Unlocking Value: Nelnet's Journey to Sustainable Dividend Growth

Understanding Nelnet's Evolving Business Landscape

Nelnet, once primarily known for its role in student loan management, has undergone a significant strategic transformation. Initially, the company thrived as a key player in financing student loans, a highly profitable venture. However, legislative changes, specifically the Affordable Care Act, led to a prohibition on private companies financing undergraduate student loans. This pivotal moment necessitated a re-evaluation of Nelnet's core business model.

Strategic Shift and New Avenues for Growth

In response to regulatory shifts, Nelnet has meticulously transitioned away from its traditional student loan portfolio. While still managing a substantial volume of residual loans expected to generate approximately $1 billion in cash flow over the coming years (with around $100 million annually from late 2025 to 2030), the company has actively diversified its operations. A cornerstone of this diversification is the establishment of Nelnet Bank, a federally chartered institution that has successfully ventured into K-12 and graduate student loans, alongside home improvement and mortgage lending. This nascent banking arm has already demonstrated significant potential, generating $14 million in net interest income, laying the groundwork for future expansion.

Unveiling Hidden Assets and Robust Cash Flow Generators

Nelnet's financial prowess extends beyond its banking and lending activities. The company possesses valuable assets and business units that are not immediately apparent. Its educational software and payment processing division stands out as a high-performing segment, reporting $486 million in revenue and $117 million in operating income in 2024. This unit's consistent earnings and strong cash flow are crucial for fueling Nelnet's dividend growth. Furthermore, Nelnet engages in student loan servicing, contributing $482 million in revenue, although with a lower operating income compared to its software arm. A particularly noteworthy hidden asset is Nelnet's approximately 22% ownership in Hudl, a private start-up that dominates the sports film and coaching software market. The potential for Hudl to go public could significantly unlock substantial value for Nelnet shareholders, given Nelnet's current market capitalization of $4.7 billion.

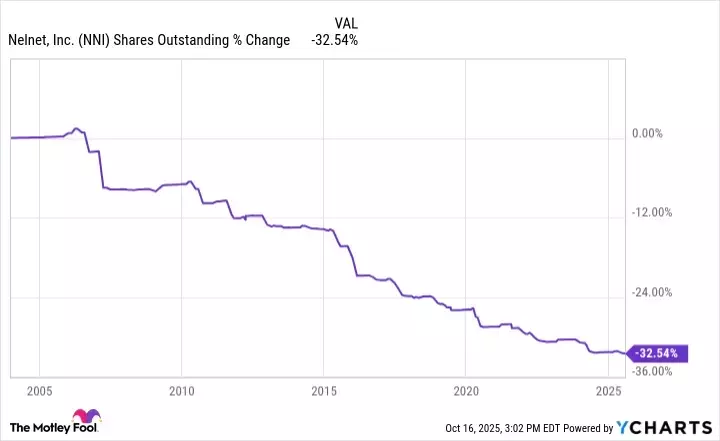

The Blueprint for Exceptional Dividend Growth

Nelnet's strategy for enhancing shareholder value revolves around a combination of robust share repurchases and consistent dividend increases. The company has a proven track record of reducing its outstanding shares, with a nearly 33% reduction since its public listing two decades ago, directly boosting earnings per share. While Nelnet's current dividend yield is modest, its historical commitment to dividend growth is compelling. From 2014 to 2024, the dividend per share has grown at an impressive annual rate of about 11%. As a relatively smaller company with ample opportunities for expansion, Nelnet is well-positioned to maintain and even accelerate this dividend growth trajectory over the next decade, further supported by its ongoing share repurchase program. These synergistic factors collectively position Nelnet as an overlooked yet highly attractive investment for dividend-seeking investors focused on long-term gains.