In the current financial climate, securing a steady stream of passive income from equity investments is a goal for many. This article delves into the potential of dividend-paying stocks and exchange-traded funds (ETFs) to achieve this objective. We examine how a strategic allocation of capital across robust companies like Chevron, consumer giants such as Coca-Cola, and diversified ETFs can contribute to a reliable annual dividend income. The focus is on long-term wealth accumulation through consistent payouts rather than short-term market fluctuations.

A significant avenue for generating consistent income is through investments in companies with strong dividend policies. Chevron, for instance, stands out as a compelling option for investors prioritizing regular payouts. Its integrated business model, encompassing both upstream and downstream operations, provides a degree of insulation from the volatility of oil prices. Furthermore, its sound financial health and substantial free cash flow generation capabilities make it an attractive prospect. The company's recent strategic acquisitions are expected to further bolster its financial position, adding billions to its free cash flow in the coming years. This financial strength not only supports its current dividend yield but also allows for potential future increases and share buybacks, enhancing shareholder value.

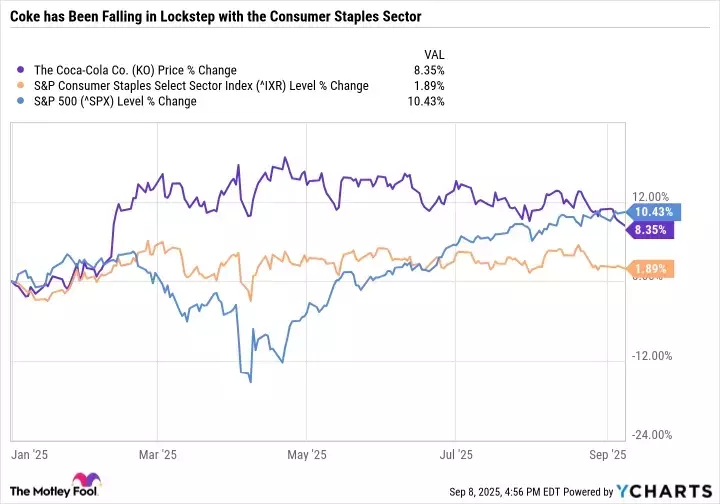

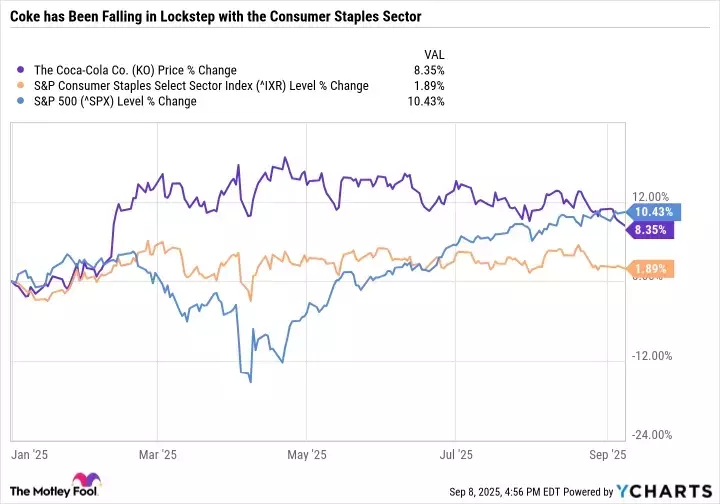

Another notable entity in the realm of dividend-paying assets is Coca-Cola. Despite recent market headwinds and shifts in consumer preferences, this beverage giant continues to demonstrate resilience. While broader market trends might influence its stock price in the short term, Coca-Cola's fundamental strengths remain intact. Its globally recognized brand, extensive distribution network, and diversified product portfolio, which increasingly includes low-sugar and non-soda options, underpin its stable performance. The company's ability to maintain and even grow its earnings per share, even in a challenging economic environment characterized by high interest rates and inflation, highlights its operational efficiency and strategic adaptability. Its impressive track record of consistently increasing dividends for over six decades further solidifies its appeal as a dependable income-generating investment.

For those seeking diversification and a more hands-off approach to dividend investing, the Schwab U.S. Dividend Equity ETF (SCHD) presents an excellent choice. This ETF is designed to provide exposure to a broad array of high-quality dividend-paying U.S. companies. Its portfolio is strategically weighted towards sectors known for strong dividend payouts, such as energy, consumer staples, and healthcare. Holdings include major players like Chevron and ConocoPhillips, ensuring a robust foundation of income. The ETF's low expense ratio makes it a cost-effective way to gain diversified access to the dividend market, making it particularly appealing for investors who may find the process of individually selecting stocks daunting or time-consuming. It offers quarterly distributions, providing regular income with minimal management effort.

In summary, a well-rounded strategy for passive income generation involves a combination of individual dividend stocks with strong fundamentals and diversified dividend ETFs. Companies like Chevron and Coca-Cola offer stability and a history of consistent payouts, while ETFs such as the Schwab U.S. Dividend Equity ETF provide broad market exposure and reduced individual stock risk. By carefully selecting and combining these assets, investors can build a portfolio capable of delivering a reliable stream of income, contributing significantly to their long-term financial well-being and investment objectives.