Uncover the Dynamics of Today's Market with These Insights

3 Steel Stocks to Monitor Amid Sector Buzz

In the current market scenario, certain steel stocks are attracting significant attention. These stocks play a crucial role in the sector and are being closely watched by investors. Their performance and trends can provide valuable insights into the overall health and direction of the steel industry. With various factors at play, these stocks offer unique opportunities and risks for those looking to invest in the sector.

The steel market is experiencing a certain level of volatility and these specific stocks are at the forefront. Their operations, financials, and market positions are being analyzed closely to determine their potential for growth and stability. By keeping a close eye on these 3 steel stocks, investors can gain a better understanding of the sector and make more informed investment decisions.

Tax Strategies Options Traders Should Know About as the Year Winds Down

As the year comes to an end, options traders need to be aware of specific tax strategies to optimize their financial positions. Understanding these strategies is crucial for minimizing tax liabilities and maximizing profits. Different tax rules and regulations apply to options trading, and traders need to be well-versed in them to make the most of their trading activities.

There are various tax strategies that options traders can employ during this time. These strategies range from proper documentation to timing of trades to take advantage of favorable tax rates. By implementing these strategies, traders can not only save on taxes but also enhance their overall trading performance. It is essential for options traders to stay updated on the latest tax regulations and seek professional advice if needed.

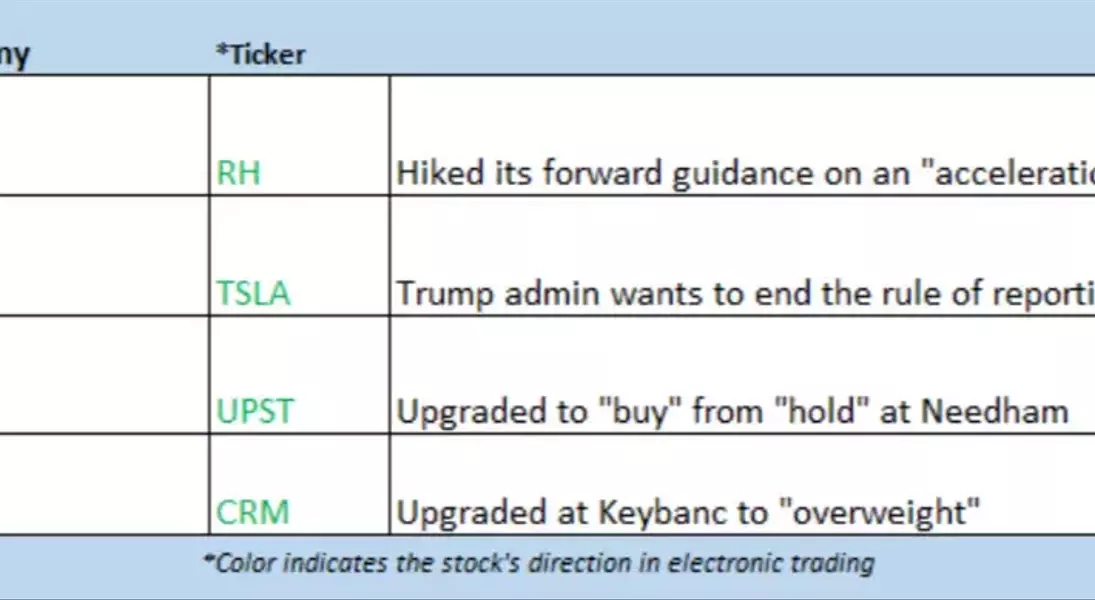

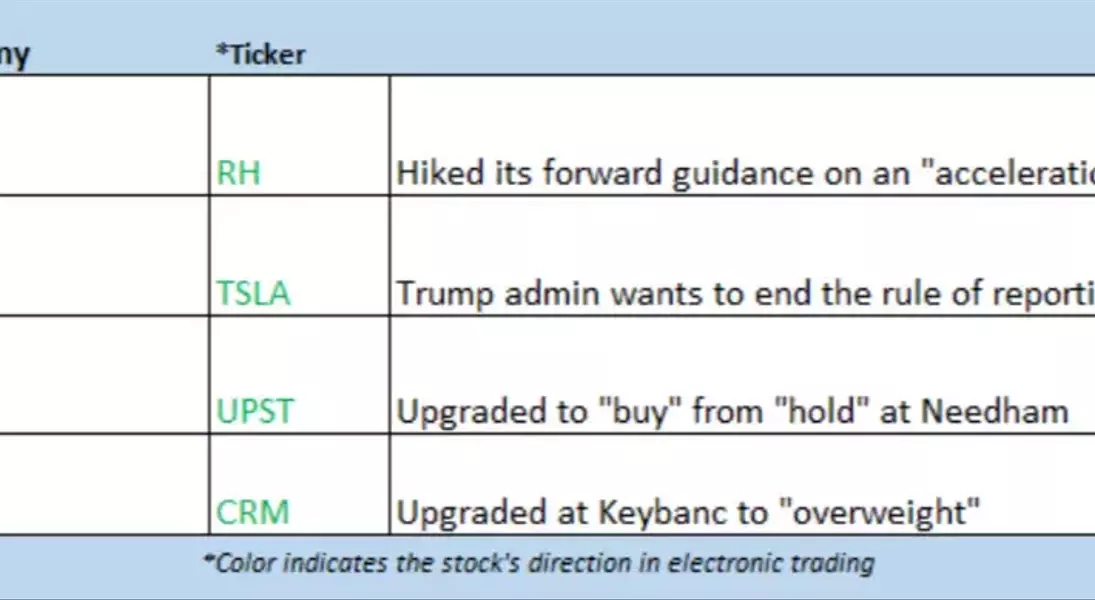

PENN and NCLH Attract Upgrades; and More on Broadcom’s Earnings Beat

J.P. Morgan Securities has upgraded PENN Entertainment Inc (NASDAQ:PENN) stock from "neutral" to "overweight," highlighting a growth path for the gambling company. Despite being up 6% in premarket trading, PENN still has a 23.1% year-to-date deficit. This upgrade indicates positive expectations for the company's future performance.

Broadcom Inc (NASDAQ:AVGO) stock is also making waves, up 16.8% ahead of the open after a fiscal fourth-quarter profit beat. The company's announcement of working with three big cloud customers to develop custom artificial intelligence (AI) chips is a significant development. AVGO has seen a remarkable 61.8% increase in 2024.

Norwegian Cruise Line Holdings Ltd (NYSE:NCLH) stock received an upgrade to "overweight" from "equal weight" at Barclays. The brokerage cited exposure to cross-Atlantic travel and strong U.S. demand as reasons for the bullish note. NCLH is up 2.1% before the open and has added more than 33% this year.

Cboe Options Exchange Activity and Equity Put/Call Ratio

The Cboe Options Exchange (CBOE) witnessed a significant exchange of call and put contracts on Thursday. More than 1.8 million call contracts and 1.2 million put contracts were traded. This single-session equity put/call ratio rose to 0.68, while the 21-day moving average remained at 0.62. These figures provide valuable insights into the options trading activity and market sentiment.

The movement in the put/call ratio indicates the balance between bullish and bearish sentiment among options traders. A higher ratio suggests a more bearish sentiment, while a lower ratio indicates a more bullish outlook. By analyzing these ratios, traders can gain a better understanding of the market's mood and make more informed trading decisions.

Asian Markets React to China’s Policy and Economic Data

Today, stocks in Asia were mostly in the red as Beijing's policy meeting failed to meet investors' expectations. The yen continued to weaken for the fifth consecutive day, with widespread expectations that the Bank of Japan (BoJ) will keep interest rates steady at its next meeting. In the manufacturing sector, there was a notable jump to 14 in the most recent quarter, surpassing estimates and improving from 13 in the September quarter.

In Japan, the Nikkei shed 1%, while the Hong Kong Hang Seng lost 2.1% and the China Shanghai Composite dropped 2%. However, South Korea's Kospi was the only gainer, adding 0.5%. These market movements reflect the impact of China's policies and economic data on the Asian region.

Retail Sales Data and Federal Reserve's Interest Rate Decision

Retail sales data will precede the Federal Reserve's interest rate decision next week. This data is crucial as it provides insights into the consumer spending patterns and the overall health of the economy. The Federal Reserve will closely monitor these figures when deciding on interest rates.

Any significant changes in retail sales can have a direct impact on the Fed's decision-making process. Higher retail sales may indicate a stronger economy and potentially lead to higher interest rates, while lower sales may suggest a weaker economy and prompt the Fed to keep rates steady or even lower them. Investors and market participants will be closely watching these developments.