The stock market is a complex web of activities and events that constantly shape the financial landscape. In this comprehensive analysis, we delve deep into the movements and trends of Dow Jones futures, along with other key indices like the S&P 500 and Nasdaq futures. The final Federal Reserve meeting of 2024 holds significant importance, as it could potentially impact market directions.

Navigating the Stock Market: Insights from Dow Jones to Nasdaq

Overview of Dow Jones Futures

Dow Jones futures open at 6 p.m. ET on Sunday, setting the stage for the upcoming trading week. It's important to note that overnight action in these futures doesn't always directly translate to actual trading in the regular stock market session. This initial movement provides a glimpse into the market's sentiment and potential trends. 1: The opening of Dow Jones futures on Sunday evening marks the beginning of a new trading cycle. It serves as a precursor to the activities in the S&P 500 and Nasdaq futures, which also open simultaneously. These futures markets act as indicators of market expectations and can influence the direction of the actual stock markets. 2: The significance of Dow Jones futures lies in their ability to provide early signals about market trends. Traders and investors closely monitor these futures to get a sense of how the market might perform in the coming days. Any significant movements in Dow Jones futures can set the tone for the entire trading week.The Stock Market Rally and Its Mixed Week

The stock market rally had a mixed week, with some sectors and stocks showing strength while others faced challenges. The Nasdaq edged higher, with notable gains in Alphabet (GOOGL) and Broadcom (AVGO), while Tesla (TSLA) hit a record high. However, the overall market fell back somewhat as Treasury yields roared back. 1: The week's performance in the stock market was a tale of two sides. While certain tech giants like Alphabet and Broadcom saw significant gains, the broader market was affected by the rise in Treasury yields. This shows the delicate balance between different factors that influence the stock market. 2: The mixed performance of the stock market during the week highlights the need for a comprehensive analysis. Traders and investors need to consider various factors such as individual stock performances, sector trends, and macroeconomic indicators to make informed decisions.Nvidia Stock: An AI Laggard?

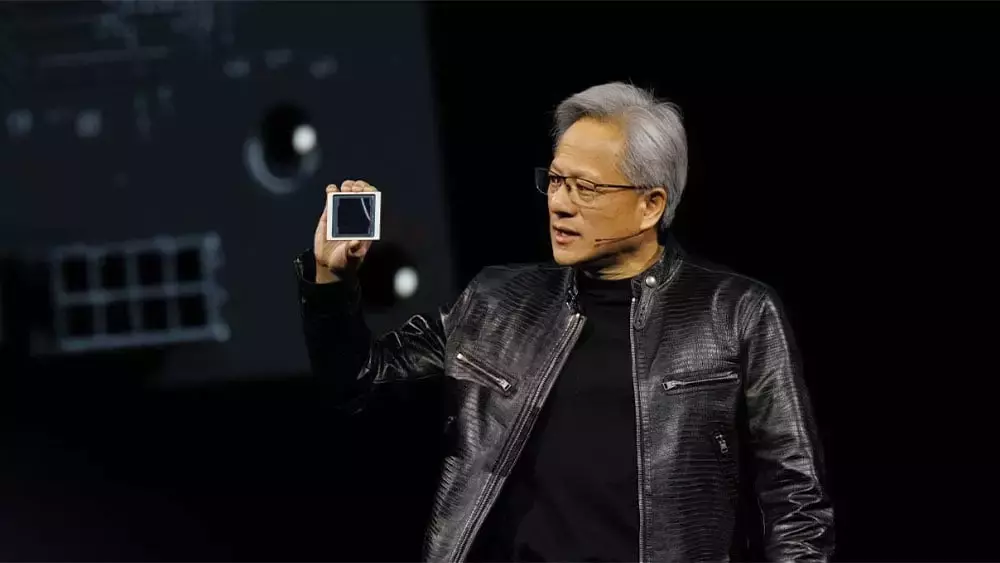

Nvidia stock fell 5.75% to 134.25 last week. Despite the overall strength in the AI chip sector, Nvidia's performance was lackluster. The stock hit resistance at the 50-day line and other key levels, indicating potential challenges. 1: Nvidia's decline is a cause for concern, especially considering the strong performance of other AI chip stocks like Broadcom and Marvell. This suggests that there might be some underlying issues affecting Nvidia's stock price. 2: However, it's important to note that a single week's performance doesn't necessarily define a stock's long-term trajectory. Nvidia still holds a significant position in the AI chip market, and its future performance will depend on various factors such as technological advancements and market demand.Nasdaq 100 Rebalancing and Key Stocks

Palantir Technologies (PLTR), MicroStrategy (MSTR), and Axon Enterprise (AXON) will join the Nasdaq 100 index, while Moderna (MRNA), Super Micro Computer (SMCI), and Illumina (ILMN) will exit. This rebalancing has implications for the market and these individual stocks. 1: The addition of these stocks to the Nasdaq 100 and the removal of others reflects the changing dynamics of the market. It can lead to shifts in investor focus and trading patterns. 2: For the stocks involved in the rebalancing, it presents both opportunities and challenges. Palantir, MicroStrategy, and Axon Enterprise now have a higher profile within the index, while Moderna, Super Micro Computer, and Illumina face the task of adapting to their new market positions.Fed Meeting and Its Impact

The final Fed meeting of 2024 on Dec. 17-18 is a crucial event. Markets are expecting another quarter-point rate cut, but there are uncertainties due to solid economic growth and sticky inflation. The latest economic projections and Fed chief Jerome Powell's comments will be closely watched. 1: The Fed meeting has the potential to significantly impact the stock market. A rate cut could provide a boost to market sentiment, while uncertainties surrounding economic growth and inflation could lead to volatility. 2: Investors will be closely analyzing the Fed's statements and economic projections to get a sense of the central bank's future policy direction. This will play a crucial role in shaping market expectations and trading decisions.ETF Market Performance

Among growth ETFs, there were significant fluctuations last week. The Innovator IBD 50 ETF (FFTY) slumped 4.5%, while the iShares Expanded Tech-Software Sector ETF (IGV) fell 3.9%. On the other hand, the VanEck Vectors Semiconductor ETF (SMH) edged up 0.35%. 1: The performance of different growth ETFs reflects the diverse trends within the market. Some sectors and stocks are performing well, while others are facing challenges. 2: ETFs provide a convenient way for investors to gain exposure to specific sectors or market segments. Monitoring the performance of these ETFs can help investors identify emerging trends and make informed investment decisions.Market Outlook and What to Do Now

The market rally had a mixed week, and the weak market breadth is a concern. While some stocks are showing strength, many are extended. A market pause or modest pullback could help leaders forge handles, round out bases, or decline in a dignified fashion. 1: The current market situation requires a cautious approach. Investors need to be aware of the potential risks and opportunities in the market. A market pause or pullback could provide buying opportunities for certain stocks. 2: It's important to keep a close eye on leading stocks and sectors and remain flexible in investment strategies. By staying informed and adapting to market changes, investors can navigate the market more effectively.In conclusion, the stock market is a dynamic and ever-changing entity. By closely monitoring key indices like Dow Jones futures, analyzing individual stock performances, and staying informed about macroeconomic events like the Fed meeting, investors can make more informed decisions and navigate the market with greater confidence.