Investor Reactions and Spillover Effects

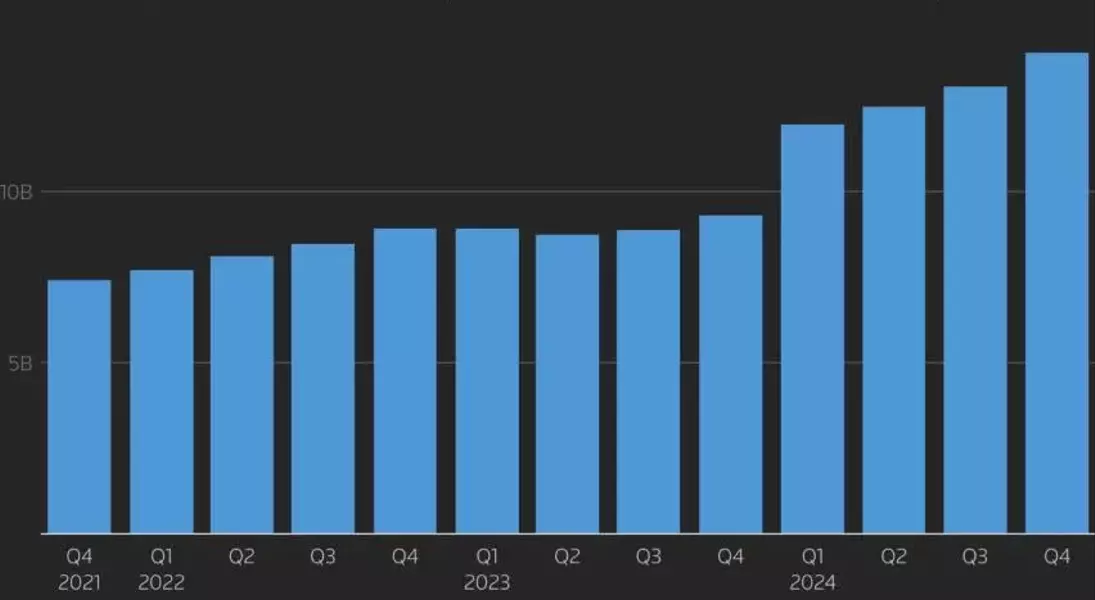

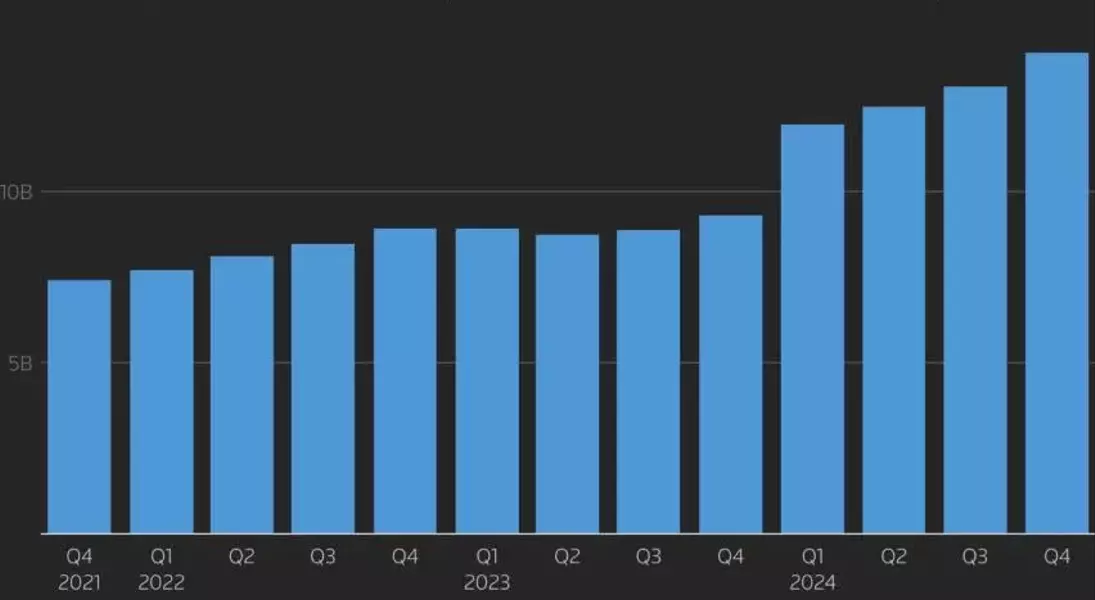

The optimism spread to other chip stocks. Rival Marvell Technology rose 5.7%, Micron Technology gained 1.2%, and AI bellwether Nvidia edged up 1.1%. This comes after a persistent technology stock rally that propelled the Nasdaq above the 20,000 mark on Wednesday. An in-line inflation reading and the expectation of a 25-basis-point cut from the Federal Reserve next week added to the momentum. Trader bets on the cut at the central bank's Dec. 17-18 meeting stand at over 96%, with chances of a pause in January indicated.Dan Coatsworth, an investment analyst at AJ Bell, said, "Clients have been extremely excited about how AI could enhance their earnings. This activity has also made Broadcom a focus for investors looking to participate in the AI boom, rather than just relying on Nvidia."

At 7:00 a.m. ET, Dow E-minis were up 85 points (0.19%), S&P 500 E-minis were up 19 points (0.31%), and Nasdaq 100 E-minis were up 138.5 points (0.64%). Wall Street had a breather in the previous session after recent gains and some hot economic data ahead of the Fed's meeting, setting the benchmark S&P 500 and the Dow for weekly losses. However, the Nasdaq was on track to end the week higher.

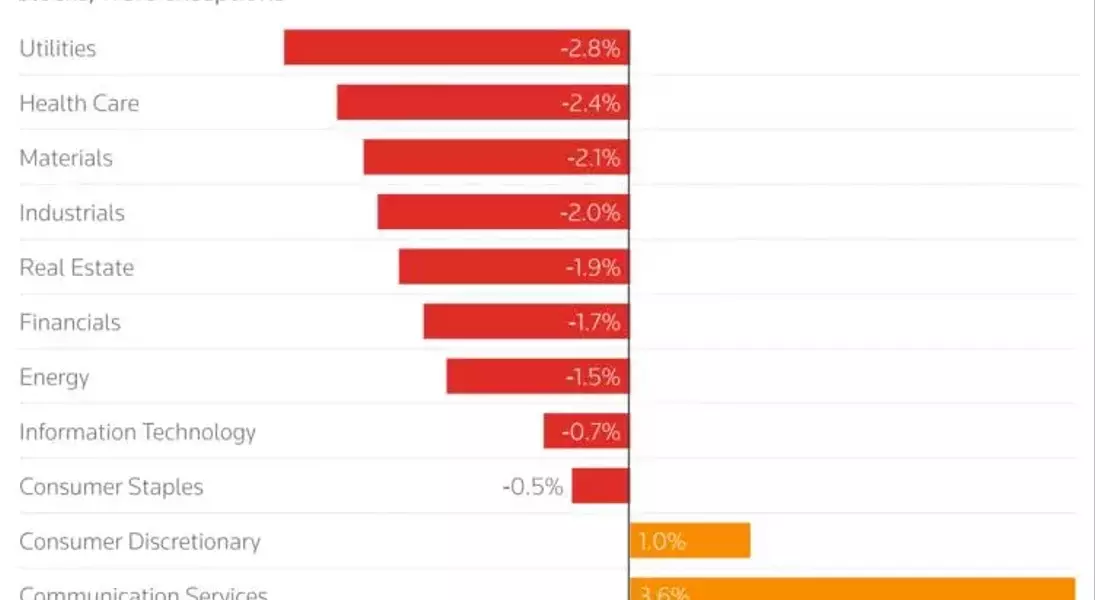

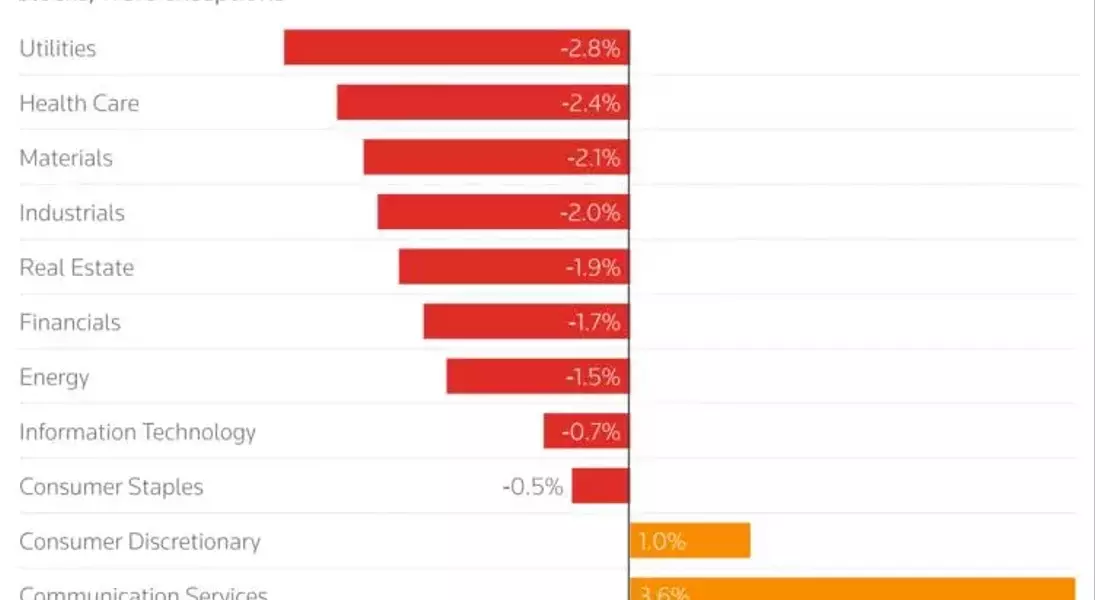

Most S&P 500 Sectors Face Weekly Losses

The three main indexes have set multiple record highs this year as investors flocked to heavyweight tech stocks to capitalize on the AI hype. U.S. equities ended November on a strong note after Donald Trump's win in the presidential election due to the prospects of business-friendly policies boosting corporate profits. December has started on a generally positive note.Among other movers, Salesforce CRM was up 1.7% after KeyBanc upgraded its stock to "overweight" from "sector weight". On the other hand, D.R. Horton eased 1% as J.P. Morgan downgraded its rating on the homebuilder to "underweight".

This shows the diverse movements within the stock market, with different sectors and stocks responding differently to various factors. The performance of Broadcom and its ripple effects highlight the importance of such forecasts in driving market trends and investor decisions.