Nvidia is positioned as a key player in the artificial intelligence sector, a role underscored by its advanced graphics processing units (GPUs) that are integral to the escalating AI competition. The company's leadership projects a significant expansion in market opportunities, forecasting a potential rise from hundreds of billions to trillions of dollars by 2030, driven by the escalating demand for AI computing infrastructure. This optimistic outlook, coupled with strategic investments from major financial figures, indicates a robust future for Nvidia, reinforcing its status as a compelling investment even when applying a cautious perspective to market forecasts.

The company's sustained profitability and strategic expansion into various tech sectors, including autonomous vehicles and gaming, further solidify its long-term growth prospects. Despite potential market fluctuations, Nvidia's foundational role in AI development and its ability to consistently exceed market expectations position it as a resilient and promising enterprise in the global technology landscape.

Nvidia's Central Role in the AI Evolution

Nvidia has cemented its position as a critical enabler in the ongoing artificial intelligence revolution. The company's specialized graphics processing units (GPUs) are the cornerstone of the computational infrastructure required for advanced AI models, giving Nvidia a commanding presence in this rapidly expanding industry. With an estimated market share exceeding 90% in the GPU sector, Nvidia demonstrates an unparalleled dominance that is rare in high-growth technology fields. This near-monopoly in a vital component of AI development makes Nvidia an exceptionally attractive proposition for investors seeking exposure to the AI boom.

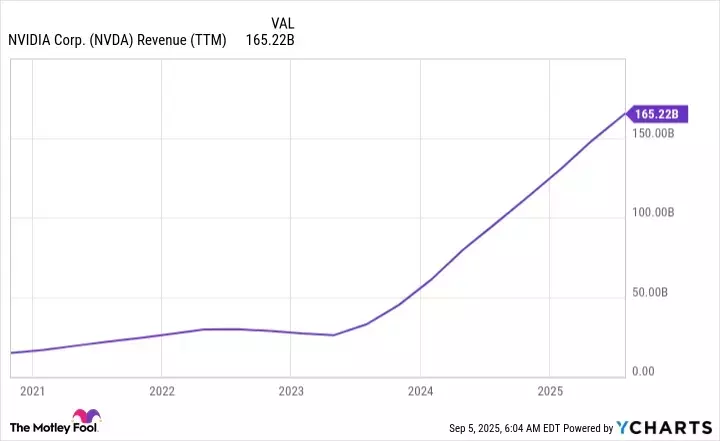

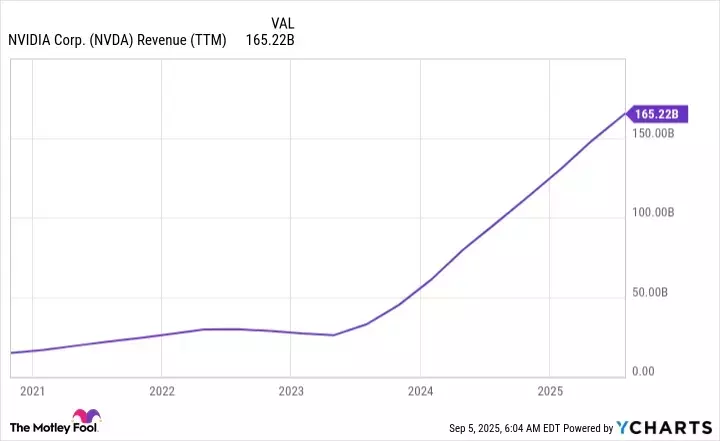

The insatiable demand for AI computing power is driving unprecedented capital expenditures in data centers, a trend that is expected to intensify over the coming years. Industry forecasts, including those from Nvidia itself, predict a staggering increase in spending on AI data centers, reaching potentially trillions of dollars by 2030. This projected surge in investment directly benefits Nvidia, as its GPUs are indispensable for these large-scale AI operations. The company's strong ties with major AI hyperscalers, who are consistently increasing their investments, highlight Nvidia's integral role in shaping the future of artificial intelligence infrastructure.

Market Potential and Strategic Foresight

The financial community, including prominent billionaire investors, is increasingly recognizing and acting upon Nvidia's immense potential. Their strategic decisions to significantly increase holdings in Nvidia stock underscore a collective confidence in the company's long-term growth trajectory and its ability to capitalize on the burgeoning AI market. These investments are often informed by deep industry insights and serve as a strong indicator for other investors considering Nvidia as part of their portfolios. The sustained bullish sentiment from such influential figures further validates Nvidia's strategic importance and promising financial outlook.

Even when adopting a conservative approach to market projections, Nvidia demonstrates remarkable potential for market-beating returns. If the market for data center capital expenditures only reaches half of the lowest projected estimate, and Nvidia maintains its substantial market share, the company still stands to generate hundreds of billions in revenue and significant profits. This demonstrates the inherent resilience and robust growth potential embedded within Nvidia's business model. Beyond its core data center operations, Nvidia's diversification into other advanced technological sectors, such as industrial applications, self-driving vehicles, and gaming, provides additional avenues for growth and further mitigates potential risks, making it a compelling investment for the foreseeable future.