Alphabet, the parent company of Google, has recently experienced a remarkable surge in its stock performance. This upward trend is attributed to several positive developments, including robust second-quarter earnings and a pivotal judicial ruling that averted a breakup of its core operations. The company's search engine continues to demonstrate strong revenue growth, even amidst increasing competition from generative AI technologies. Furthermore, Google Cloud, its burgeoning cloud computing division, is expanding rapidly and enhancing its profitability. Despite this impressive rally, Alphabet's stock remains attractively valued compared to its industry counterparts, positioning it as a potentially lucrative investment.

Detailed Report: Alphabet's Continued Ascent in the Tech Sector

In recent months, Alphabet's stock (NASDAQ: GOOG, GOOGL) has garnered considerable attention for its substantial gains. Following its Q2 earnings report on July 23rd, the company witnessed a series of favorable events that propelled its shares upward by over 30%. A key factor was a judge's decision to not pursue a division of Alphabet's primary business, easing investor concerns. This strong momentum has led Alphabet to surpass the $3 trillion valuation mark, solidifying its position as the fourth-largest company globally.

Looking ahead, investors are keenly awaiting Alphabet's Q3 earnings report, scheduled for October 29th, as management's outlook could serve as another significant catalyst for further stock appreciation. Analysts point to three main pillars supporting this optimistic view:

First, Google Search demonstrates remarkable resilience and growth. Despite widespread concerns earlier in 2025 regarding the impact of generative AI on its dominance, Google's search engine has maintained a robust revenue growth rate of 12% in Q2. This success is partly due to the seamless integration of AI search overviews into its platform, creating a hybrid experience that combines traditional search with AI-powered results. Importantly, this integration has not negatively impacted monetization, indicating a successful adaptation to the evolving technological landscape.

Second, the Google Cloud division is emerging as a high-growth area. The burgeoning demand for cloud computing, driven by a general shift towards cloud infrastructure and the increasing adoption of AI, provides a fertile ground for Google Cloud's expansion. The division has secured partnerships with prominent AI entities like OpenAI (creator of ChatGPT) and Meta Platforms, showcasing its competitive edge. In Q2, Google Cloud reported a strong 32% year-over-year revenue increase and significantly improved its operating margin from 11% to 21%, a trend that investors hope will continue.

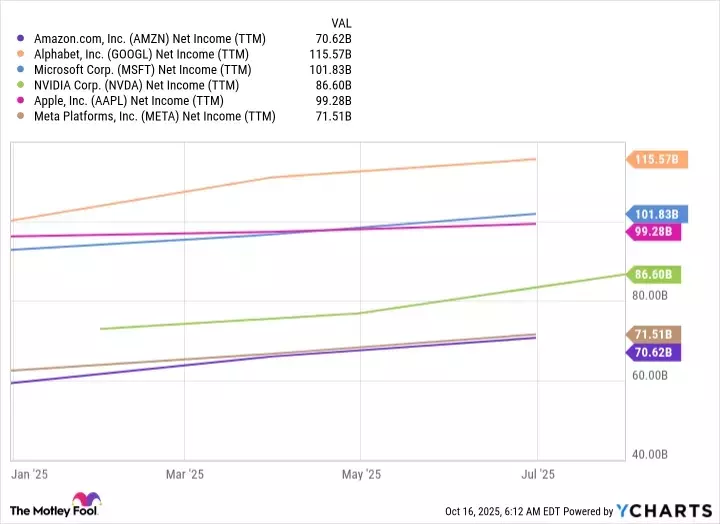

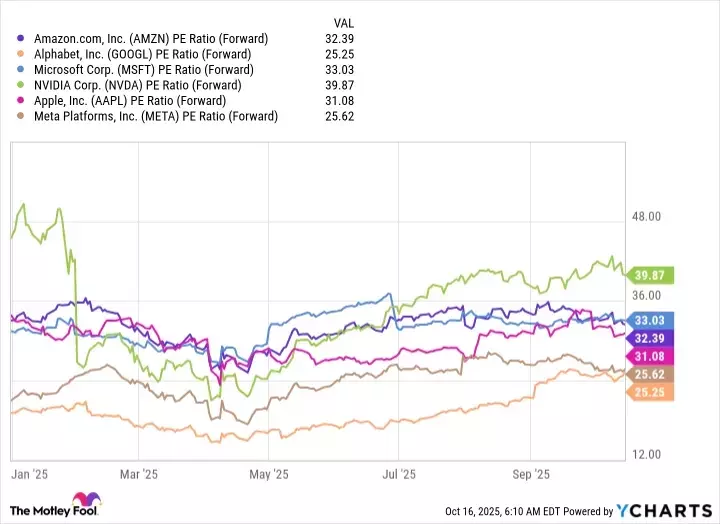

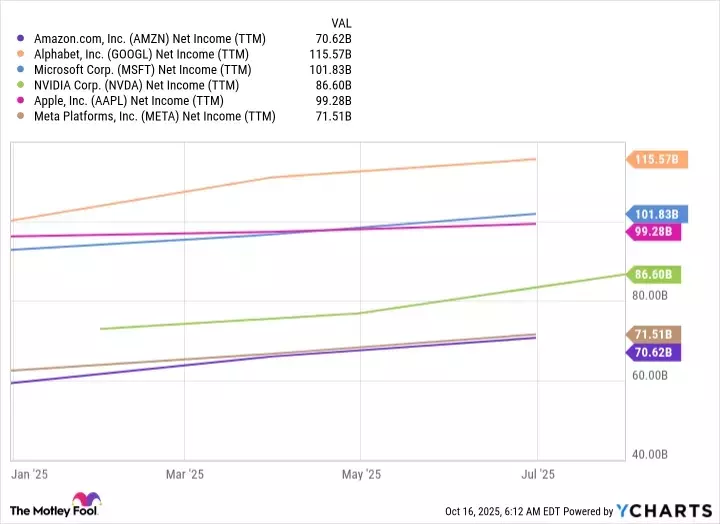

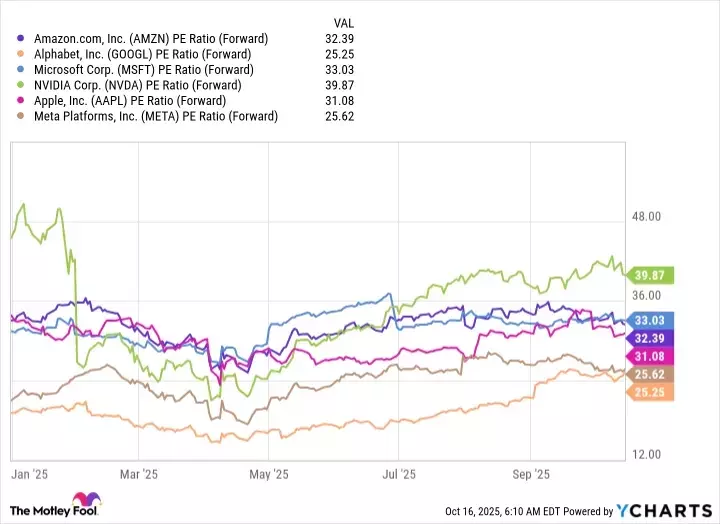

Finally, Alphabet's stock maintains an appealing valuation. Even after its recent surge, the company trades at a discount in terms of forward price-to-earnings (P/E) compared to its major tech rivals, including Microsoft and Apple. While it is closely approaching Meta Platforms in valuation metrics, Alphabet's superior net income generation suggests that, under equal valuation conditions, it would be the world's largest company. This strong financial position, coupled with substantial cash flows, enables Alphabet to invest in future growth initiatives, such as AI development, stock buybacks, or strategic acquisitions, further enhancing its long-term potential.

Investor Perspective: A Prudent Opportunity in a Dynamic Market

From an investor's standpoint, Alphabet presents a compelling case for consideration. The company's ability to innovate and adapt, particularly in the face of disruptive technologies like generative AI, underscores its robust business model. The continued strength of its core advertising business, combined with the explosive growth and improving profitability of Google Cloud, paints a picture of a company with diversified revenue streams and significant upside potential. The current valuation, which appears favorable relative to its industry peers, suggests that now could be an opportune moment for investors to acquire shares before the anticipated Q3 earnings announcement. Such an investment could potentially capitalize on further upward movements, making Alphabet a strategic addition to a growth-oriented portfolio.