observed in leading tech firms like Nvidia.

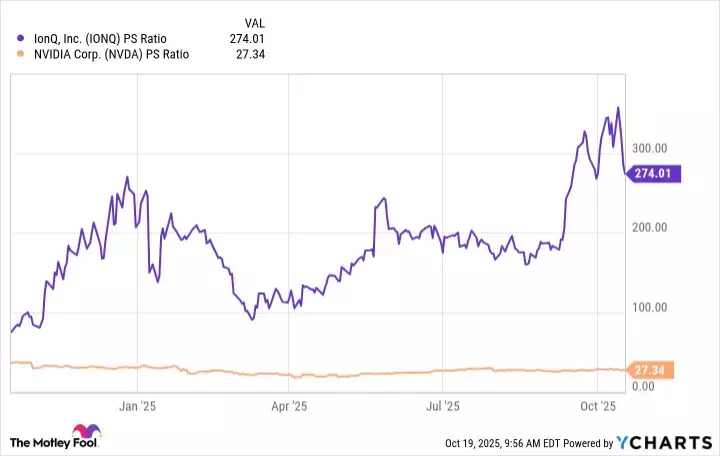

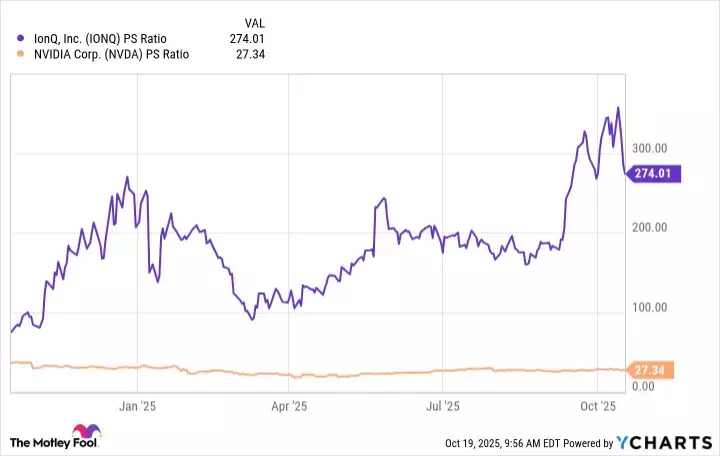

IonQ's technological prowess has translated into impressive financial growth, with revenue reaching $43.1 million in 2024, nearly doubling the previous year's $22 million. The company projects continued robust growth for 2025, with sales estimated to be between $82 million and $100 million. However, the development of advanced quantum computers is a capital-intensive endeavor, which means IonQ is not yet profitable. The company reported an operating loss of $160.6 million in the second quarter, a substantial increase from the prior year. Despite this, IonQ maintains a strong financial position, holding $1.7 billion in cash and equivalents with no debt as of September 12. While Nvidia offers readily available AI solutions, IonQ's quantum technology represents the future of AI, promising advancements in inference and energy efficiency. However, the nascent stage of quantum technology and IonQ's high stock valuation, as indicated by its price-to-sales ratio, suggest that Nvidia currently offers a more favorable investment profile. Nevertheless, IonQ's innovative approach and potential for future breakthroughs position it as a significant contender in the long-term evolution of AI.